Who wins from Oracle's giant deal?

From Miners to Plumbers: All You Need To Know To Invest in Data Center Stocks

Larry Ellison — the man who helped lead the internet revolution — is now at the center of the AI boom. Oracle’s stock has surged nearly 40%, making Ellison the richest man in the world.

And this is bigger than just a market rally. OpenAI has signed a $300 billion, five-year contract with Oracle — one of the largest cloud deals ever struck.

The real driver behind Oracle’s surge is its remaining performance obligations (backlog) — now standing at a staggering $455 billion, up 359% year-over-year. That pipeline of future contracts is what convinces the market this isn’t a quarter-to-quarter story but a structural shift.

For investors, the message is clear: the AI boom isn’t fading — it’s accelerating. Demand for compute in the U.S. is insatiable, and AI-optimized data centers will drive the market for at least the next five years. This is the new megatrend — where Oracle stands alongside emerging challengers, semiconductor makers, and infrastructure providers that all fuel the same wave.

What makes this moment striking is the irony: Sam Altman, who only months ago warned of an AI bubble, is now the one inflating it — turning OpenAI into Oracle’s largest client. That contradiction itself has become fuel for the market’s speculative fire.

The AI boom isn’t just about NVIDIA chips or flashy software startups. It’s about the infrastructure — the power, the land, the servers, the cables — that makes it all possible. From Bitcoin miners like IREN and WULF reinventing themselves as AI landlords, to the so-called “plumbers” like Powell, Sterling, and Credo keeping the lights on and the data flowing, the race to build data centers has become the real backbone of the AI economy.

More Deals, More Debt

Ellison’s earnings blowout landed just days after another frenzy: NeoCloud Nebius (NBIS) spiked more than 50% on news of a $19 billion deal with Microsoft — the same Microsoft that bankrolled OpenAI in its early days. The parallel wasn’t lost on investors: one giant bet on OpenAI’s software layer, another on Nebius’s infrastructure layer.

The $NBIS deal with $MSFT is an aggressive yet calculated move that is fundamentally changing the company’s financial profile. The acquisition of $3 billion in new capital is directly tied to the $19.4 billion contract. Without this deal, NBIS would not have been able to secure such significant funds, as the contract serves as a financial guarantee. This confirms Microsoft’s urgent need for AI capacity and its trust in NBIS’s expertise.

As a result, NBIS’s total assets will grow from $5.1 billion to $8.1 billion. Debt is climbing sharply from $1.3 billion to $4.3 billion, pushing the debt-to-assets ratio from 26% to 53%. That makes the company more leveraged — and more fragile. By comparison, CoreWeave runs a 42% debt-to-assets ratio ($11.05 billion debt on $26.24 billion assets). NBIS is now overtaking it in financial risk.

Ultimately, NBIS, like CoreWeave, has chosen the path of aggressive growth financed by debt. This is the price of admission to the big leagues: rapid market entry at the cost of higher leverage and heavy reliance on a single client. For now, investors are willing to bet that this gamble will pay off.

The Next Layer: Bitcoin Miners Turned AI Compute Providers

While Oracle and challengers like Nebius dominate the headlines, another group of unlikely winners has emerged: Bitcoin miners repurposing their infrastructure for AI workloads.

Iris Energy (IREN)

Share price: ~$33

Up more than 220% year-to-date.

Reported Q4 revenue up 228% to $187M, driven by its pivot toward AI hosting.

Named an NVIDIA preferred partner, expanding GPU deployment to 10,900 units — turning IREN into one of the most visible AI crossover stories in the sector.

Cipher Mining (CIFR)

Share price: ~$10

109% YTD

Re-rated by investors from a pure miner to a flexible operator of energy-dense data centers that can host AI and high-performance computing (HPC).

TeraWulf (WULF)

Share price: ~$10.8

94% YTD

Signed a 10-year, $3.7B AI hosting deal with Fluidstack, with optional extensions to $8.7B.

Backed by Google, which provided $3.2B in financing and took up to a 14% equity stake — a major validation of WULF’s AI strategy.

Why It Matters

These companies aren’t just Bitcoin miners anymore — they’ve become critical infrastructure for the AI economy. They already control what hyperscalers and startups desperately need: cheap power, real estate, and scalable data center capacity.

The re-rating of IREN, CIFR, and WULF shows how far the compute boom has spread. It’s no longer just about NVIDIA or Oracle — even miners once written off as “wasted electricity” are being recycled into the backbone of AI.

