IREN cleans balance sheet. Will it stay the course or mix bare metal with REIT?

The new convertible issuance is not just preparation for major investments, it also raises the question of which strategic path IREN will choose next.

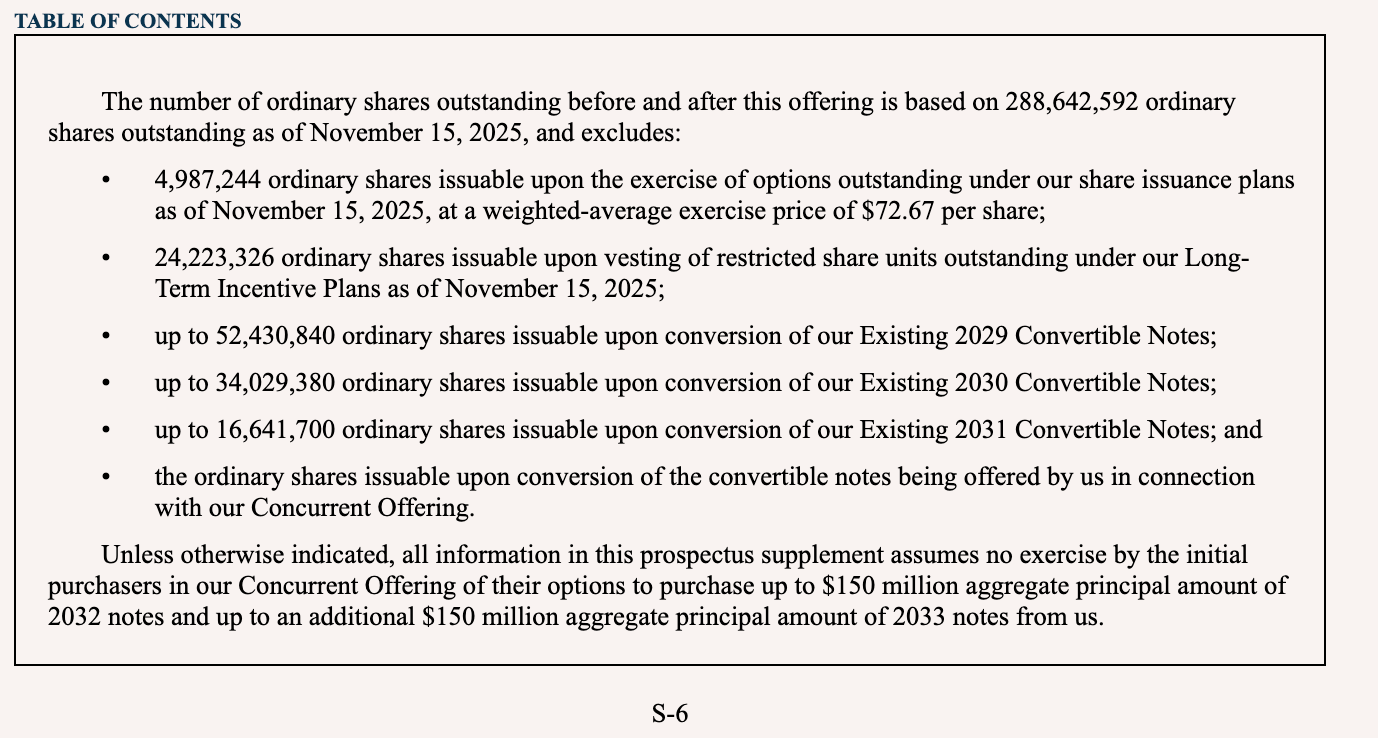

IREN is removing a 30% dilution risk. The latest SEC filing confirms 288.6M shares outstanding, while the 2029 + 2030 converts represent up to 86.4M shares of potential dilution, more than 30% of the entire float. These notes were issued in 2024–2025 with coupons of 3.5% (2029) and 3.25% (2030), which is expensive capital for an AI-infrastructure company that now has the ability to issue zero-coupon paper.

The 2030 notes also came with a capped call struck at $25.86 on a $400M notional. That hedge fully protected shareholders only up to the cap level. With the stock now at $48, the entire capped-call structure is worthless: the company receives no compensation above $25.86, while the converts are deeply in-the-money and create direct dilution.

