Nuclear's Revenge: The $80B Deal That Just Decided the AI Energy War

As Europe shutters reactors, America's technological sovereignty is being built on nuclear power. Here is our three-segment investment strategy to capitalize on this shift.

Hi,

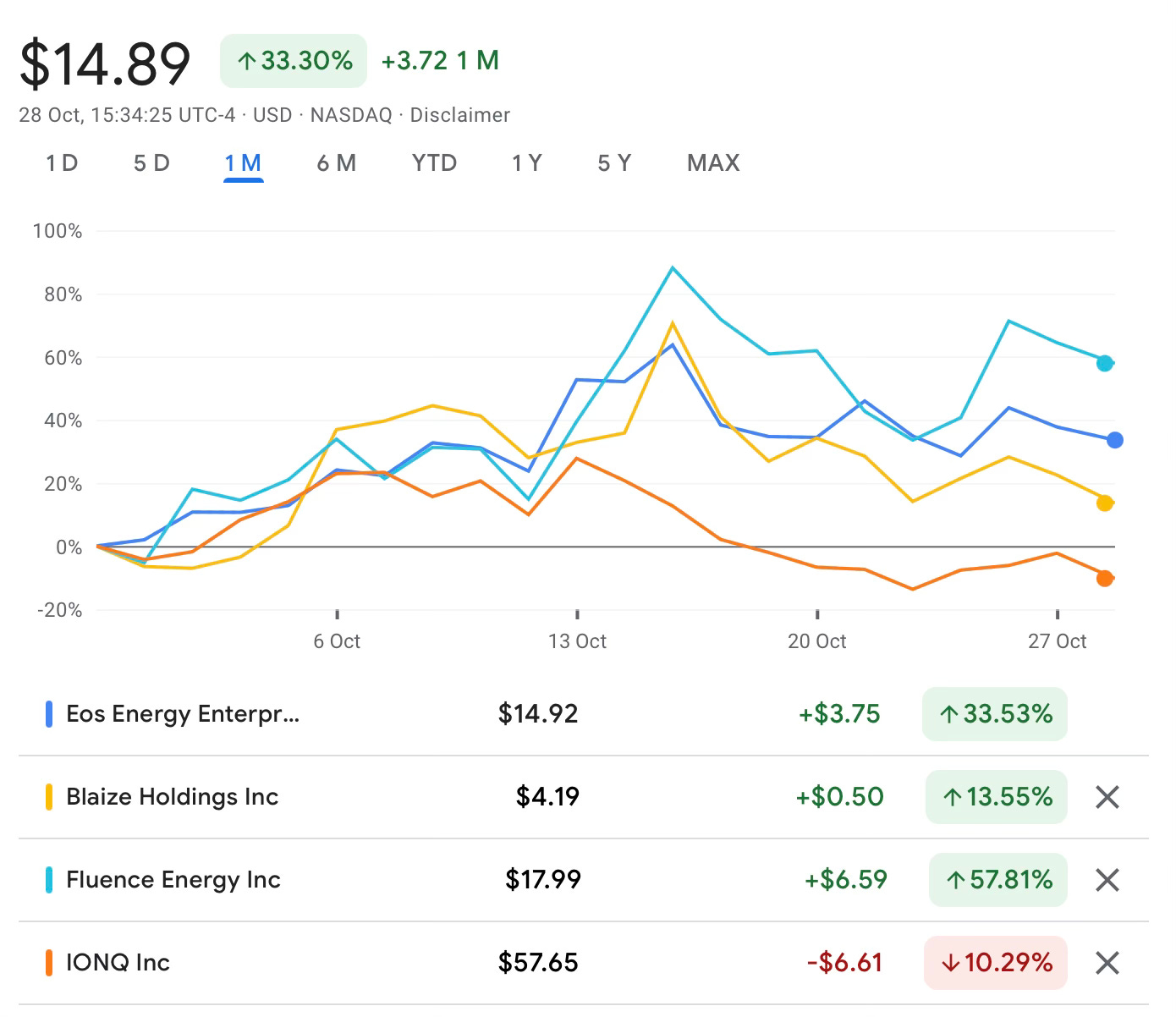

Today is an important day. NVIDIA crossed 200,OpenAI began preparing for an IPO as the simplest way to fund its growth, and the market continued its sell-off of speculative assets, driving a flight to quality—a trend I’m seeing firsthand in my own portfolio.