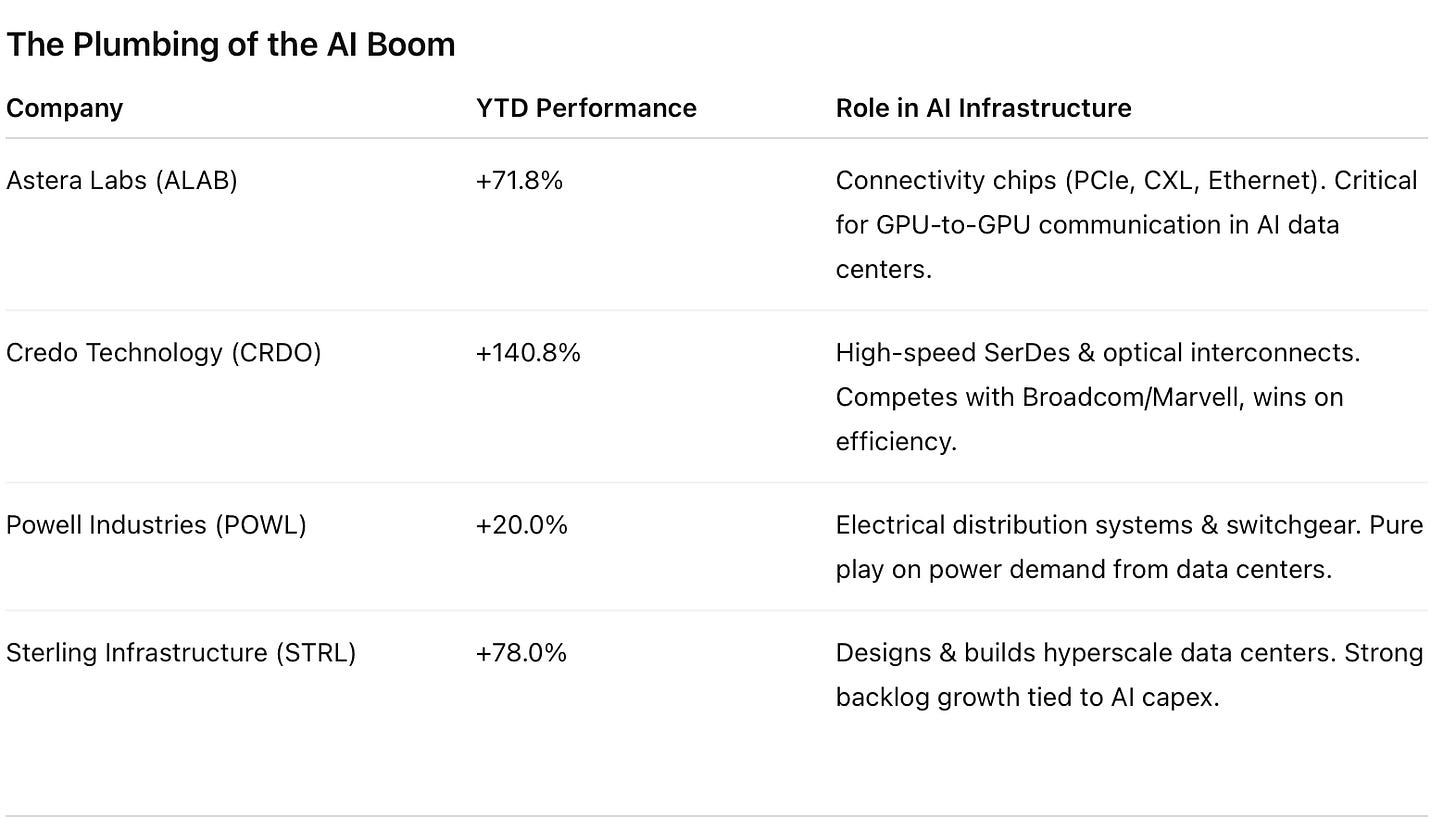

The Plumbing of the AI Boom: Stocks That Power the System

Why These Players Matter

These aren’t headline names like NVIDIA or Oracle — but they’re the hidden backbone of the AI boom.

ALAB & CRDO: the nervous system (ultrafast connections between chips).

POWL: the circulatory system (electricity distribution).

STRL: the skeleton (physical data center construction).

Together they show that AI isn’t just about chips and software — it’s an industrial megatrend reshaping the entire stack.

