The Little Drone Maker Delivers Big: Zenatech’s Earnings Shock the Street

Zenatech went from underdog to market standout this quarter, blowing past expectations with the kind of numbers that make even skeptics pay attention.

Zenatech went from underdog to market standout this quarter, blowing past expectations with the kind of numbers that make even skeptics pay attention.

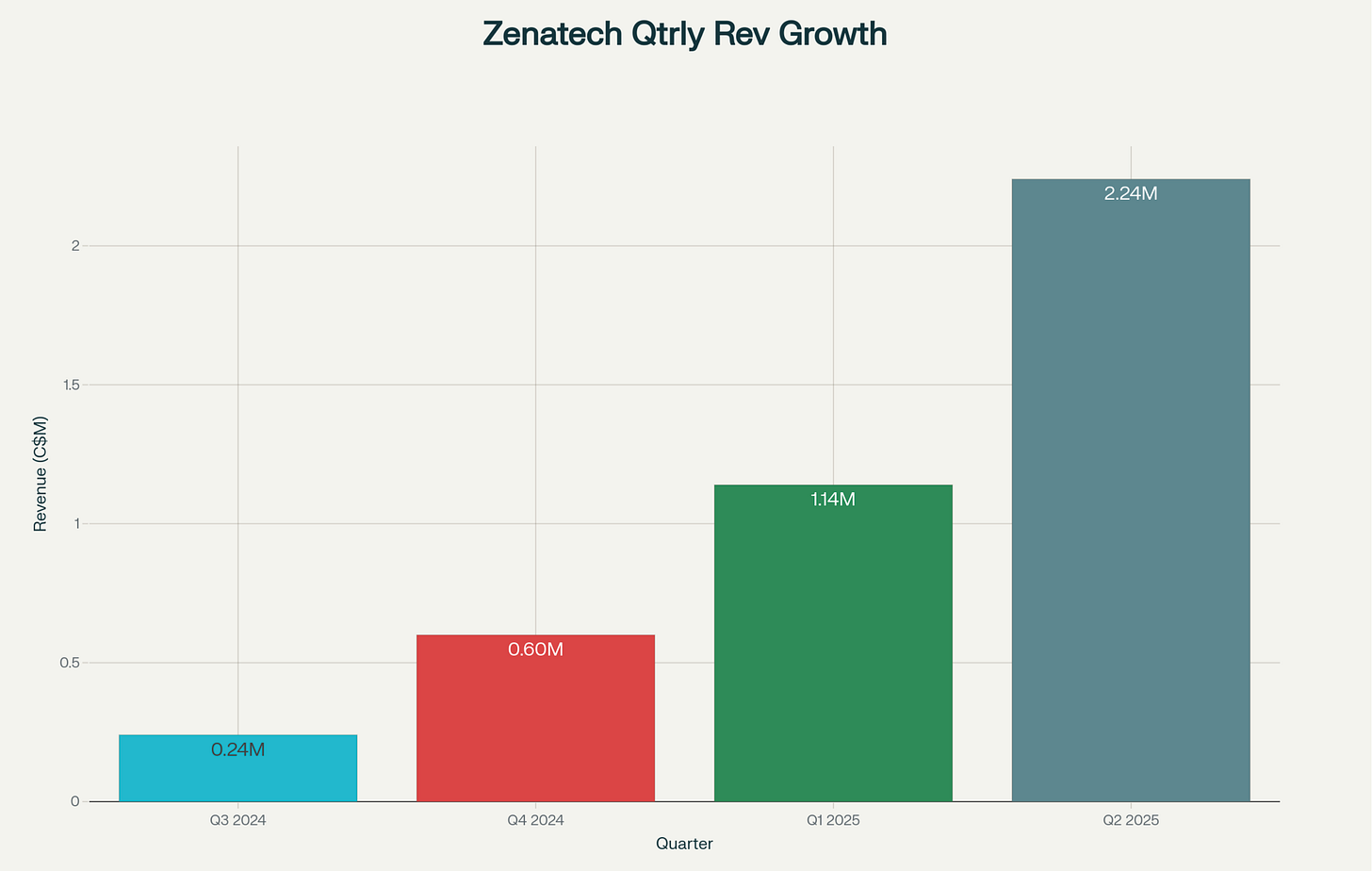

500% Revenue Growth — Record-Setting Acceleration

Zenatech’s Q2 2025 revenue soared to $2.24 million, up an astonishing 503% from just $371,049 in Q2 last year. For the first half of 2025, revenue jumped 251% to $3.38 million compared to $962,428 for the same period in 2024.