The sell-off started around mid-October and has hit quantum computing stocks, energy, drones, and other sectors, clearing out the overbought positions. The fact that all these stocks are moving synchronously is very telling

But while the market is cleaning out the froth, we must look at the fundamental structural shifts that will drive stocks for the next 5–10 years.

The main shift right now is in ENERGY. Specifically, how the AI boom is elevating NUCLEAR POWER from its decades-long stagnation to a must-have strategic asset.

Here are two absolutely fresh data points that should compel you to re-evaluate your portfolio:

1. U.S. Government’s $80 Billion Power Play (The Westinghouse Deal)

Today, the U.S. government announced an $80 billion contract with Westinghouse Electric Company for the construction of large-scale nuclear reactors.

This $80 billion government contract is only the public part of the equation; this strategic initiative cannot be executed without its private owners. Westinghouse Electric Company is co-owned by Brookfield Renewable Partners and CCJ 0.00%↑

, with Brookfield holding a 10 percent equity stake.

This direct relationship makes the initiative a comprehensive strategy involving the state, the global fuel supplier (Cameco), and a major private infrastructure financier BAM 0.00%↑ . This partnership ensures the critical components of fuel security and capital backing for the entire project.

The Strategic Implication: This is far more than mere ‘government support.’ This is a geopolitical decision at the level of national security. The U.S. is betting hard on atomic energy to:

Fuel AI: New reactors are essential to supply the uninterrupted, round-the-clock, clean power required by the massive data centers being built.

Energy Sovereignty: Reduce reliance on foreign fuel and minimize geopolitical exposure (a core theme of our analysis).

2. Google and NextEra Revive a Nuclear Plant

Here is the proof from Big Tech itself. Google and energy giant NextEra Energy have agreed to restart the Duane Arnold nuclear plant in Iowa, which was shuttered in 2020. Google signed a 25-year Power Purchase Agreement (PPA) to feed its growing AI infrastructure.

The Meaning of Google’s Bet: When GOOG 0.00%↑ commits to a 25-year contract with a nuclear facility, it ends the debate:

AI Needs Baseload Power: AI cannot wait for the wind to blow. It requires a baseload, 24/7, zero-emission power source.

The Fastest Path: The ‘fast track’ for AI growth isn’t building a new NVDA 0.00%↑ fab; it’s restarting existing nuclear capacity.

This stands in stark contrast to Europe. While the U.S. closes the world’s largest nuclear deals, Germany recently demolished a closed reactor and now struggles with expensive energy that is crippling its industry.

We won’t dwell on the politics of losing economic sovereignty, but the conclusion is clear: Nuclear reactors have become the backbone of technological leadership for powering the dozens of modern data centers that are key to the AI future.

🎯 Strategic Stocks: How to Bet on the Nuclear Renaissance

These events transform atomic energy from a speculative theme into a fundamental, long-term trend. This is not a sector where you buy one stock; it requires exposure across the entire value chain.