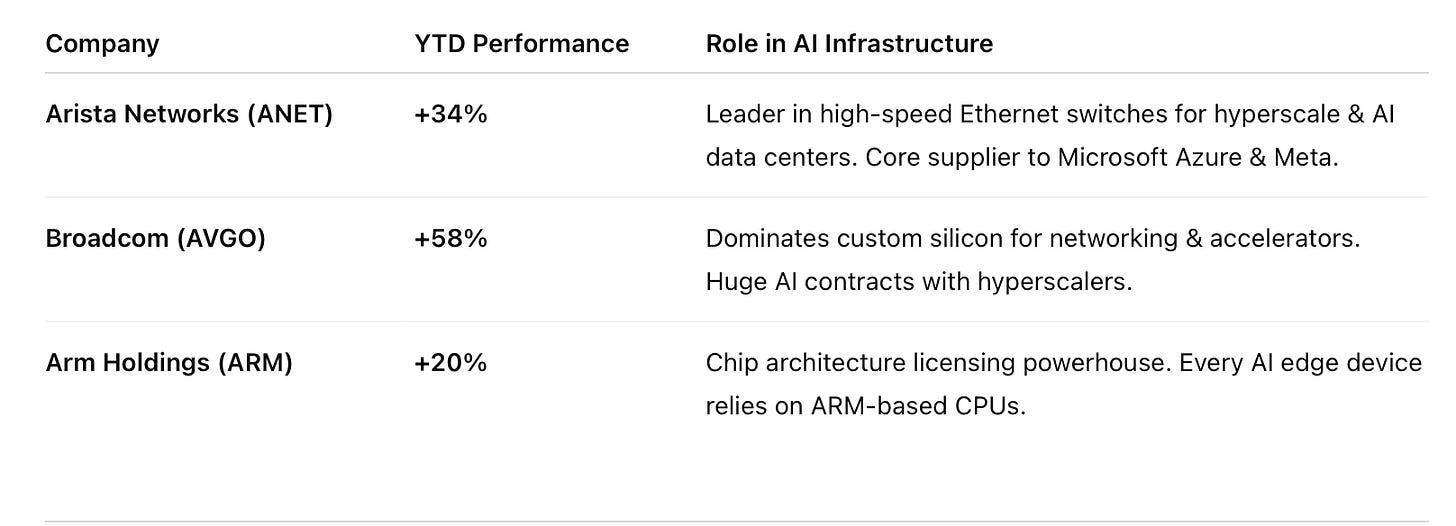

The Network Layer & Chip Architects

These three companies are the nervous system of AI infrastructure: without them, GPUs remain isolated islands.

The Landlords & Utilities of AI

If the network layer is the nervous system and the plumbers are the circulatory system, then this is the real estate and power backbone. AI can’t scale without places to house servers and massive amounts of reliable energy to run them.

Equinix (EQIX): The world’s largest colocation data center operator, with more than 250 facilities globally. As hyperscalers and AI-native companies scramble for compute space, Equinix is capturing premium rents and expanding capacity at record speed.

Digital Realty (DLR): A top hyperscale data center landlord with a strong global footprint. Its strategy is focused on building campuses tailored to AI workloads, making it one of the biggest direct beneficiaries of rising AI-driven capex.

NextEra Energy (NEE): The largest producer of renewable energy in the U.S., with a rapidly growing portfolio of solar and wind projects. AI and cloud providers rely on NextEra to secure long-term, clean power contracts that make data center expansion possible.

Constellation Energy (CEG): A leading U.S. supplier of nuclear and zero-carbon electricity. Its ability to deliver stable, round-the-clock baseload power positions it as a critical enabler for energy-hungry AI data centers.

The winner takes it all

The deals struck by Oracle and NBIS show that the AI bubble is still far from bursting. Data centers will require tens of billions of dollars in investment for many years ahead, and the leadership in this race is not fixed. Giants like Meta and Google are already building massive campuses, while Apple could eventually awaken to the opportunity — nothing can be ruled out.

If OpenAI is committing such extraordinary sums, it’s inevitable that others — xAI, Anthropic, and perhaps even Mistral — will follow with equally heavy spending. The AI boom is not slowing; it is accelerating, reshaping infrastructure, power markets, and technology investment for the next decade.

The AI race is no longer about quarterly earnings, but about who can finance and build the next layer of global infrastructure. The winners may shift, but the direction is unmistakable: more money, more power, more data centers. This is not the end of a bubble — it’s the beginning of an era

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Great post, that was really interesting.

Oracle’s backlog is impressive, but debt-fueled infrastructure bets remind me of telecom in the late ’90s. Demand is real — but so is the risk when leverage piles up.