NextGen 10 Stock Tracker: Who’s the Next 10-Bagger?

Welcome to NextGen Stocks, your guide to the most exciting tech companies shaping the future. I’ll break down the most promising stocks in emerging industries without the noise

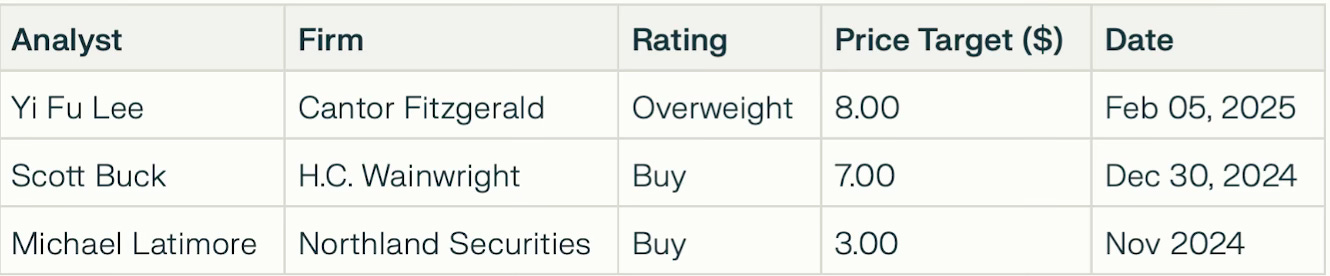

1. BigBear.ai (BBAI): A Jump into Consumer Payments

News: BigBear announced a partnership with SoftPoint to integrate its Trueface facial biometric solutions into SoftPointPay’s point-of-sale systems. This collaboration aims to enhance security for consumer payment transactions across banking, dining, retail, and event venues. The stock was hit hard after info about Pentagon’s 8% spending cut

Opinion: While the partnership with SoftPoint highlights BigBear.ai’s efforts to diversify beyond defense and national security, the company’s financial struggles remain a concern. With an operating loss of $44.76M TTM and total revenue of $154.97M, BigBear.ai must demonstrate that it can translate such partnerships into sustainable revenue growth. The upcoming earnings report on 06/03 will be critical in assessing whether the company is making progress toward profitability

2. Tempus AI (TEM): Cancer Treatment Expansion

News: The Chairman Eric Lefkofsky, sold 153k shares worth about $11.9 million to cover stock-related costs. Meanwhile, Tempus has partnered with Stemline Therapeutics to use AI technology to improve care for metastatic breast cancer patients. Stemline is a part of the Menarini Group, an Italian pharma company.

Opinion: Tempus' partnership with Stemline Therapeutics is a strategic move that could significantly expand its oncology database, strengthening its AI capabilities in cancer care. A larger dataset enhances Tempus’ value proposition, making its platform more attractive to healthcare providers and pharmaceutical partners. However, the financial terms of the deal remain unclear, and investors should assess how this collaboration contributes to the company’s path to profitability.

3. Archer Aviation (ACHR): Flight School Progress

News: Archer received its Part 141 certificate from the Federal Aviation Administration (FAA), allowing it to operate a flight school for pilot training. However, a recent report from The WSJ highlights tough times ahead for the eVTOL (electric vertical takeoff and landing) industry. The report notes that Germany’s two prominent eVTOL startups, Lilium and Volocopter, are undergoing insolvency procedures, raising concerns about the viability of zero-emission aircraft development globally.

Opinion: Archer’s FAA certification is a step forward in its ambitious plans to launch commercial air taxi services, but high development costs, regulatory complexities, and uncertain demand make this sector particularly risky. Investors should remain cautious, as success in this emerging market will require significant capital, favourable regulations, and consumer adoption—all of which remain uncertain.

4. SoundHound AI (SOUN): Struggles after NVidia exit

News: SoundHound AI has been under significant selling pressure, failing to attract dip buyers during the recent market meltdown. With its Q4 2024 earnings due on February 27, 2025, investors are looking for signs of innovation and revenue growth as the company faces mounting competition in the voice AI space.

Opinion: SoundHound AI operates in a highly competitive field where barriers to entry are relatively low, allowing any software company with sufficient resources to enter the voice AI market. To stand out, SoundHound must focus on aggressive innovation and differentiation to maintain its relevance. The upcoming earnings report will be critical for demonstrating progress toward its ambitious FY 2025 revenue target of $155–$175 million as failure to deliver on these goals could further erode confidence in the company’s long-term potential.

