The Pentagon's Best-Kept Secret That Could Make You Money

This isn’t a rocket company. It doesn’t build missiles or satellites. It builds the mission-critical subsystems that make those work.

It doesn’t scream headlines, doesn’t draw attention. But every time a defense budget goes up, Ducommun gets paid. The stock is up 30 YTD and people behind defense sector didn’t even hear about it. We’ll take a closer look

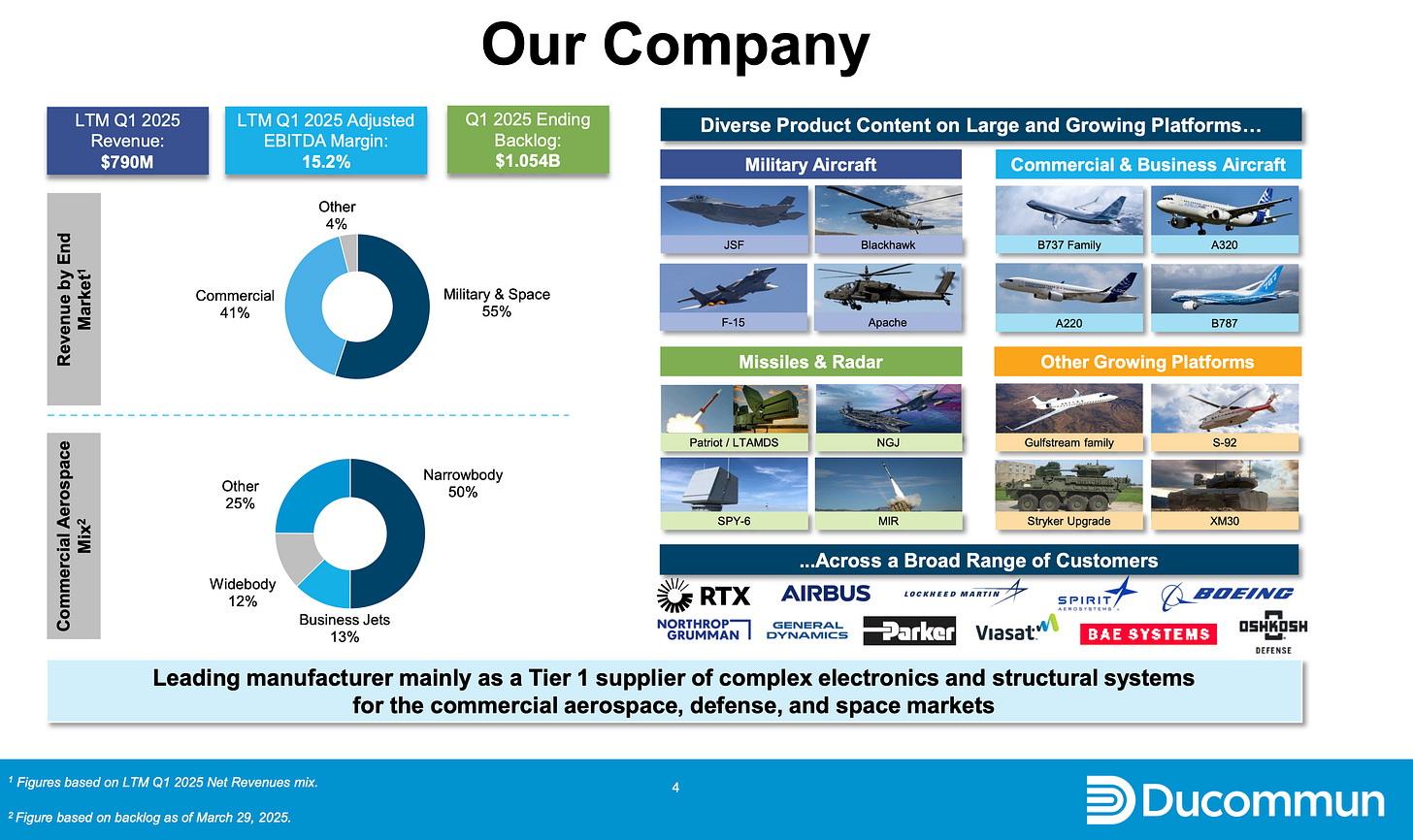

What the Data Shows

Record gross margin of 26.6%, +200bps YoY — a direct result of restructuring and strategic vertical integration.

Backlog of $1.05 billion, up $8M YoY — with $620M directly tied to defense, including classified programs.

Customers: Boeing, Raytheon, Lockheed Martin, Northrop Grumman — top-tier integrators relying on this tier-2 supplier.

Adjusted operating income: $19.2M (9.9% margin) — strong leverage despite commercial aerospace headwinds.

The Q1 print quietly revealed a 15% YoY growth in defense, offsetting a -10% decline in commercial aerospace. And buried in the report: “Acquisition placeholder” — a coded reference often used when strategic defense transactions are in motion but not yet disclosed.