This isn’t incremental progress—it’s a growth spurt that marks Zenatech’s best quarterly result in its history.

The driving force? Explosive growth in their Drone as a Service (DaaS) segment, which brought in $1.98 million for the first half, and steady, building momentum in their enterprise SaaS line at $1.39 million.

Zenatech is quickly proving it isn’t just a hardware or “gadget” company—its mix of high-tech services and recurring software revenue is creating a resilient business model critics can’t ignore.

Strategic Moves — Fuel for the Next Leg Up

Zenatech didn’t just ride one trend this quarter. Management executed:

• Six key US acquisitions in the land surveying and engineering field, laying the groundwork for a national network that leverages drone tech for everything from mapping and inspections to agriculture.

• Defense progress—not only did they submit applications for the Green UAS certification (key for US defense contracts), but they launched Zena AI to laser-focus on advanced AI for military needs.

• Balance sheet fortification—cash reserves jumped to $10.29 million as of June 30, 2025, from $3.75 million at the end of last year.

Dr. Shaun Passley, Zenatech’s CEO, called Q2 a “transformative quarter,”

“Our aggressive entry into the drone services market has generated substantial revenue growth, while our established enterprise software business continues to provide a stable foundation… We believe defense will continue to be a key segment… we are poised to quickly react to ongoing policy directives favoring American drone makers.”, Dr. Shaun Passley, Zenatech’s CEO

Eyes on the Future

Looking ahead, Zenatech expects even more revenue growth in the second half of 2025, driven by:

• Full-period contributions from its recent acquisitions

• A rich acquisition pipeline (targeting 25 DaaS-related companies by mid-2026)

• Expanding applications in surveying, inspections, agriculture, and maintenance

• Expansion of SaaS for more enterprise clients

• Progress toward full Blue UAS certification—key to unlocking rapid US Department of Defense sales

What Drives The Growth

Zenatech operates through several distinct but interconnected divisions that together form the company’s growth engine. Breaking down these units helps clarify where the revenues come from, the different customer bases served, and the company’s multi-faceted approach in the drone and software space.