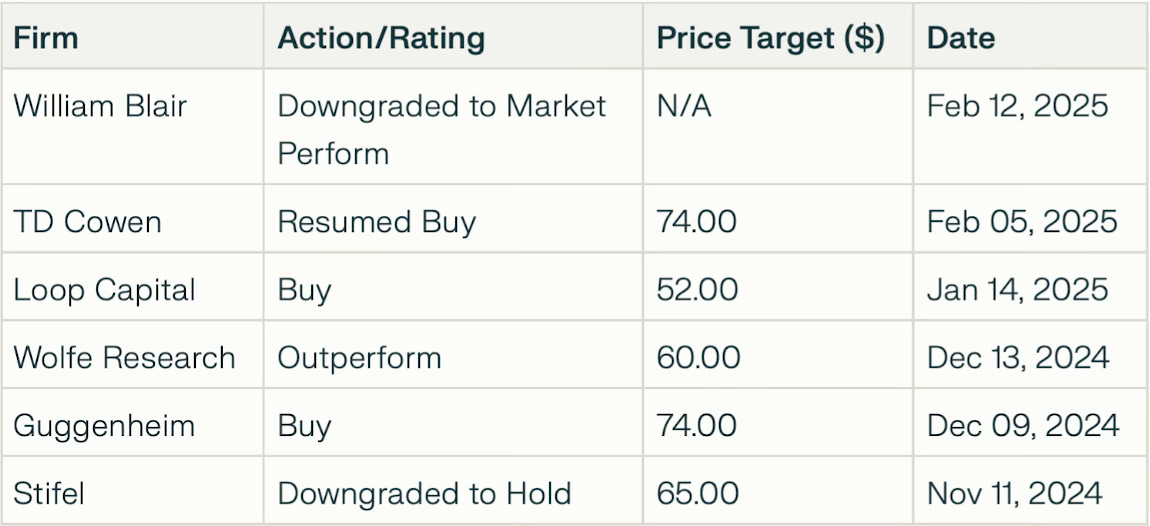

5. Rocket Lab (RKLB): Successful Launch and Upcoming Earnings

News: Rocket Lab successfully launched its 60th Electron rocket on February 19, 2025, deploying the first Gen-3 satellite for BlackSky’s Earth-imaging constellation. The satellite was placed into a 470km low Earth orbit, further enhancing BlackSky’s real-time space-based intelligence capabilities. Additionally, RKLB is set to report its Q4 earnings on 02/27, 2025 while it faces increasing competition from major players like SpaceX, Astra, and Firefly Aerospace, as well as emerging startups like Relativity Space and Virgin Orbit.

Opinion: Rocket Lab consistently generates positive news with successful launches and technological innovations, but the key question remains: Can the company translate these achievements into long-term profitability? While Rocket Lab’s proprietary technologies, such as the Motorized Lightband and vertically integrated approach, provide differentiation, it must establish a clear competitive moat to maintain leadership in this space.

6. Astera Labs (ALAB): AI Connectivity Leader with Challenges Ahead

News: Astera Labs continues to position itself as a leader in AI and data center connectivity solutions. The company’s Intelligent Connectivity Platform, which includes high-speed PCIe, Ethernet, and CXL solutions, is designed to address the growing demands of cloud-scale AI infrastructure. Key products like the Aries PCIe Retimer, Taurus Smart Cable Modules, and the recently launched Scorpio Smart Fabric Switches are driving innovation in GPU clustering, low-latency memory connectivity, and scale-out AI platforms.

Opinion: Despite delivering strong Q4 2024 results with revenue of $141.1 million (up 25% QoQ and 179% YoY), Astera Labs faces challenges. The company’s gross margin declined to 74%, down from 77.3% in the prior year, raising concerns about profitability as it scales hardware-based solutions. Additionally, the stock has seen a pullback due to valuation concerns despite its impressive growth trajectory.

