NVIDIA Earnings: A Critical Moment for AI Infrastructure

Can Jensen Huang Save the Market from Credit Crunch, CoreWeave, and Circular Financing?

NVIDIA earnings don’t matter.

There, I said it.

Whether the stock goes up or down 10% tomorrow is irrelevant to the infrastructure thesis. What matters is one thing only: is Big Tech still spending? Everything else is noise.

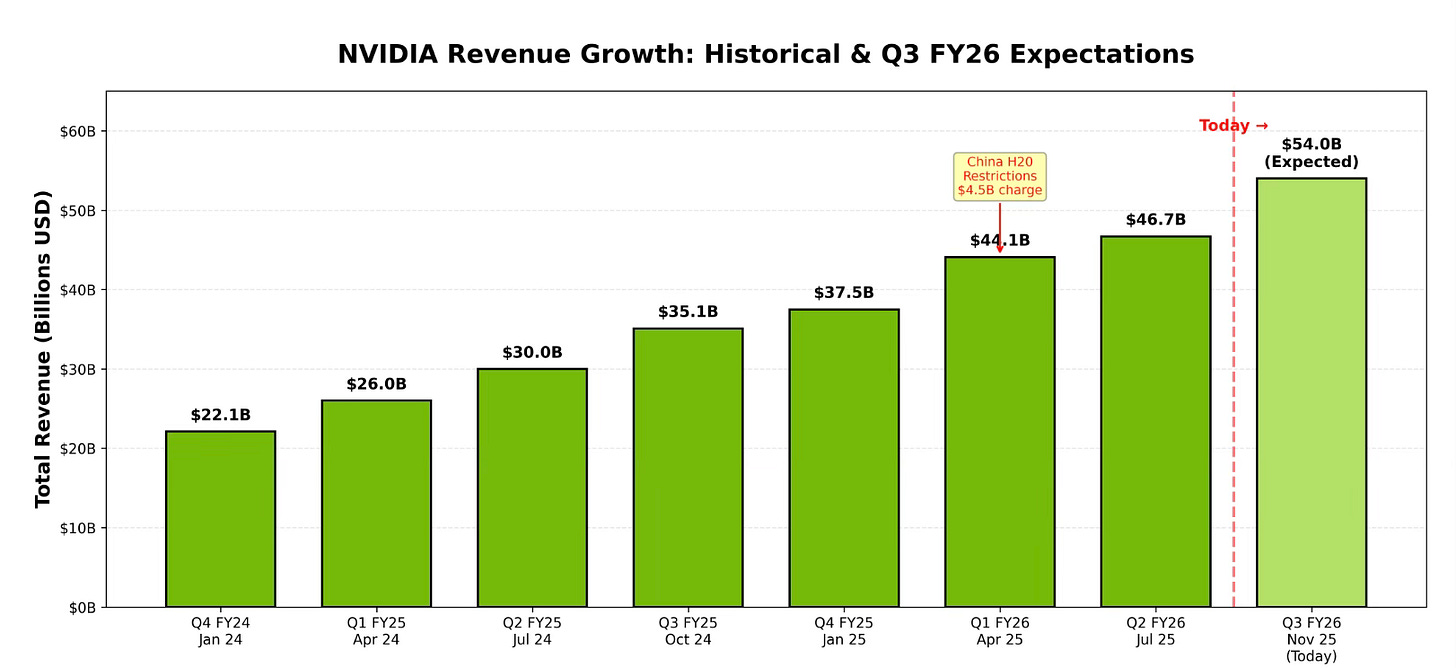

The Numbers Everyone’s Watching

Expected Revenue: ~$33.1B (+83% YoY)

Datacenter Revenue: ~$29.5B (89% of total revenue)

Q4 Guidance: Market expects ~$37B

Gross Margin: Consensus at ~73-74%

The real question: Blackwell ramp timeline and capacity allocation

But the bar is absurdly high. The stock trades at ~35-40x forward earnings, and any guidance miss - even by a billion or two - could trigger a selloff. The market wants to see not just growth, but acceleration in growth. At $3T+ market cap, that’s a tough ask.

The Context: Fear Is Creeping In

NVIDIA’s earnings come at a critical moment. The market has started to fear that Big Tech won’t be able to recoup their AI investments, companies are showing poor margins, and won’t be able to pay off their debts. Among the reasons for the decline in absolutely all AI-adjacent stocks, the following are cited:

The market has become less liquid - institutional investors have achieved unprecedented position sizes and can no longer buy aggressively

AI is not generating revenue yet - despite massive capex, monetization remains elusive for most players

This is where NVIDIA can help, even if it shows a double beat. Jensen Huang’s earnings report reflects demand, not his forecasting skills. The more data centers ordered, the more demand for his products - simple as that.

Look at that chart. That’s not a company struggling to find customers. That’s relentless, sequential growth in the face of “AI bubble” narratives.

