Who Really Rules Nvidia?

Record-breaking numbers. $45B in quarterly revenue. AI supremacy cemented. But behind the blowout report lies a quieter, more dangerous story.

Record-breaking numbers. $45B in quarterly revenue. AI supremacy cemented. But behind the blowout report lies a quieter, more dangerous story.

The DeepSeek Distraction

On the surface, Nvidia looks untouchable. The company just posted $44.06 billion in quarterly revenue—a number so large that it now earns more in three months than AMD makes in a year ($28B), and nearly as much as Broadcom’s entire annual revenue ($51B).

Meanwhile, media coverage has focused on China’s DeepSeek, the mysterious AI startup that some feared might undermine Nvidia’s dominance. Rumors even circulated that DeepSeek would be forced to slow orders due to tighter U.S. export controls.

But here’s the truth: that story was a mirage.

The real firepower behind Nvidia’s growth isn’t startups like DeepSeek—it’s the hyperscalers. Companies like Google, Meta, Amazon, and Microsoft now spend over $300 billion annually on infrastructure, and a massive share of that capex flows directly to Nvidia’s data center business. DeepSeek, impressive as its model may be, is a sideshow.

The headlines miss the point: Nvidia hasn’t just survived—it’s entrenched.

The China Backchannel

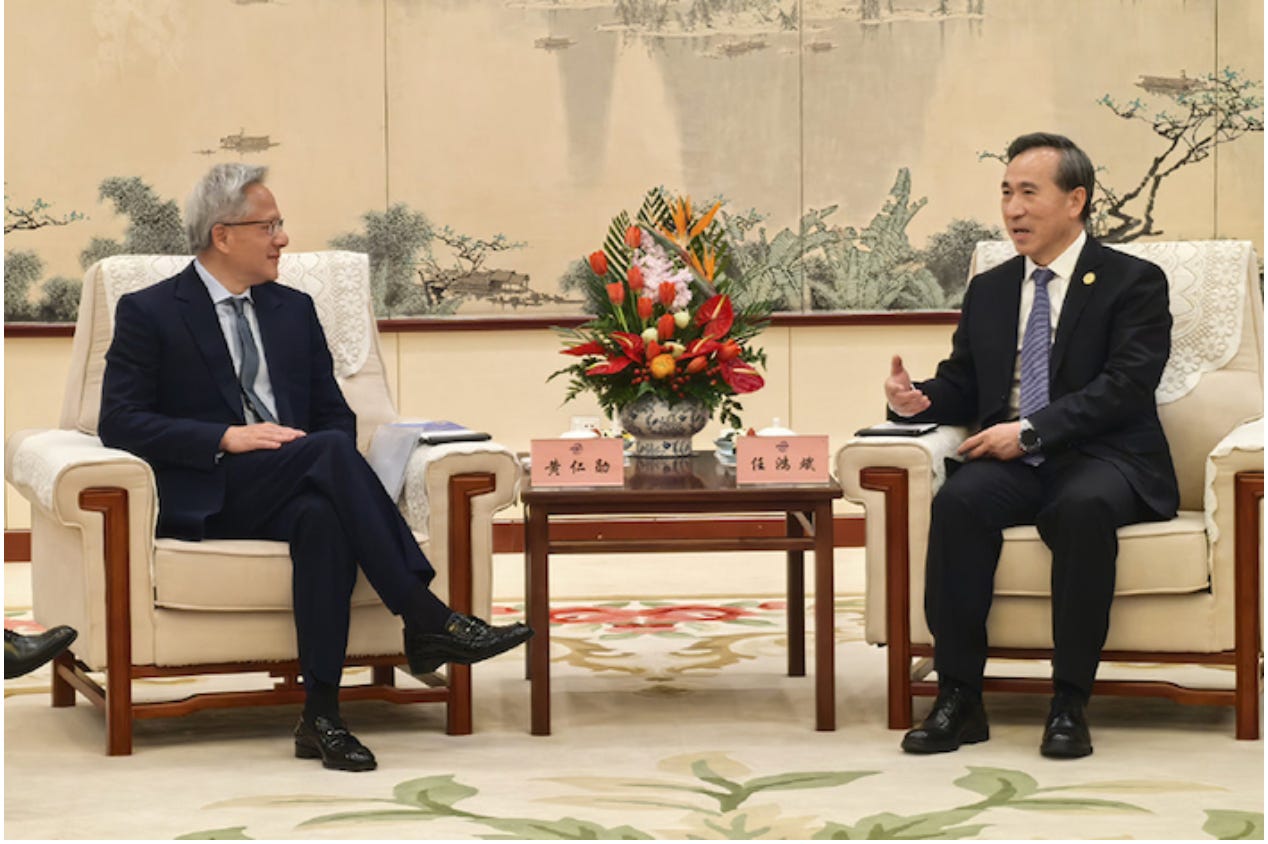

The second so-called “risk” was that Big Tech—Amazon, Google, Meta—would start making their own chips and replace Nvidia. But despite some in-house development (TPUs, Trainium), Nvidia’s momentum hasn’t slowed. Even with U.S. export controls, Nvidia has maintained relationships—and shipments—to China. CEO Jensen Huang has been conducting a form of shuttle diplomacy, quietly meeting with officials on both sides of the Pacific.

But this week, the story went public.

A WSJ report revealed that Nvidia’s plans to expand its Shanghai office triggered backlash in Washington. Lawmakers including Elizabeth Warren and Jim Banks demanded answers, citing national security concerns. They warned that the office could give China access to sensitive technologies—despite Nvidia’s assurance that no advanced R&D would occur there.

The symbolism is explosive: a bipartisan coalition now sees Nvidia not just as a market leader, but a geopolitical actor.

The U.S. fears Nvidia is doing too much to preserve access to the Chinese market. China fears losing its only real path to world-class AI compute. Jensen Huang is caught in the middle—and doing everything he can to stay in the game.

Sanctions, Loopholes, and Backdoor Deals

After the Biden administration imposed stricter export controls, Nvidia didn’t stop. Instead, it responded with the H20 chip—engineered to formally comply with restrictions while still offering performance close to its top-tier products. In practice, these chips maintained near-maximal throughput, keeping Chinese clients competitive.