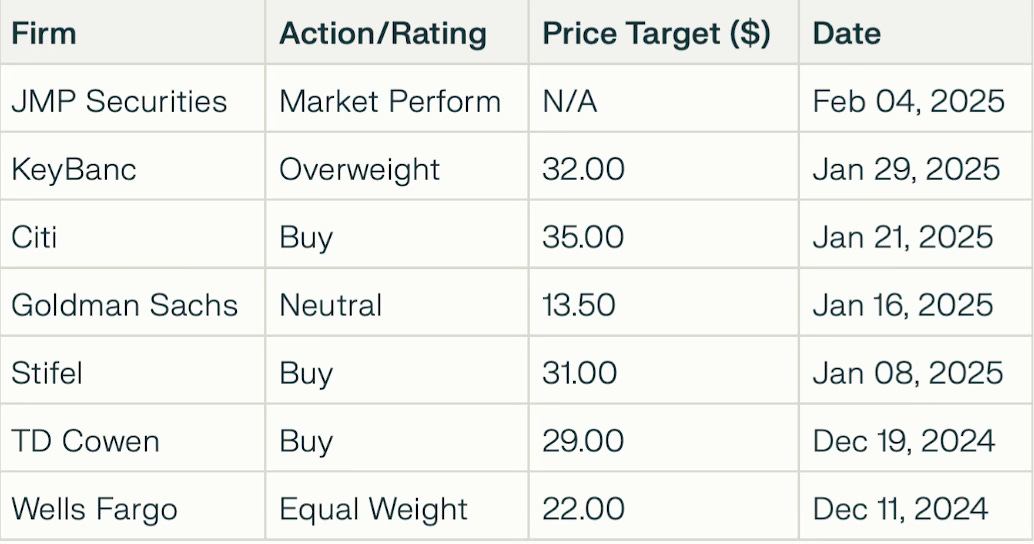

7. SoFi Technologies (SOFI): Growth and Challenges in Fintech

News: SoFi has experienced mixed performance recently, with a year-to-date decline of 4.8% but a strong one-year gain of 80%, reflecting its volatile position in the fintech space. The company continues to expand its financial services offerings, leveraging its banking charter to reduce funding costs and drive growth. However, insider selling by EVP Kelli Keough, who sold 9,185 shares for approximately $141,725, has raised questions about management’s confidence in the stock’s near-term performance.

Opinion: SoFi’s ambition to become a one-stop financial services platform is impressive, supported by its banking charter and strong customer acquisition. However, the company faces significant challenges in balancing growth with profitability in a highly competitive fintech landscape. The insider selling may signal caution from management, especially as SoFi’s forward guidance for 2025 EPS ($0.25–$0.27) fell short of analyst expectations ($0.28).