This is what the pros call signal. Most won’t read past the headline. You just did.

No hype. No spotlight. Just high-margin exposure to multi-decade defense tailwinds.

This isn’t a meme stock. This isn’t a story stock.

This is a margin machine that lives in the footnotes of Pentagon procurement flows.

176 Years of Staying Power

Founded in 1849, Ducommun predates the Pentagon, the Wright brothers, and even the concept of aerospace itself. It started as a metal supplier during the California Gold Rush, evolved into a critical manufacturer during WWII, and has supported nearly every major U.S. military program since.

From B-17 bombers to Apollo-era guidance systems to classified space technologies today — it has always been in the background, building what matters.

The company went public in 1949, exactly 100 years after its founding. That kind of timing wasn’t random — Ducommun listed on the NYSE to capitalize on the coming Cold War boom in aerospace and military R&D. And it hasn’t left the defense-industrial bloodstream since.

Fun fact: when Northrop built the B-2 Spirit stealth bomber, Ducommun made the nose structure. When NASAneeded specialty shielding materials for deep-space electronics, they called Ducommun. Most investors have never heard of it. Most defense insiders don’t make a move without it.

The Hidden Engine of the U.S. Defense Industry

Ducommun operates in two segments — Structural Systems and Electronic Systems — both of which are indispensable to modern military and aerospace platforms.

Structural Systems: Ducommun manufactures critical airframe and engine components — the literal skeleton of fighter jets, bombers, rotorcraft, and unmanned platforms. These are not off-the-shelf parts; they are highly specialized, built to meet extreme tolerances, and integrated directly into platforms like the F-35, V-22 Osprey, and B-2.

Electronic Systems: From radar shielding and circuit cards to high-reliability wiring for guided munitions and satellite payloads, Ducommun builds the hidden electronics that give modern weapons and spacecraft their edge. Think: high-reliability interconnects for space vehicles, signal integrity systems for missile guidance, and flight-critical avionics for next-gen aircraft.

This isn’t a company that competes with Lockheed or Boeing.

It’s the company that makes sure Lockheed and Boeing can deliver.

Deep Defense Integration

In 2024 alone, Ducommun shipped 1.3 million+ individual components across more than 75 active defense and space platforms. Roughly 90% of Electronic Systems revenue and 70% of Structural Systems revenue was tied directly to defense and classified customers. The F-35 alone accounts for nearly 10% of total sales — and that's just one airframe.

Revenue per program isn’t flashy — but it’s sticky. A single radar shielding subsystem can generate $1–3M annually for decades. Multiply that across 30+ long-cycle platforms, and you start to see why defense investors quietly load this name.

Built-In Moat

Its components are often non-substitutable once qualified. That means once Ducommun is inside a system — it's locked in for the lifecycle. In the defense world, that could mean 20 to 30 years of recurring revenue per program.

Its manufacturing footprint spans multiple U.S. states, many co-located near military bases or defense hubs — not for convenience, but because proximity matters in secure supply chains.

Designed for the 2025 Playbook

Classified programs? It’s in those too. The company doesn’t break them out for obvious reasons — but the balance sheet and growth trajectory say enough.

And perhaps most critically: 95% of Ducommun’s manufacturing is done inside the U.S. Only 5% of production is located in Mexico — and that’s for non-defense applications. This is a rare case of a legacy defense supplier whose entire value chain is aligned with the America First doctrine.

In a Trump-led administration, where reshoring, defense autonomy, and domestic jobs are policy priorities, Ducommun is perfectly positioned — almost like it was built for this political cycle.

Geopolitical Insulation

This is a backbone supplier. You don’t read about it in headlines, but its parts fly every day — and keep flying, even when budgets tighten or programs shift.

And it’s not just about manufacturing. Ducommun’s entire revenue base is domestic: over 85% of 2024 sales were to U.S.-based customers. Sales to China? Less than 3%, mostly for Airbus — and even those have seen no tariff-related impact so far.

Supply chain? Also U.S.-centric. Less than 5% of direct suppliers are foreign, and even among those, China exposure is in the low single digits. The company expects to mitigate any residual tariff impact through military duty exemptions, alternative sourcing, or passing costs to the customer.

“We are a U.S. manufacturing business with U.S. employees and generate 95% of revenues from our domestic facilities.”

— Suman Mukherjee, CFO, Q1 2025 Earnings Call

Earnings & Outlook: A Margin Machine in Motion

Ducommun isn’t just riding defense tailwinds — it’s operationally outperforming. Q1 2025 results confirmed what insiders already suspected: the company is quietly entering its most profitable phase in decades.

RBC Capital recently raised its price target from $72 to $95, citing Ducommun’s growing leverage in engineered subsystems and defense integration. Meanwhile, The Goldman Sachs Group boosted their price target from $84.00 to $94.00 and gave the company a "Buy" rating in a research note — joining a growing list of institutions spotlighting this quietly compounding small-cap.