NVIDIA: From Chipmaker to Kingmaker

But more importantly, NVIDIA has transformed into something far more powerful than just a chip company.

Jensen Huang has evolved into a kingmaker. A small stake from NVIDIA in a company can send its stock up 20-30% overnight. We’ve seen this repeatedly - NVIDIA’s investment or partnership announcement has become a market-moving catalyst on its own.

The company itself has turned into a giant octopus that controls distribution: who gets chips first, who gets to service Big Tech, who gets priority in the queue. NVIDIA doesn’t just sell GPUs anymore - it orchestrates the entire AI infrastructure ecosystem.

Its partnerships with Microsoft and Anthropic aren’t just customer relationships; they’re strategic moves that shape industry structure. NVIDIA is effectively deciding which companies get to participate in the AI buildout and which ones don’t.

This creates a fascinating dynamic:

Companies like IREN, CIFR, and other NeoCloud players aren’t just competing on fundamentals anymore - they’re competing for NVIDIA’s attention and favor. Getting early Blackwell allocation, securing technical partnerships, or even getting mentioned favorably by Jensen can be worth hundreds of millions in market cap.

The semiconductor sector commentary matters more than ever. What will Jensen Huang say about the semiconductor market? Will NeoCloud demand improve? Will he increase his NBIS stake or acquire the company outright to do his own deals? Could NVIDIA take stakes in IREN or other NeoClouds to secure their capacity for preferred customers?

CoreWeave’s Problem

CoreWeave’s recent poor earnings raise critical questions. The company, once seen as NVIDIA’s golden child in the AI infrastructure space, stumbled badly in its latest report. Will NVIDIA step in to support them? Increase its stake? Or let them struggle?

This matters because CoreWeave was supposed to be the success story - the crypto miner turned AI datacenter darling with preferential NVIDIA treatment. If even they can’t make the model work profitably yet, what does that say about the broader NeoCloud thesis?

Here’s the key question: Will NVIDIA bail out CoreWeave to protect its own ecosystem? Or will they let market forces play out and reallocate precious chip supply to better operators?

The answer will tell us everything about how NVIDIA views its infrastructure partners - as strategic assets to be protected, or as interchangeable capacity providers.

What Really Matters: The Infrastructure Bottleneck

Here’s what I actually care about:

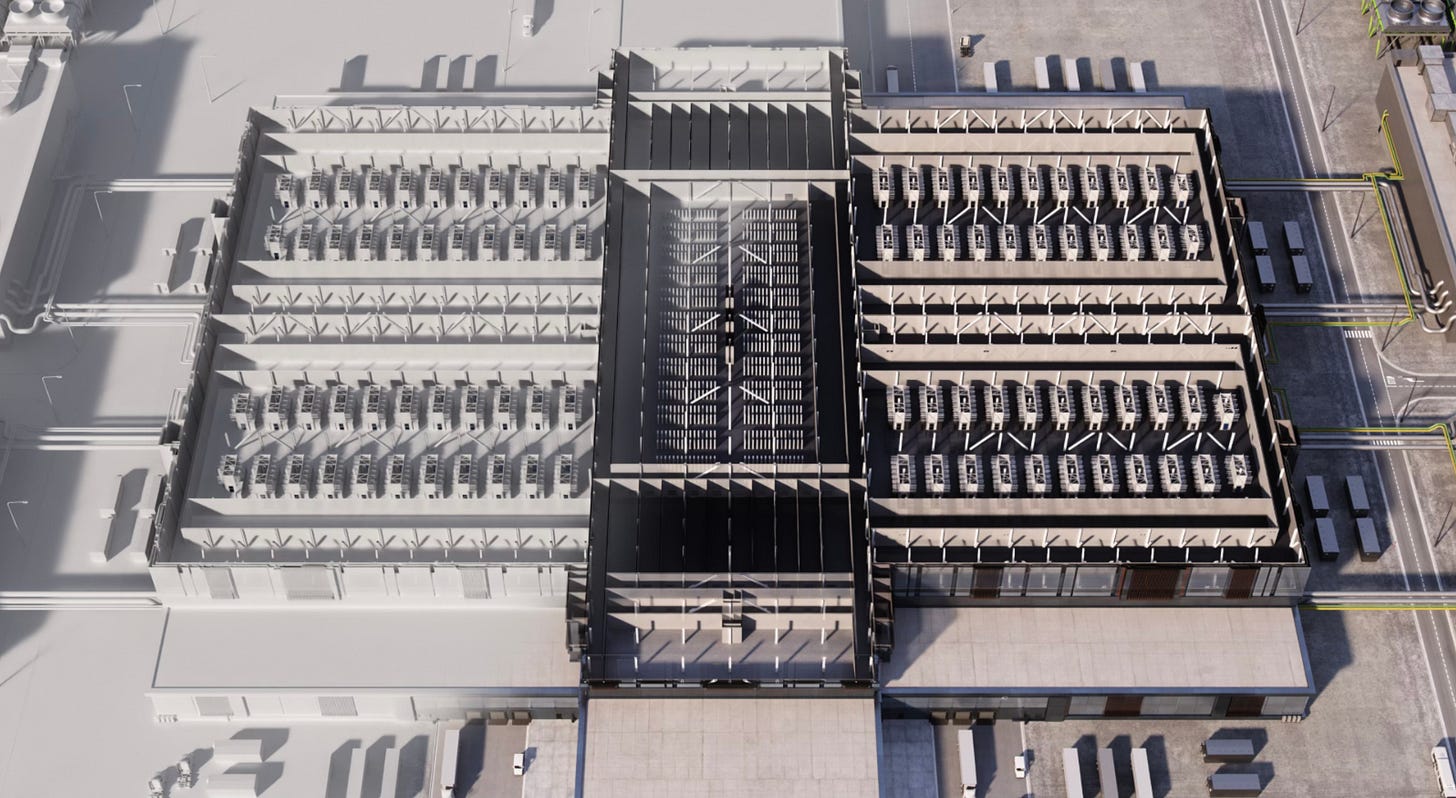

The AI infrastructure buildout is hitting physical constraints - power, cooling, and speed of deployment. NVIDIA’s guidance will tell us whether hyperscalers are slowing down (bearish for the entire thesis) or accelerating despite macro concerns (bullish for picks-and-shovels plays).

For IREN, CIFR, and the power infrastructure thesis:

If NVIDIA confirms continued strong datacenter demand, it validates the power bottleneck narrative. Hyperscalers need capacity NOW, and companies that can deliver megawatts faster than traditional datacenter developers become exponentially more valuable.

But there’s a second layer: does NVIDIA see these NeoCloud players as strategic partners in solving the capacity crunch? The company has shown willingness to invest in and elevate infrastructure partners. Any hint of NVIDIA’s strategic interest in the power/datacenter space could be massive.

Here’s the setup most people are missing:

The market is pricing in AI capex fatigue. NVIDIA’s report will either confirm this fear or prove it’s premature. Given Microsoft’s $80B capex guidance and continued Blackwell demand, I’m betting on the latter.

What Could Go Wrong?

Let’s be real about the bear case:

Hyperscalers signal capex slowdown for 2025 - this would be genuinely bad

Blackwell delays push revenue to later quarters - temporary pain, not structural

China revenue declining faster than expected - already known, likely priced in

Jensen hints at demand normalization - would crater the entire sector

I’m not worried about the first three. The fourth one? That would require re-evaluation.

What I’m NOT Worried About

I’m not worried about “AI bubble” talk - the power infrastructure being built is real, physical, and necessary regardless of AI hype cycles

I’m not worried about competition - CUDA moat remains unbreakable in the near term, and switching costs are enormous

I’m not worried about one bad quarter - this is a multi-year infrastructure cycle, not a product launch

I’m not worried about valuation - I don’t own NVDA for a reason. I own the infrastructure it needs.

What I’m Actually Watching

Datacenter revenue growth trajectory - is it accelerating or plateauing?

Blackwell ramp commentary - supply constraints mean demand is real

Q1 2025 guidance - this matters MORE than Q4 results

Jensen’s commentary on power constraints - does he acknowledge the bottleneck?

Any mentions of infrastructure partnerships or investments - this is the wildcard

Customer concentration - are hyperscalers still 40%+ of revenue?

The Trade Setup

Here’s what matters for positioning:

If NVDA confirms strong demand but the stock sells off on valuation concerns, that’s the best setup for IREN/CIFR - you get thesis validation with better entry prices on the actual infrastructure plays.

Remember 2021 crypto mining boom? NVDA was king then too. But when mining crashed, GPU prices collapsed 70%. This time is different - AI infrastructure is being built by companies with $200B+ cash reserves and $80B annual capex budgets, not retail speculators with credit cards.

Bottom Line

NVDA can miss, the stock can tank, and I’ll still be bullish on power infrastructure.

Because when Microsoft commits $80B in capex and can’t find enough datacenter capacity, that’s not a problem Jensen Huang solves - that’s a problem IREN solves.

And the market hasn’t figured this out yet.

The stock might be priced for perfection, but the infrastructure thesis doesn’t require NVDA to go up - it requires AI capex to continue. And that’s a much easier bar to clear.

Short-term stock reactions don’t matter. What matters is whether the capex cycle is intact. If it is, the power infrastructure bottleneck only gets worse - and that’s exactly what we’re positioned for.

What’s your take? Drop a comment:

✅ NVDA beats and guides up - infrastructure thesis validated

⚠️ NVDA beats but guides conservatively - short-term pain, thesis intact

❌ NVDA misses - time to re-evaluate everything

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

✅