1Breaking Down Zenatech’s Business Divisions and Revenue Streams

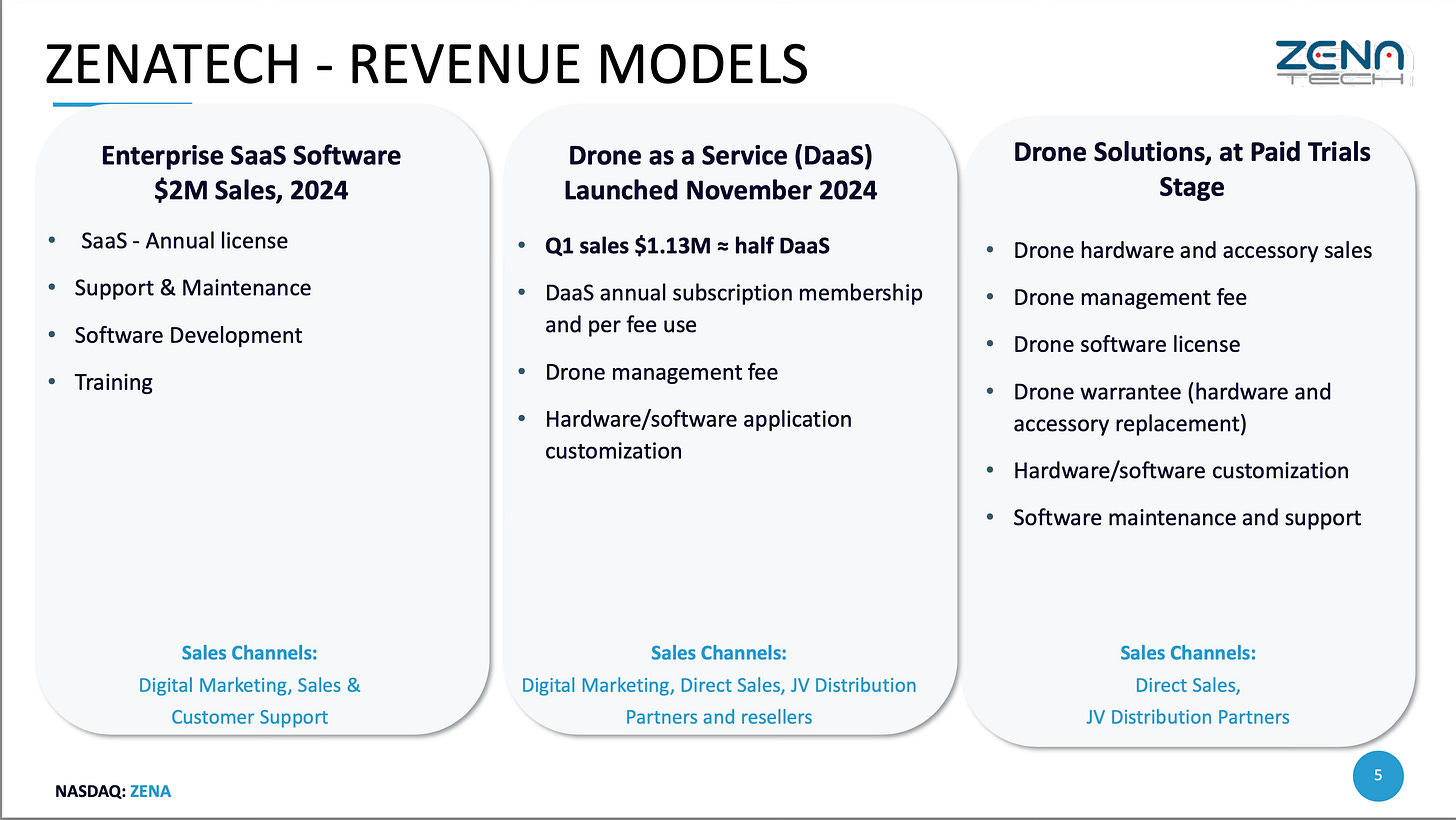

Zenatech’s strength lies in a diversified business model, composed of three core divisions that work together to drive growth and create a scalable platform in the evolving drone and AI tech market.

1. Enterprise SaaS Software

This division represents the stable backbone of Zenatech’s revenue, bringing in around $2 million in sales for 2024. It offers annual software licenses alongside support, maintenance, and training, focused on AI-driven fleet management, data analytics, and compliance tracking. Its customers are mostly large enterprises and government agencies, attracted by the high-margin recurring revenue that this software brings. This segment enhances Zenatech’s move beyond hardware, positioning it as a technology platform provider.

2. Drone as a Service (DaaS)

Launched in November 2024, DaaS is the fastest-growing component, with Q1 sales already pushing around $565,000. This “Uber for drones” model lets customers subscribe or pay per use for drone services without owning the hardware or managing pilots. It covers applications from land surveying and infrastructure inspection to agricultural monitoring and security. Zenatech is building out this network through strategic acquisitions of regional surveying and engineering firms, aiming for a national footprint in the U.S. This recurring revenue stream develops deeper, stickier client relationships and fuels predictable growth.

3. Drone Solutions and Hardware Sales

While currently in the early “paid trials” phase with large enterprise and government clients, direct sales of drones (like the flagship ZenaDrone 1000 and IQ series) and customized software packages remain a critical foundation. These hardware sales and associated service contracts often pave the way for future DaaS and SaaS engagements, helping Zenatech convert one-time buyers into long-term subscribers.

Why This Matters

Most of Zenatech’s 2024 revenue came from the SaaS business, but the rapid ramp-up of DaaS signals a shift toward a more service-oriented model. By layering subscription services on top of hardware sales, Zenatech is building a more resilient and scalable business. This approach also aligns well with industry trends projecting explosive growth in the global drone market, both commercial and defense-related.

Combining software, recurring drone service subscriptions, and specialized hardware sales allows Zenatech to differentiate from pure hardware vendors and compete with larger tech players by offering full-stack solutions. As they scale these divisions — especially with government-certified pilot training and defense contracts in the pipeline — the company is positioning itself to capture growing market demand while managing operational complexity.

4. Training & Certification

While smaller in scale compared to the others, the training division is growing in strategic importance. By acquiring an FAA-certified flight school specializing in Part 61 pilot certifications and complex Beyond Visual Line of Sight (BVLOS) drone operations, Zenatech aims to internalize critical pilot training capabilities.

This positions the company to meet evolving regulatory requirements and specialize in government and military contracts that require highly certified drone pilots. It also strengthens the quality and consistency of operations under the DaaS model.