Now, multiple U.S. opinion-makers have begun defending Nvidia, with op-eds arguing that it's in America's interest to spread its technology globally. Interestingly, these pro-Nvidia columns are landing on the exact same day as harsh bipartisan criticism from MAGA-aligned conservatives and progressive Democrats in Congress.

Recent plans for an Nvidia facility in Shanghai risk giving China access to cutting-edge technology, Sen. Jim Banks (R., Ind.) and Sen. Elizabeth Warren (D., Mass.) wrote in a recent letter to Chief Executive Jensen Huang, a copy of which was viewed by The Wall Street Journal.

The facility “raises significant national security and economic security issues that warrant serious review,” they said in the letter. The senators demanded that Nvidia provide a comprehensive timeline and description of its plans for the facility, including details on specific research and engineering projects and any financial incentives.

The real pressure point? Not AI competition—because China still trails far behind in chipmaking capacity. SMIC, China’s flagship foundry, is operational but hardly booming, with quarterly revenue just over $2B. Hua Hong Semiconductor, another key player, posted an 88% drop in profit for Q1 2025, netting only $3.8 million.

So the idea that U.S. chip sanctions are stifling “global competition” is—at best—debatable.

But what’s becoming more plausible is this: Nvidia is being used as geopolitical leverage—a bargaining chip not just between the U.S. and China, but potentially between China and Taiwan. Huang’s shuttle diplomacy may be more than just risk mitigation. It may be about preserving supply chains at any cost, under informal guarantees negotiated behind closed doors.

A Shadow Diplomat

What if Nvidia isn’t just a tech company — but the cornerstone of a shadow architecture that binds together global elites, national strategies, and data empires?

Consider the following: every major government pushing national AI projects — from Saudi Arabia to France to Singapore — is doing so with Nvidia hardware. They don’t just license technology — they build sovereign compute stacks that rely entirely on one vendor.

What if this isn’t accidental? What if Nvidia’s global expansion is less about product-market fit — and more about embedding dependence into national defense, health, and intelligence infrastructure? If compute is the new oil, then Nvidia is not Exxon — it’s OPEC.

And who better to negotiate backchannels and sovereign concessions than a charismatic founder with transpacific credibility? Jensen Huang might not just be a CEO — he might be the most important unofficial diplomat of the AI age.

Sovereign AI and the Offshoring of Compute

In recent months, Nvidia’s biggest deals haven’t come from Silicon Valley — they’ve come from places like Riyadh and Abu Dhabi. The company has secured multi-billion-dollar agreements to supply thousands of AI chips to national data centers in the Gulf region. These aren’t just sales — they’re infrastructure-level commitments, with long-term strategic impact.