This risk is not theoretical. IREN’s own filings show that the company was already paying $9.3M in quarterly finance expense, or roughly $30–37M per year, primarily driven by interest on these legacy notes. Replacing 3–3.5% paper with near-zero-coupon 2032–2033 notes cuts this cash burden dramatically while also raising the effective conversion price through new capped calls.

The refinancing removes a structure capable of dumping tens of millions of shares into the market. The company is actively dismantling the 30% overhang created during the 2024–2025 financing cycle, although the exact portion of the old notes that will be repurchased is still pending final settlement.

New CFO in action

IREN is refinancing its debt not because it wants a cosmetic optimization, but because the company is entering the most capital-intensive phase in its history. Sweetwater is only one direction. The new liquid-cooled AI centers cost $14M–$16M per MW, well above the industry’s ~$10M per MW baseline excluding GPUs. These are high-density Tier-3 clusters built for Nvidia GB300/GB400 generations and 150–200 kW per rack, some of the most expensive data-center designs on the market.

A single 1 GW campus translates to roughly 700 MW of IT load, which requires min $9–11B of capital before counting the GPUs themselves. Under these economics, the current $2B round is only the first step that enables construction to begin, not the full financing cycle. The company cannot enter multi-billion-dollar projects with a capital structure carrying 30% potential dilution and legacy coupons of 3.25–3.5% that weaken its credit profile.

Refinancing the old notes clears the balance sheet for a multi-year investment cycle. Long-dated low-cost capital, the removal of legacy convertibles, a rational conversion level, and protection through capped calls are prerequisites for any discussion of 3–5 GW development.

The new CFO Anthony Lewis from Macquarie is following a standard infrastructure playbook: eliminate legacy constraints, bring in a Tier-1 auditor, extend maturities, strengthen the credit profile, and only then pursue the next round of large-scale deals.

The arrival of the new CFO matters because the playbook changed instantly. Anthony Lewis came from Macquarie, one of the most sophisticated global investors in digital infrastructure.

Macquarie backed and scaled Aligned Data Centers before its multi-billion-dollar exit - a level of expertise rarely found in companies that originated in mining. Under his direction, IREN is doing exactly what infrastructure companies do before major deals: removing expensive legacy debt, extending duration and improving capital quality, strengthening the credit profile, and clearing risks that could hinder negotiations with hyperscalers.

KPMG is a separate but equally important point. Moving to a Big Four auditor is always a signal to the market and to lenders, but in infrastructure it is critical. A KPMG signature can lower future borrowing costs by 1–2 percentage points, because banks and project-finance desks underwrite risk based on audit quality, not on slide decks.

For a company preparing to build 3GW+ of projects and raise billions in long-dated capital, this is not rebranding, it is a prerequisite for accessing cheap financing and large-scale hyperscaler contracts.

The Strategic Fork: Full-Stack AI or Partial REIT

IREN is now standing at a real strategic fork. The company has enough scale, power, and in-house capability to choose among several viable long-term models, and each of them is materially different from the playbook of a typical miner.

The first path is full-stack AI infrastructure. IREN already designs and builds its own liquid-cooled HPC facilities, operates completely on renewable energy, and controls more than 3GW of grid-connected power across its pipeline. This is vertical integration in its purest form: power, land, interconnection, design, construction, and operation - all under one roof. Very few independent companies globally can do this at scale. If GPU economics remain strong, this route gives IREN full upside on AI compute margins and long-term recurring revenue.

The second path is a CIFR-style approach: becoming a developer and landlord of high-density powered shells and build-to-suit facilities for hyperscalers. This dramatically reduces capex, accelerates returns, and monetizes what is now the rarest asset in digital infrastructure - power.

“I don’t think we’re in a bubble in AI. There is a use case for AI in all 11 sectors of the economy. I don’t care if you’re real estate or financial services, AI is already being used. So now we got a really big problem, and it’s called the grid”, - Kevin O’Leary

Both Morgan Stanley and Kevin O’Leary say the same thing in different words: the limiting factor for AI is no longer chips, it’s electricity. O’Leary’s line “There’s no power left” captures the entire problem. Morgan Stanley quantifies it: a 47GW cumulative shortfall from 2025 to 2028. In a world where power is the bottleneck, companies that own power become the infrastructure, not just service providers.

Each path is viable. Each path is monetizable. And the most important point is that IREN is not forced to pick only one. A hybrid model — part full-stack AI, part REIT-style development is exactly what vertically integrated power-first platforms might evolve into.

IREN has reached that threshold.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.