Breaking Zenatech’s business into these clear areas shows a company balancing traditional product sales with innovative service-based offerings and forward-looking software solutions. Investors and customers alike can appreciate how this multi-pronged model seeks to build stable, diversified revenue streams while scaling in a complex, fast-changing market.

The Defense Dream: Zenatech, the Pentagon, and the Eagle Point Factor

If you’re following Zenatech, you’ve probably noticed the growing buzz around their push into defense. It’s no secret—cracking the Pentagon is the holy grail for any drone startup. Military budgets dwarf the commercial side, but defense deals are a world apart from selling drones to farmers or warehouse operators.

Despite a lot of headline heat, real military drone money hasn’t landed just yet. Their earnings are coming mostly from commercial services and enterprise software. But that could change—and fast—because they’re laying down all the right tracks.

First, there’s the recent paid trials with the U.S. Air Force and Navy Reserve, where their big ZenaDrone 1000 lugged around heavy cargo for field deliveries. That’s a legit credibility builder; not many upstart companies even get their hardware in the door for defense-grade evaluations.

Next, Zenatech’s lining up the paperwork: they’re chasing the right certifications (like Green UAS) to even be allowed onto government rosters, and they’ve spun up a defense-focused AI unit (“Zena AI”) to tailor their tech for military needs. The moves are deliberate—they’re positioning themselves well ahead of the D.C. demand for “approved, American-made” unmanned systems.

The real X-factor: Eagle Point Funding

On paper, Eagle Point is an Israeli-American consultancy that helps tech companies grab non-dilutive federal funding. But talk to anyone in the deep-tech scene and there’s more buzz to them than a typical advisory. Their cofounders love to brag—loudly—on LinkedIn about scoring clients “hundreds of millions” in U.S. grants and defense R&D contracts. They say they’ve won over $1.5 billion for companies large and small (while keeping equity safe and founders in control).

Rumor is, Eagle Point isn’t just about helping Zenatech write good proposals. These folks have sat in on those no-press rooms where DARPA, AFWERX, and other Pentagon groups decide what projects actually move. They’re the unseen hand who knows which team to call, what language gets a cold email read, and—sometimes—how to quietly accelerate a project from demo to deployment.

“Our collaboration with Eagle Point Funding will accelerate testing, pilot deployments, and enable long-term procurement discussions—helping ZenaDrone to advance as a key provider of American-made drone solutions,” said Shaun Passley, ZenaTech CEO. “Their expertise in navigating federal R&D funding programs such as SBIR and Department of Defense solicitations (DoD BAA), gives us a powerful advantage as we develop next-generation drone technologies aligned with US defense priorities.

So, while Zenatech isn’t booking fat checks from the Pentagon just yet, don’t be surprised if something newsworthy drops in their next few updates. For now, the defense angle is a promise—a pipeline, not a profit center. But with trials under their belt and Eagle Point whispering at the right doors, this is one subplot you’ll want on your radar.

No military jackpot—yet. But Zenatech is setting itself up with the right people, paperwork, and partners. If (or when) the real contract lands, it could flip their whole growth story overnight.

Crunching the Numbers (Without the Spreadsheet Headache)

Alright, let’s get serious for a second. Here’s how ZENA looks if you try to put some real numbers on it:

Market Cap: About $132 million (that’s today’s share price multiplied by the 25.5M shares outstanding).

Last 12 months revenue: About $5.2 million (annualizing latest numbers).

Price-to-Sales (P/S) Ratio: 25x. That’s high, even for a tech growth play—but not unheard of if you believe revenue’s about to ramp big time.

Peer Check:

• Average drone/software “story stocks” in the US trade at 8–20x sales when hot.

• Sector leaders like Draganfly, AgEagle, or Red Cat are also unprofitable, but a few have hit contracts that rapidly narrow that P/S. ZENA’s revenue growth rate is actually higher than most, but it’s starting from a much smaller base.

Profitability:

• ZENA isn’t profitable yet. Latest net loss was over $10M for the first half of 2025.

• If they keep up this level of burn, they’ll need to boost sales fast or raise more cash at some point.

Bull Case (Upside):

• If DaaS subscriptions and big government/defense deals materialize, revenue could rise 2-3x over the next year or two.

• In that scenario? If the market keeps rewarding growth, you could justify a $250M–$350M market cap. That’s $10–$14 per share, more than double the current price.

Bear Case (Downside):

• If government sales take longer or DaaS hits a wall, the P/S ratio could compress to industry averages. That might mean the stock just drifts or even drops until the next major growth proof.