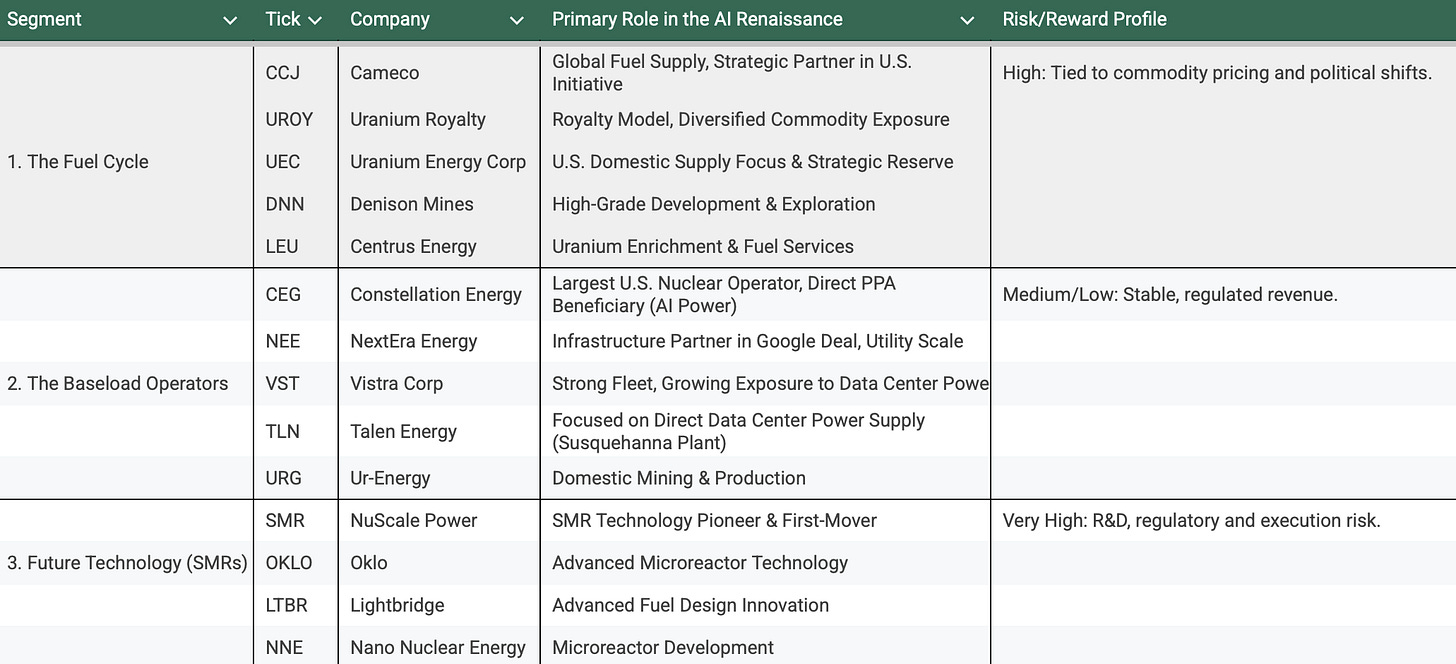

We believe that a well-diversified portfolio must include positions in three core segments:

The Fuel Cycle (Uranium Miners): This segment captures the raw commodity squeeze, which is directly impacted by geopolitical mandates and strategic stockpiling.

The Baseload Operators: These are the reliable utilities signing long-term PPAs with data center giants like Google, guaranteeing stable, rising cash flows for decades.

The Future Technology (SMRs): These highly volatile names represent the venture capital exposure—the opportunity for true exponential growth if they successfully scale the next generation of small modular reactors.

What is the advantage of holding these specific stocks?

These companies can effectively be considered quasi-governmental, primarily because they all possess significant lobbying power. For instance, the former Board Director of OKLO 0.00%↑ is now U.S. Secretary of Energy, Chris Wright, a fact which has generated friction among Democrats.

Similarly, SMR 0.00%↑ is building a reactor in Romania using technology deemed expensive in the U.S., while its partners have strong White House connections that allow them to lobby for sanction relief. Broadly, these companies operate precisely within the current of state policy, without which they would be unable to survive in this highly regulated market.

This political backing is the only way to explain the sustained growth in the share prices of these three specific companies, which have yet to even construct their reactors. Investors remain unfazed because they recognize the commitment of the Trump administration to the expansion of nuclear power.

However, while these emerging companies can be seen as speculative, established players like VST 0.00%↑ and TLN 0.00%↑ are secured by long-term contracts, boasting stable cash flow, and both are actively developing new growth areas. $VST is highly active in West Texas, the hub for the majority of new data centers, and $TLN has secured a contract with EOSE 0.00%↑ for energy storage. Paired with CEG 0.00%↑ , which Wells Fargo considers undervalued, this trio provides your portfolio with solid, low-risk growth.

When constructing a portfolio, the most crucial step is understanding the macrotrends. The expansion of data centers, a topic I’ve covered extensively, is fundamentally impossible without reliable energy sources. The conclusion for smart investors is straightforward.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Doesn’t OKLO actually fall into all three buckets? I.e. new-tech, baseload operator and fuel-recycling. Such vertical integration makes effectively makes them a highly leveraged pure SMR play.

I myself have been buying OKLO/CCJ for a while now. Though now I believe they are both extended now. Sam Altsman OKLO was a buy around 67 and Uranium miner CCJ came on to my radar at around USD 86 and the added to my position yesterday as it bounced from its 50 day moving average. Though yesterdays buy was a much smaller position compared to my initial entry.