The Market Entry Strategy: How to Conquer Analytical Paralysis

Why $UAMY, $IDR, and Others are Soaring: How the Retail Investor Can Join the Trend

Hello,

The market is running on pure adrenaline today. $UAMY, $USAR, and many other Rare Earth Metals (REM)companies are soaring on geopolitics.

The reason is China’s latest tightening of export controls. Beijing didn’t just restrict material; they added five key rare earth elements to their control list and, crucially, introduced rules that:

Limit REM export to overseas defense firms and semiconductor producers.

Ban the export of dozens of refining technologies and magnet manufacturing know-how, cementing their monopoly.

Require compliance from foreign producers (like those in India) to ensure Chinese materials are not rerouted to the U.S.

This is an economic weapon that instantly increases the value of any non-Chinese alternative.

A logical question arises: which companies to buy, beyond those everyone is talking about, and how to do it when so little is known and written about them?

For example, who knew about Idaho Resources Corporation ($IDR) until recently? I’ve added it to my portfolio very recently when I was looking for new REM companies, and I was surprised that it has grown no less than RobinHood.

And here a very logical question arises: how should we, ordinary investors, act when a hot topic suddenly emerges, there is practically no time to study the companies, and analyst valuations mostly slow things down because they focus on reporting and not the current trend, and cannot instantly account for newly emerged circumstances.

How should an investor act if they need to catch the trend on unfamiliar stocks and participate in the growth?

2. Overcoming Analytical Paralysis: A Quantitative Plan

This is where the trap of analytical paralysis sets in: there is no time to study the companies, analysts are focused on old reports rather than the current trend, and you need to get in on the growth of an unfamiliar stock.

Crucially, before buying an unfamiliar stock, a very logical fear of losing money arises in every investor, including myself. It is extremely difficult to predict the behavior of a stock that was irrelevant for a long time. On the other hand, there is a chance to profit from a hot trend.

This is the very essence of analytical paralysis: you desperately want to profit, but you are terrified to hit the ‘Buy’ button.

Undeniably, here you must rely solely on your own judgment, not on the “super-investors” who surround us on social media and who supposedly bought Amazon before Jeff Bezos was born.

Therefore, we will now look at an approach that can be called conservative. It doesn’t promise multi-bagger returns, but it allows you to join the trend while protecting your capital.

How to act?

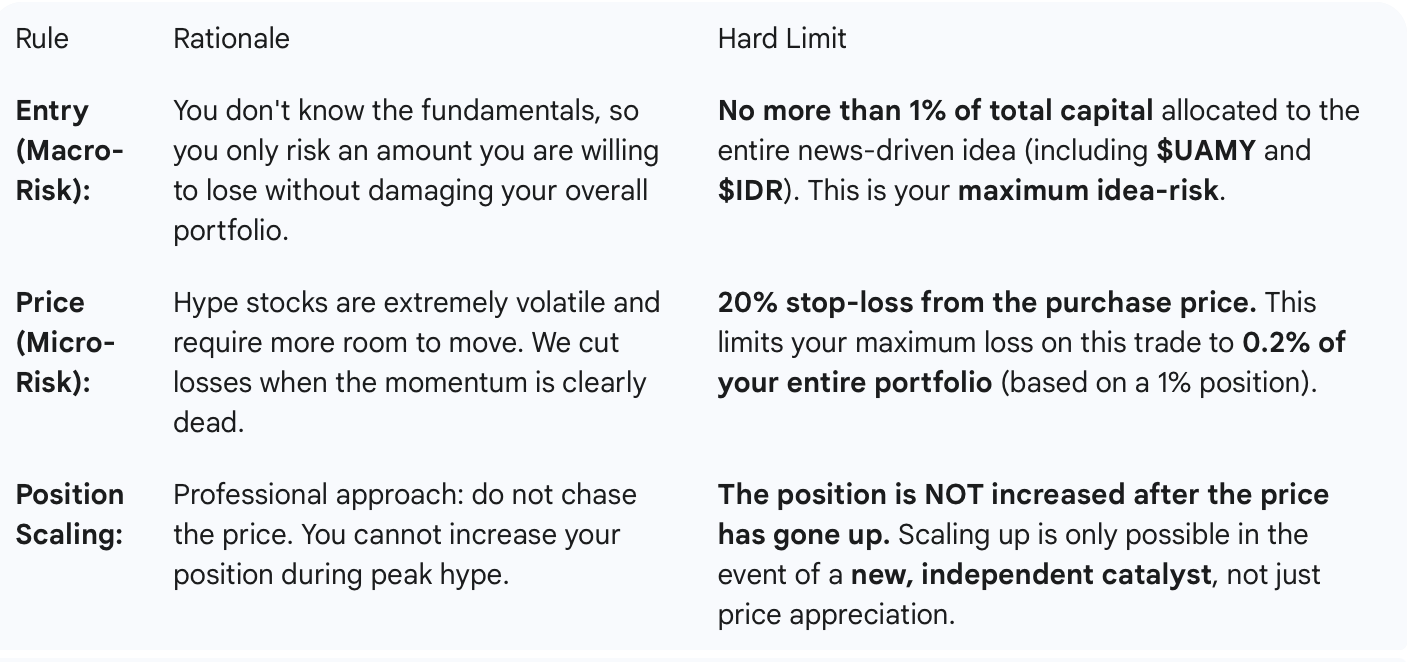

The answer is simple: translate emotional resolve into rigid, quantitative rules. We cannot control the price, but we must control the risk.

Here is our refined, quantitative plan for entering a momentum trade on an unfamiliar stock. This plan is conservative—it protects capital but inevitably limits potential upside:

The Investor’s Lesson: Building Your Own Strategic ETF

If you lack understanding of which single stock to pick, the best way to mitigate risk is to create your own mini-ETFconsisting of several stocks with varying participation percentages. This strategy allows you to:

Reduce Concentration Risk: You are protected if one high-risk player fails.

Gain Sector Insight: You get a practical understanding of how the sector operates, which helps you conduct better research later.

Cover Different Metals: You can choose stocks that produce different elements to cover various industrial sectors and track news accordingly.

For example:

$LAC (Lithium Americas Corp.) focuses on aluminum and lithium, representing a relatively more established segment of the energy transition.

$NB (NioCorp Developments) is developing the Elk Creek project in Nebraska to produce niobium, scandium, and titanium, aiming to establish a domestic supply for the United States.

Crucially: NioCorp is in the pre-production, building, and development phase. This means it carries a high operational risk. If the company bears this high risk, then so do you, the investor.

Therefore, your approach must be aligned with your risk profile:

High-Risk Profile: Buy 1-2 highly volatile stocks that could “explode” but might also go to zero.

Conservative Profile: Buy 3-4 stocks to create a space for maneuver, balancing potential winners against potential failures.

You don’t need to do this immediately, but you should always have your strategy ready.

Stop overthinking, Time To Act

My practical advice is to use this news to train your decisiveness and discipline. Stop overthinking. It’s time to act, but only while strictly controlling the risk.

The foundation of any strategic bet is quality research. In the next letter, exclusively for paid subscribers, I will present a comprehensive guide to the Rare Earth Metals market.

This is your chance to get the research needed to build your portfolio and gain a clear understanding of the geopolitical landscape. The fight for control over rare earth metals is not going away, regardless of how negotiations between China and the U.S. conclude. Even if a tactical thaw occurs, the strategic disagreements will remain.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Great read → With REE and metals there are decades where nothing happens; and there are weeks where decades happen... basically! Good work Edge ♥! Time to act!