THE MARKET IS CRASHING—HOW DID WE END UP HERE AGAIN AND WHAT TO DO NEXT?

Learn how to sell—it's the only way to survive.

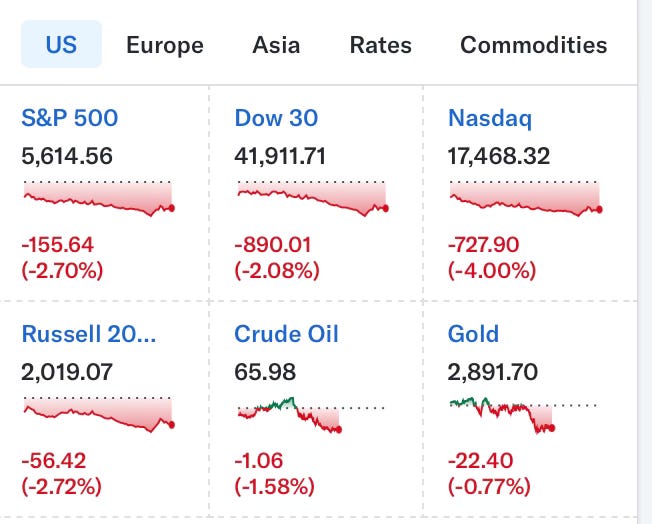

What we saw today in the market was a real bloodbath—no sugarcoating it. Everything is in red after tariff wars threatened to reignite inflation and force more rate hikes.

Goldman Sachs just slashed its 2025 GDP forecast from 2.4% to 1.7%. The Nasdaq is taking its worst beating since 2022. Panic is in the air.

I’m not here to list every ominous sign flashing across your screen. The real question is simple:

🔍 What do you do when your entire portfolio is bleeding?

🔍 How do you make sure this never happens to you again?

WHEN WARREN BUFFETT SELLS, PAY ATTENTION

Buffett doesn’t panic sell. He doesn’t day trade. He plays the long game. So when he quietly trims his biggest winners, people should ask why.

Just two months ago, Buffett started selling Apple—his largest position and one of the most dominant companies on the planet. He also dumped shares of Bank of America and other financial stocks.

No official reason. No big announcement. Just… selling.

Why? Because he saw risk on the horizon.

Could it be uncertainty around a second Trump presidency? Could it be rising geopolitical risks, inflation concerns, or overvalued tech stocks? Or maybe it's just Buffett doing what he always does—seeing risk before the rest of the market does.

Remember when he dumped airline stocks in December 2019? No one understood it at the time. The economy was still running strong, travel demand was high, and airlines looked like solid bets. But Buffett saw the early signs of the pandemic's impact before the rest of the market did. He anticipated travel restrictions, declining demand, and major disruptions that would shake the airline industry. So he exited while others stayed optimistic.

The lesson? You don’t need a perfect reason to sell. If the risk outweighs the reward, take your money and move on.

Buffett’s rule is simple: 🔴 If something feels off—sell.

WHEN TO SELL—THE BIG QUESTION

You have two ways to survive this market:

1️⃣ Try to time it—Sell high, buy lower.

2️⃣ Hold stocks you believe in—because history shows the market always bounces back.

The stock market recovered from the dot-com crash, the 1987 collapse, and the 2008 financial crisis—and each time, it climbed to new highs. That’s how this game works. But if you don’t want to play the long game like Buffett, you mustlearn when to sell at the right levels before a crash erases your gains. Remember, it never hurts to take some money off the table.

WHY SELLING IS HARDER THAN BUYING

Here’s why most people fail at selling:

Good earnings drop → Analysts raise price targets → You hold for more gains.

Stock keeps rising → You see no reason to sell.

Suddenly, a crash hits. 30%, 40%, 50% gone in days. **Tesla, Applovin, Robinhood—ring a bell?

Be very careful with unprofitable small-cap stocks that suddenly pop up in triple digits. It’s one of the signs of the market overheating. In hard times, you’re better off sticking with Apple and Google than with hopefuls like Snap or BigBear.

📉 The key? Discipline.

Don’t wait until fear kicks in—sell when your targets are hit, not when the market forces your hand.

🔥 Final Thought: The market doesn’t reward greed. It rewards discipline. Know your exit points, or the market will decide them for you.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.