Oscar Lifts Outlook, Medpace Soars 45%, and a Drone Maker with 30% Room to Fly

Healthcare gets a boost, biotech surprises, and defense tech stays hot

Oklo x Vertiv: Betting on the Future of Power

Nuclear startup Oklo just locked in a partnership with Vertiv, the $100B+ data center infrastructure giant. The two companies will collaborate on integrating Oklo’s compact nuclear reactors into data center designs — a big step toward solving the energy problem at the edge of AI growth.

This isn’t about press releases or vague intentions. Oklo’s reactors aren’t science fiction — they’re designed for 24/7, carbon-free power, and have already attracted backing from Sam Altman, who chairs the company. Citi recently gave OKLO a $68 target (a 300%+ upside), citing the massive potential in next-gen energy for AI infrastructure.

For Oklo, the Vertiv deal gives them credibility in the data center space and a realistic path to deployment. For Vertiv, it’s a strategic hedge — a way to stay relevant as traditional energy grids struggle to keep up with demand.

Vertiv, meanwhile, could use the momentum. Just a few weeks ago, the stock dropped 10% in a single day after reports that Amazon was planning to phase out third-party equipment — including Vertiv’s — in favor of in-house solutions. The Oklo deal helps shift that narrative: instead of being seen as a replaceable vendor, Vertiv is aligning itself with frontier infrastructure projects where customization and integration matter more than scale.

This partnership is a bet on what powers the next wave of computing — not just chips, but the electrons behind them.

Oscar Health raises guidance — but losses still dominate the picture

Oscar Health bumped its FY2025 revenue outlook to $12.0–12.2B, up from $11.2–11.3B previously. That beats the consensus estimate of $11.32B, but the market didn’t cheer: the stock dropped nearly 2%.

Why? Because the rest of the numbers aren’t improving.

The company still expects a medical loss ratio of 86–87%, SG&A expenses of 17.1–17.6%, and a full-year operating loss of $200–300M. Even adjusted EBITDA remains in the red — roughly $120M in losses. The topline may be rising, but margins are still severely constrained.

Oscar also hinted at higher risk scores in ACA plans and plans to resubmit its 2026 rate filings. That’s another sign the macro environment for health insurers remains unpredictable.

In short, the revenue revision is a step forward — but not enough to shift the broader narrative. Investors are still waiting for a path to profitability.

ZenaTech Expands Drone Ops with Virginia-Based Acquisition

ZenaTech ($ZENA) just announced its acquisition of a Virginia-based land survey and civil engineering firm, expanding its drone services footprint across Virginia, North Carolina, and South Carolina. The move strengthens ZenaTech’s Drone-as-a-Service model with deeper integration into U.S. federal and regional infrastructure contracts.

The acquired company brings an existing client base with federal and state agencies, offering services like 3D imaging, land surveying, and civil engineering — the kind of hands-on infrastructure exposure few drone players have.

The timing isn’t random. In recent months, the Pentagon has made it clear that it plans to allocate billions into drone and defense tech over the coming decade. For ZenaTech, buying this firm isn’t just geographic expansion — it’s a way to plant boots on the ground in critical states while tightening its grip on government infrastructure contracts.

The playbook here is classic: use M&A to get closer to government budgets, then layer in recurring drone contracts. The company is making the right kind of noise in the right places.

ZenaTech is a microcap with a market cap of just $137M, generating only $2.5M in revenue and running a net loss of $8.9M. But fundamentals haven’t mattered much this July: the stock more than doubled from $3.50 to over $7 before pulling back to $5.54.

The move comes amid a broader wave of investor enthusiasm for drone-focused companies. Just today, Citi raised its price target on Kratos Defense ($KTOS) to $70 — a 30% implied upside — citing strong momentum in military drone adoption. In that context, ZenaTech’s land-survey acquisition looks less like a small-cap footnote and more like a bid to position itself for the coming federal drone boom.

ZenaTech’s drone subsidiary also has applied for Green UAS certification, a necessary step to get on the Pentagon’s procurement list. The compact IQ Square drone is built for terrain mapping, surveillance, and reconnaissance in high-risk areas.

It’s a milestone that moves ZenaTech closer to broader federal adoption — just as defense spending on drones accelerates.