The term “Sovereign AI” is no longer theoretical. Saudi Arabia’s King Abdullah University of Science and Technology (KAUST) is building its entire AI research cluster on Nvidia’s Blackwell chips. The UAE, through G42 and other national initiatives, is doing the same. These nations are not just buyers — they are building strategic digital capabilities.

In effect, countries are converting their capital reserves into compute power. And Nvidia? It’s positioning itself as the global supplier of that digital infrastructure.

The Web Nvidia Feeds

Nvidia's strength doesn't come from customers alone — it comes from the ecosystem it feeds. From Micron and Samsung, which supply memory and components, to Supermicro (SMCI), which builds the racks that house its GPUs, Nvidia sustains an entire supply chain.

Even SoftBank, with its bets on infrastructure and compute, and Stargate, with its ambitions for AI-first cities, ride Nvidia’s coattails. These companies — whether public giants or stealth-mode hyperscalers — are tied to Nvidia’s gravitational pull.

When Nvidia expands, they expand. When Nvidia sneezes, they catch the cold.

This isn’t just dominance — it’s dependence. Nvidia has become the beating heart of an AI economy, pulsing resources through a network of suppliers, integrators, and strategic partners. It's not just hardware — it's the foundation of compute capitalism.

Who Really Controls Nvidia?

For years, Jensen Huang was considered an engineering visionary—not a lobbyist, not a diplomat. Nvidia, despite its meteoric rise, had no meaningful lobbying presence in Washington as recently as 2017. And yet today, the company is shaping global policy, striking deals with sovereign states, and sidestepping export controls with strategic elegance.

Some have started asking the obvious question: who actually runs Nvidia now?

Chamath Palihapitiya recently made headlines with a pointed observation:

"You have a 2017 plan that they've been executing against, which is to say, we want to dominate this space. And you have an American company that has been working around the guidelines at every turn to try to land silicon into the hands of China."

In other words, this isn't a rogue actor — it's a structured, methodical expansion. But to whose benefit?

There are no clear answers. On the one hand, Nvidia’s deep integration into U.S. tech makes it a natural ally to the Silicon Valley consensus. On the other, its chip roadmap—feeding data centers, humanoid robots, and autonomous fleets—puts it in direct competition with Elon Musk, whose own AI ambitions are tightly linked to Tesla and xAI.

Are they rivals? Partners? Two arms of the same long-term play?

The uncomfortable truth may be that Nvidia has outgrown the traditional definition of a corporation. It feeds too many companies, negotiates with too many states, and holds too many geopolitical levers to be understood solely through a quarterly earnings lens.

It’s a compute empire—and like all empires, its true center of power may be intentionally opaque.

The Coming Battle for AI Governance

The final and most consequential question is this: who will set the standards for the next era of AI?

As language models proliferate, governments are rushing to implement alignment frameworks, safety boards, and regulatory protocols. But increasingly, it’s the chipmakers, not the policymakers, who control the stack.

If you control the silicon, you can throttle the training. You can enforce architecture-specific compliance. You can mandate safety layers at the hardware level. Nvidia is now so deep into AI infrastructure that it’s practically unavoidable in any sovereign initiative — which gives it unprecedented influence over what “safe” or “aligned” AI means.

In essence, we may be witnessing the birth of a new kind of regulator — not elected, not appointed, but etched in silicon and APIs.

As regulators play catch-up and Big Tech grapples with philosophical debates, Nvidia moves quietly — and globally — shaping how models are built, how inference is scaled, and how control flows from data to policy.

This isn’t a tech company. It’s a sovereign infrastructure layer, operating above nation-states, tethered to market logic but fused into political reality.

$200 and Beyond

With $45 billion in quarterly revenue, geopolitical entrenchment, and monopolistic control over compute infrastructure, Nvidia’s path to a $200 stock price is not a matter of if, but when.

Valuation metrics are increasingly irrelevant in the face of structural dominance. This is not a cyclical chip company—it’s the operating system of the AI economy. As global demand for foundation models and sovereign AI accelerates, so too will Nvidia’s margins and bargaining power.

Investors betting against it are not just betting against a stock — they’re betting against the future of AI itself.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Great article. Loved this line: "If compute is the new oil, then Nvidia is not Exxon — it’s OPEC."

I do think it still remains to be seen how much countries can/will/try to push Nvidia around and vice versa. That is the most fascinating part of the story I'm looking forward to.