At the center of it all: the Engineered Products segment — under 25% of total revenue, but generating over 60% of EBITDA.

Q1 Snapshot:

Gross margin: 26.6% — record high, driven by vertical integration.

Adjusted EBITDA: $25.7M — with margin expansion despite commercial drag.

Backlog: $1.05B — including long-cycle and classified programs.

Debt: moderate, with solid coverage and conservative capital allocation.

Even after a 30% YTD rally, shares still trade at ~10x forward EBITDA — materially below peers when adjusted for defense exposure and recurring revenue quality.

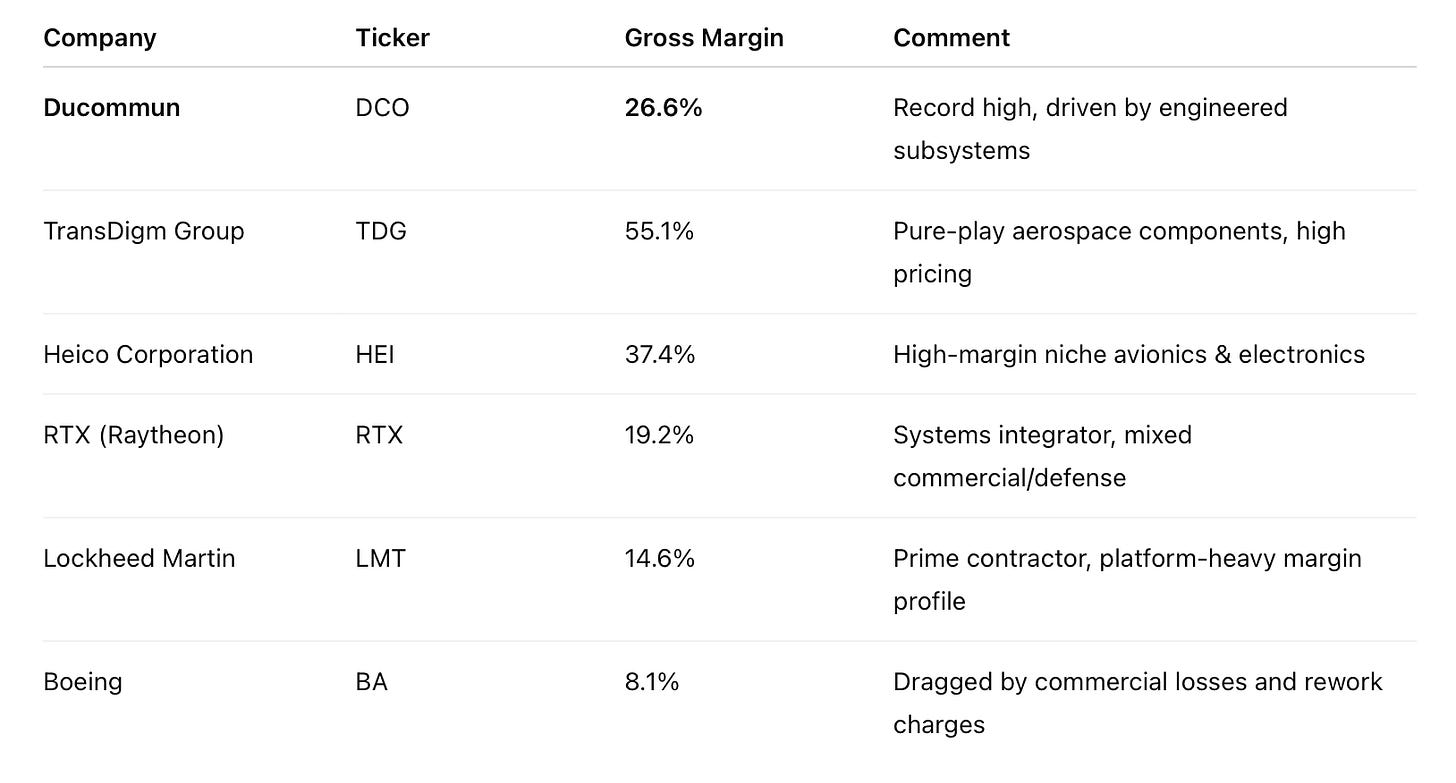

How Ducommun’s Margins Stack Up

FY2024–Q1 2025 gross margin comparison

Ducommun doesn’t match the 50%+ profile of TransDigm — few do — but it outpaces every Tier-1 integrator, while retaining a smaller-cap valuation and deeper embeddedness in platform internals.

What’s Next?

FY26 Pentagon budgets are expected to expand across space, missiles, hypersonics, and unmanned systems — all platforms where Ducommun already ships components.

Commercial aerospace is bottoming out, offering optionality as Boeing and Airbus normalize production.

Any future disclosure or bolt-on M&A within the Engineered Products segment could catalyze both margin expansion and multiple rerating.

This is what happens when a 176-year-old supplier quietly compounds on the back of precision, qualification, and long-cycle defense inertia.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.