The Realistic Take:

• ZENA is a high-risk/high-reward bet. You’re counting on management to deliver not just eye-popping growth rates, but actual contracts that stick.

• For serious-sized positions, patience (and a tight stop if you trade) is key.

As always, do your own diligence—this isn’t investment advice, just my own best read on the situation.

Technical Take

If the fundamental growth story continues to play out and catalysts like defense contracts or accelerated DaaS adoption hit the tape, the chart offers a clear roadmap for how that momentum could unfold.

From a price action standpoint, ZENA has carved out a clear range with well-defined levels on both sides. Key support sits near $4, where the 200-day moving average has recently started to provide a base.

Daily Chart:

Even a deeper pullback toward the $2.50 area, home to the all-time point of control, would still be considered healthy within the broader uptrend.

On the upside, the $7.50 to $8.50 zone is a heavy band of resistance, aligning measured moves, Fibonacci retracements, and the convergence of a major weekly trendline.

Weekly Chart:

A breakout above that zone opens a fast track to the $11 to $12.50 area, which marks both the Nasdaq listing high and all-time high.

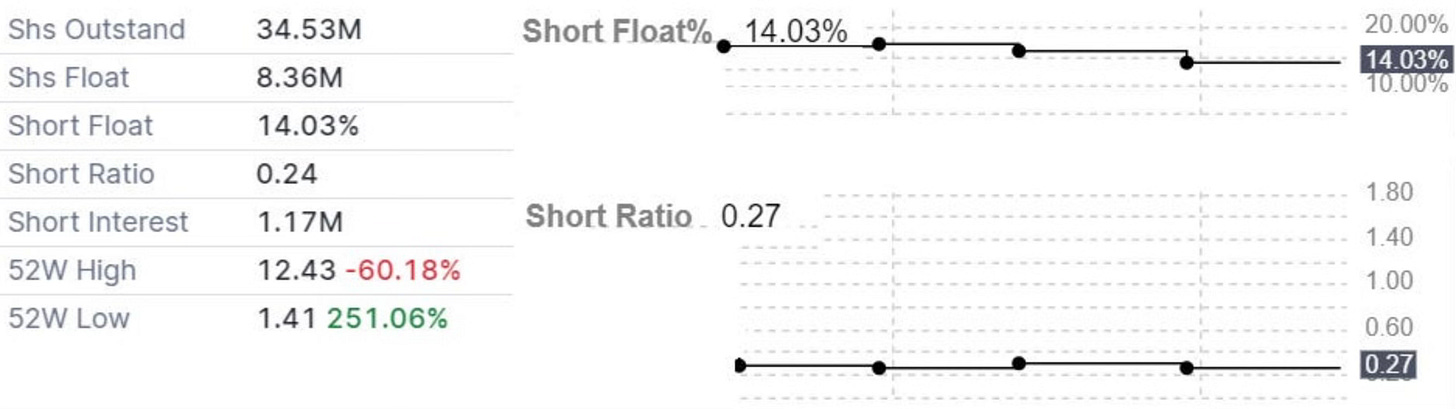

Float and positioning could add fuel to any move. According to Finviz, the float is just 8.4M shares against 34.5M outstanding, with roughly 14% of it sold short, a setup where any aggressive buying could quickly turn into a fast and furious squeeze.

According to Finviz, ZENA’s float has held around 8.36M shares, with short interest hovering between 14% and 17% since June, down sharply from nearly 40% late last year. While the short ratio is currently low at 0.24 days to cover, the combination of a small float, heavy insider ownership (over 67%), and minimal institutional presence means liquidity can dry up fast. That’s a setup where any strong catalyst could see shorts forced to cover quickly, turning an orderly breakout into a momentum squeeze.

From a broader tape perspective, volatility runs high with ATR near 0.50 on a $5 stock, and RSI sits at a neutral 49, leaving room for directional expansion. Given the 52-week low of 1.41 and high of 12.43, the current price is still sitting in the lower third of the range, keeping risk/reward skewed for active traders watching those key resistance zones.

Takeaway

Zenatech’s fundamentals and technical setup are aligned for high-volatility potential. Strong business momentum, a tight float, and well-defined chart levels create a backdrop where the right catalyst could trigger a move that is both sharp and sustained.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Interesting to see DaaS already driving results this fast. Diversification into services + SaaS makes their growth story feel a lot more durable than just hardware hype.