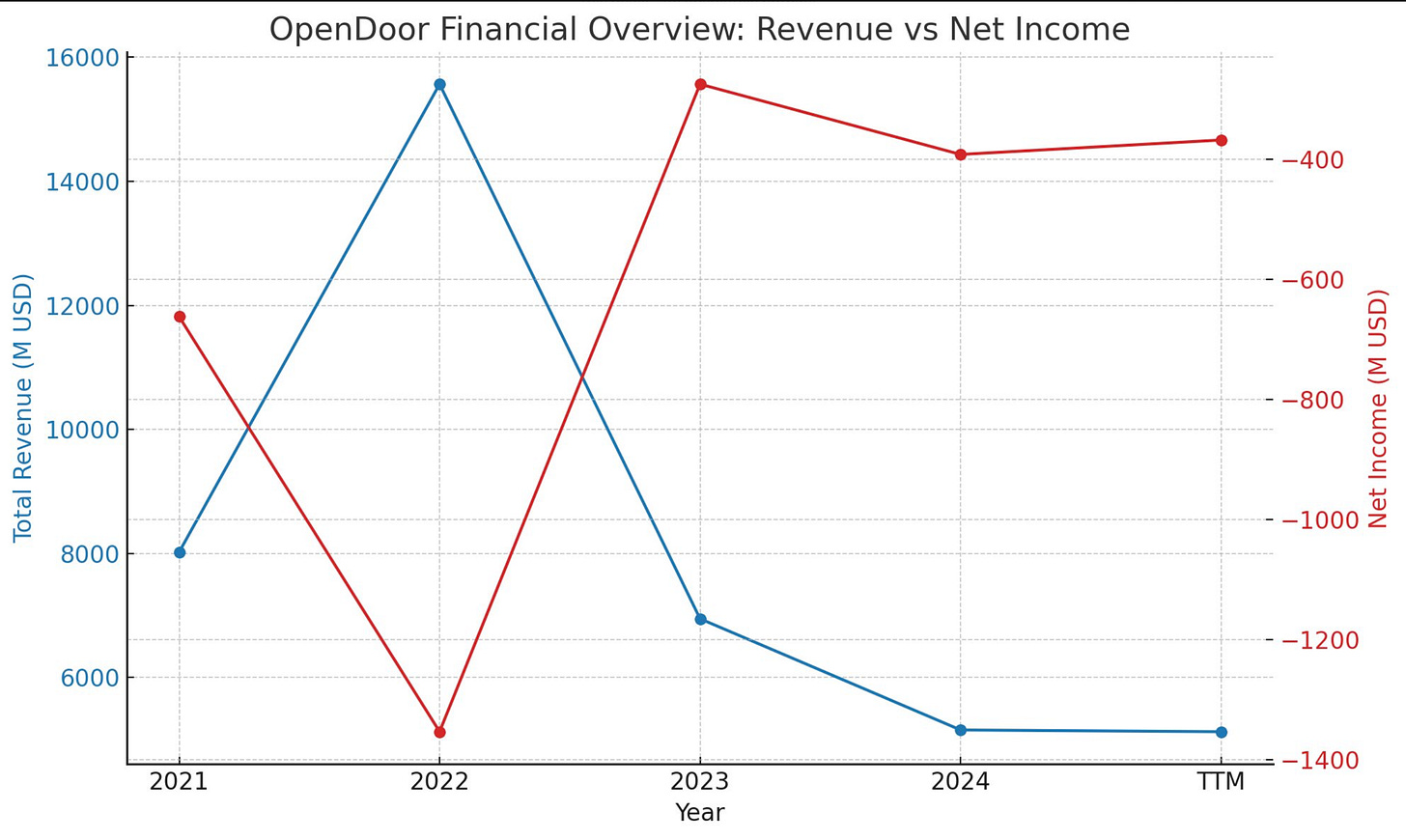

$OPEN: Still Up 17% in July Despite the Post-Hype Drop

The stock is now trading near $3.80 after hitting $5 earlier this month — a 24% drop from the highs. But zoom out, and it’s still up over 17% month-to-date. That’s after a 600% three-day rally that looked like one of the most aggressive retail-driven spikes this year.

Much of that run was sparked by a single trader known online for heavy momentum bets. What’s fascinating is how little resistance the stock faced — this wasn’t a sector-wide move or part of an earnings cycle. It was pure flow.

Fundamentally, not much has changed. The company remains unprofitable, burning cash in a tough housing environment. But OpenDoor has always thrived on volatility — in real estate and in sentiment. It’s one of the few pure-play public bets on the iBuying model, and that alone makes it a magnet when liquidity sloshes into small-caps.

Citi still has a $0.80 price target on $OPEN. But we all know how this goes — analysts usually update after the stock has already moved.

Anyways, congrats to everyone who rode this rally. Just remember what you’re playing with — it’s not valuation, it’s volatility.

Keep reading with a 7-day free trial

Subscribe to Edge of Power to keep reading this post and get 7 days of free access to the full post archives.