The Lithium Gatekeepers: How the Australian MAGA-Rinehart Axis is Redrawing the Map of Greenland

The Great Lithium Paradox: Triple-digit stock gains and zombie-factories. How billionaires are cornering the market and the global fight for critical metals.

Rare earths and critical minerals have become bargaining chips in the confrontation between the United States and China, and the key thing to understand is that they are not going away. They will accompany every deterioration in relations. When Donald Trump announced that countries trading with Iran would face a 25% tariff, China was the first country that came to mind. How Beijing could respond is not hard to imagine: critical minerals are always on the table.

But in the case of lithium, the shot was fired in advance.

China announced a phased rollback of value-added tax rebates on battery exports: first cutting the rebate from 9% to 6%, and then eliminating it entirely from 2027. Formally, this is a tax adjustment. In reality, it is a form of quiet tightening of export policy.

The logic is straightforward. Chinese battery manufacturers understand that exporting will become less profitable in the future. The rational response is to accelerate shipments now, while the old rules still apply. To do that, they ramp up battery production. Higher battery output automatically means higher demand for lithium.

The tax measure applies to batteries, not to lithium carbonate itself. But markets do not trade legal wording; they trade consequences.

As a result, lithium demand is pulled forward from the future into the present, the domestic Chinese market tightens, and lithium prices react immediately.

This is the key point: lithium is being used as a political instrument not through bans or sanctions, but through adjustments to economic incentives. No dramatic announcements, no formal restrictions, yet a direct and visible impact on prices.

That is how critical minerals move from geopolitics into markets long before open confrontation begins.

Lithium: The Indispensable Element

To understand why lithium is a geopolitical bargaining chip, we have to look at where it goes. We are no longer in an era where lithium is mainly for glass and ceramics; it is now a pure-play energy metal.

1. Transportation (~75% of Total Global Demand)

EVs: This is the undisputed “Elephant in the Room.” A standard Tesla-sized battery pack requires about 8 –10kg of lithium carbonate equivalent.

E-Trucks: The 2026 trend toward heavy-duty electric logistics is a massive multiplier - these vehicles require 3–5x more lithium per unit than passenger cars.

2. Grid Storage (BESS) (~15% of Total Global Demand)

The “New” Sink: Solar and wind farms require giant Battery Energy Storage Systems (BESS) to buffer power.

Growth: This sector is expanding at 40% per year, currently outpacing the growth rate of the EV market. It is the primary reason why lithium demand remains “sticky” even when car sales fluctuate.

3. Consumer Tech & Defense (~5% of Total Global Demand)

Ubiquity: While the percentage is small, this covers every smartphone, laptop, and medical device (pacemakers/lithium treatments).

Strategic Defense: This 5% includes the drones and man-portable electronics essential to modern warfare. In a conflict, this “small” percentage becomes a matter of national survival.

4. Legacy Industrial (~5% of Total Global Demand)

Lubricants & Glass: High-temperature greases (lithium stearate) and heat-resistant glass. Once the dominant sector, it is now a minor footnote in the global lithium balance.

Moving from what lithium does to where it comes from is where the story gets critical. Most people focus on “Lithium Reserves” (who has it in the ground). That is a mistake.

In the 2026 market, the only thing that matters is Refining Capacity.

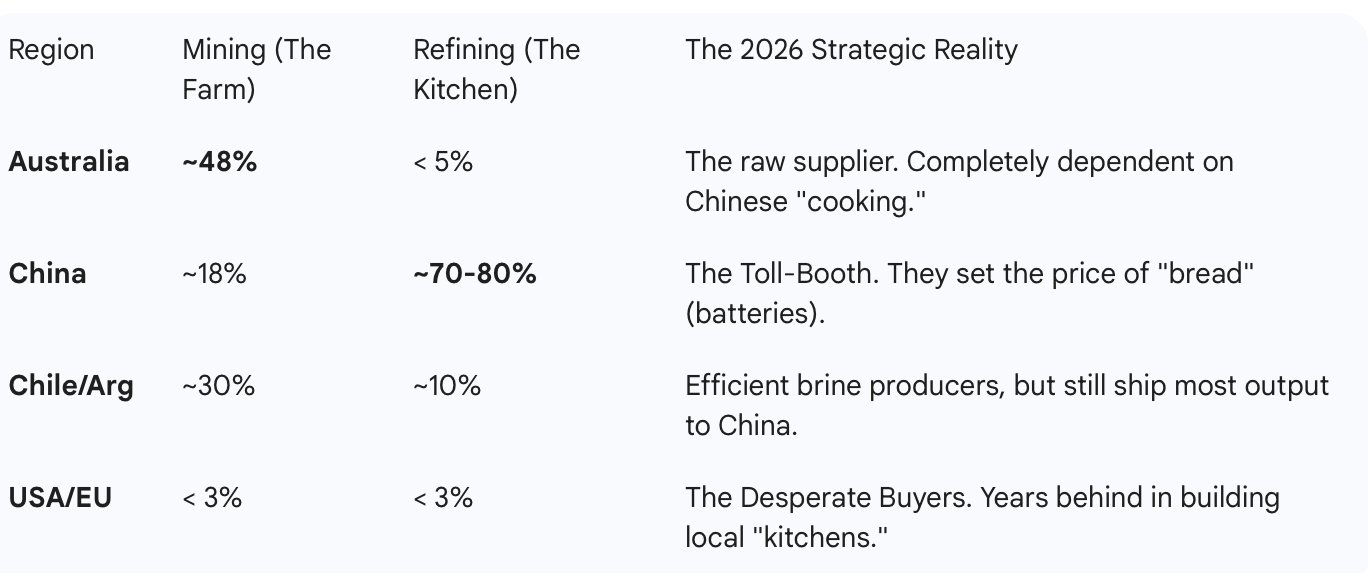

The “Farm” vs. The “Kitchen”

Think of lithium like flour. Many countries can grow the wheat (mining), but if only one country owns all the mills (refining), they decide the price of bread.

That’s why China’s reduction in VAT export rebates has triggered a “front-loading” rush. Battery makers are overproducing now to export before the next tax hike in April.

This creates a temporary spike in lithium demand and stock prices. But this demand “pulled forward” from the future. Once the tax deadline passes or warehouses fill up, the market could hit a massive oversupply wall by late 2026. For stocks like Albemarle (ALB) or Pilbara (PLS), this means extreme volatility. Current gains are likely driven by Chinese policy shifts, not a long-term deficit.

Keep reading with a 7-day free trial

Subscribe to Edge of Power to keep reading this post and get 7 days of free access to the full post archives.