NVIDIA saved the market from AI bubble

Huang proved once again that the only way to thrive is to stand next to him

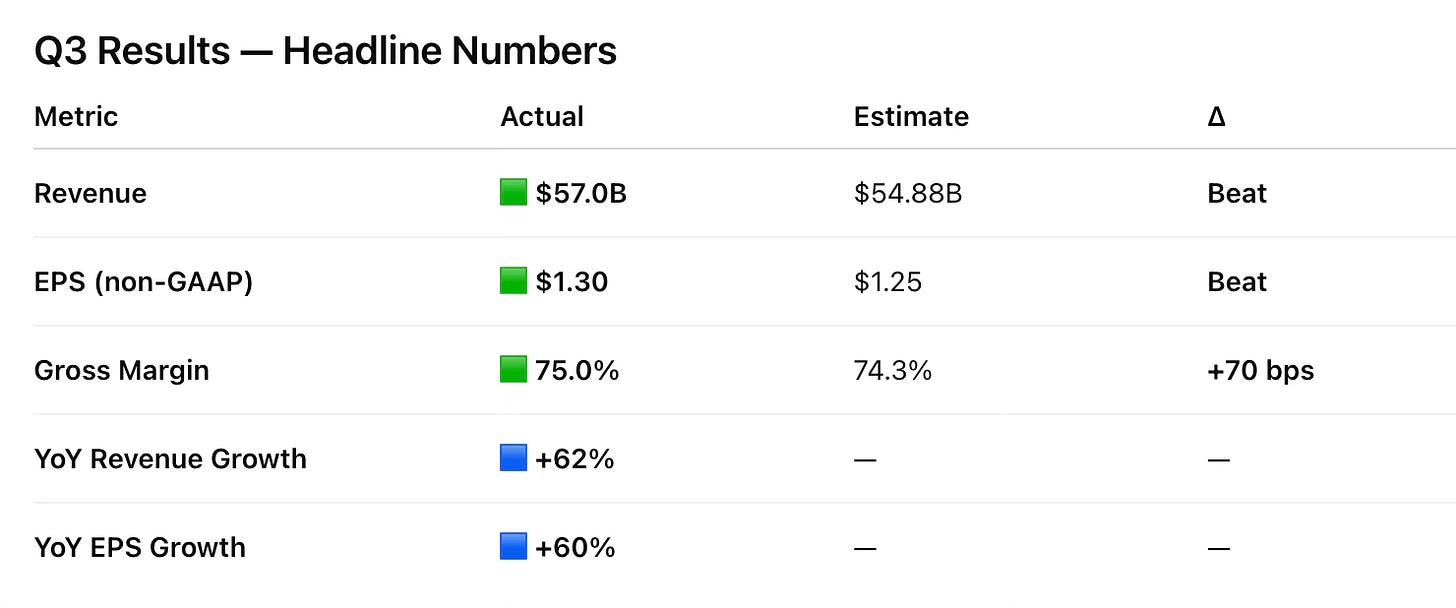

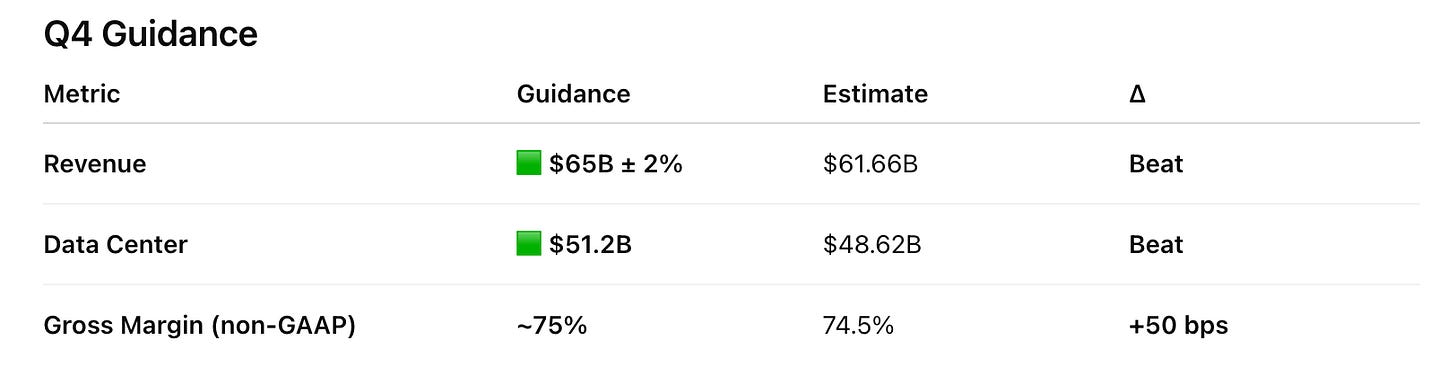

The biggest value in NVIDIA’s earnings is that they were undeniably strong. A double beat on the quarter and a double beat on guidance, with margins untouched. Every chip is sold out, compute demand is accelerating, and they didn’t say a single word about China.

Huang says demand is growing globally. It’s obvious that large sovereign data-center contracts are rolling in, and the overall boom continues. NVIDIA’s report eased the market’s fears, and everything tied to it jumped immediately from VRT 0.00%↑ to $IREN. Even $CRWV moved.

In short, Huang gave the market a shoulder to lean on at the most dramatic moment and made it clear he still has no real competition — not with Google’s TPUs, not with AMD’s sad attempts, which won’t earn in a year what NVDA prints in a single quarter.

And I’m increasingly convinced NVIDIA will either buy or increase its stake in one of the NeoClouds. Most likely $CRWV, to build a full cloud stack. But you can also read between the lines of Huang’s remarks: everything is sold out, hyperscalers are doubling down on generative AI, and we should expect a wave of new products that will reshape how the market thinks.

What do we see already? Software companies are losing steam, even PLTR 0.00%↑ has worn people out, and Huang had to prop it up today. NOW 0.00%↑ lost $100 in a month. Why? Because nobody understands what their future looks like. Why is Adobe spending money on Semrush? Why is DUOL 0.00%↑ falling? The market has no idea what comes next.

And the winners will be those who actually invest in AI. Right now Perplexity is the most lagging chatbot, which means they’ll eventually have to build data centers too. The successful launch of Gemini 3 shows that competitors will be releasing new products, and OpenAI and Anthropic will expand their lineups aggressively. I’m sure these products will appear quickly. Big Tech badly needs good news.

As for NVDA 0.00%↑ itself, I’m holding it, not trimming anything, and I think it should be a cornerstone position. I believe it has a real chance to reach $250 before the New Year.

During market turmoil like now, you need anchor stocks in the portfolio. Don’t think, “This one will only grow 20% while $SMCI can grow 200%,” because a lot of people thought that way — look where those stocks are now. I think $300 is coming, and stop reading articles talking about the next “threat” to NVIDIA.

Huang also said he doesn’t see an AI bubble and that alone lifted CIFR 0.00%↑ , IREN 0.00%↑ , and NBIS 0.00%↑ . Maybe the worst is over for these names, although crypto weakness is still dragging miners down. We’ll see if NVDA can lift that market too.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Great work. Love your writing.

👍👊