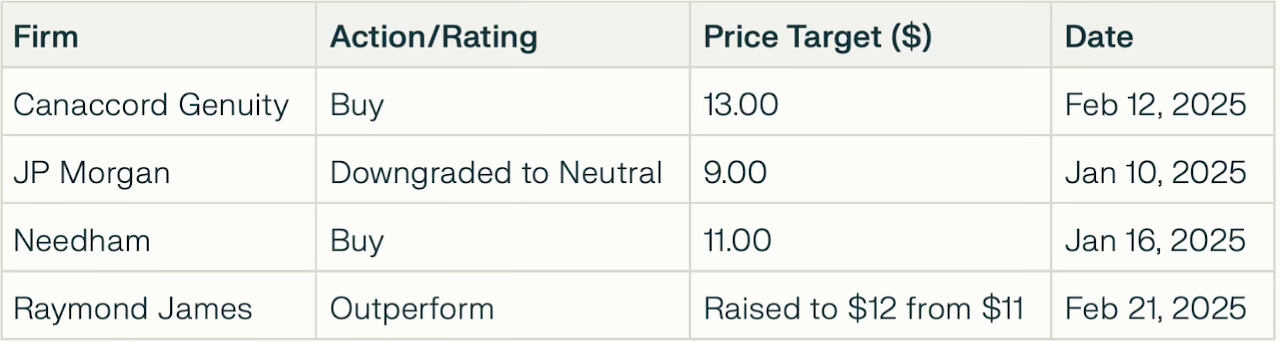

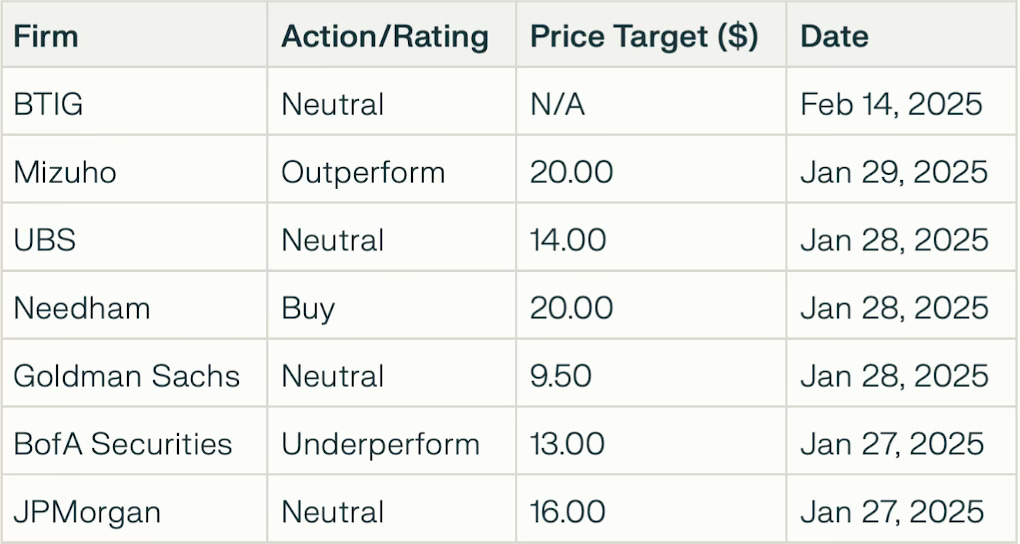

8. D-Wave Quantum Inc. (QBTS): Martin Shkreli’s Stark Prophecy

News: Microsoft recently announced a breakthrough in quantum error correction, claiming it could significantly shorten the timeline for practical quantum computing apps. This development highlights the rapid advancements made by major players, potentially overshadowing smaller companies. Martin Shkreli stirred the market, predicting a grim future for quantum stocks. He cited the high costs, extended development timelines, and limited commercial applications as reasons why many companies in the sector could struggle to survive.

Opinion: Shkreli’s remarks underscore the broader concerns about quantum computing: like the lack of immediate use cases. For D-Wave to counter this narrative, it must focus on delivering tangible results through partnerships and real-world applications. Investors should remain cautious, as the sector’s volatility and long-term nature make it a high-risk investment.

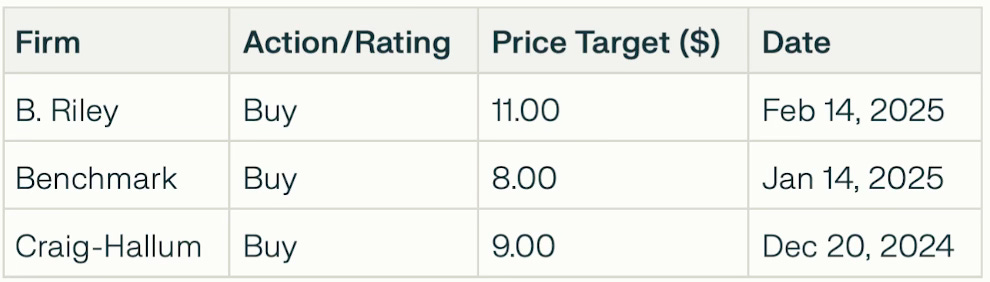

9. Recursion Pharmaceuticals (RXRX): Supporting Biotech Startups Amid Federal Funding Cuts

News: Recursion Pharmaceuticals has launched the Altitude Lab Fund, a pre-seed venture fund aimed at supporting early-stage biotechnology startups impacted by recent federal funding disruptions, particularly cuts to NIH Small Business Innovation Research (SBIR) grants. Announced on February 19, 2025, the fund will provide $100,000–$250,000 in capital, along with 12 months of lab and office space and admission to Altitude Lab’s accelerator program.

Opinion: Recursion’s launch of the Altitude Lab Fund is a strategic move that not only addresses a critical funding gap but also strengthens its ecosystem in the biotech sector. By targeting SBIR-reviewed startups with high-impact scores, Recursion is effectively leveraging government due diligence to identify promising ventures while minimizing risk.

This initiative could enhance Recursion’s long-term growth prospects by fostering a pipeline of innovative startups that may align with its strategic interests.

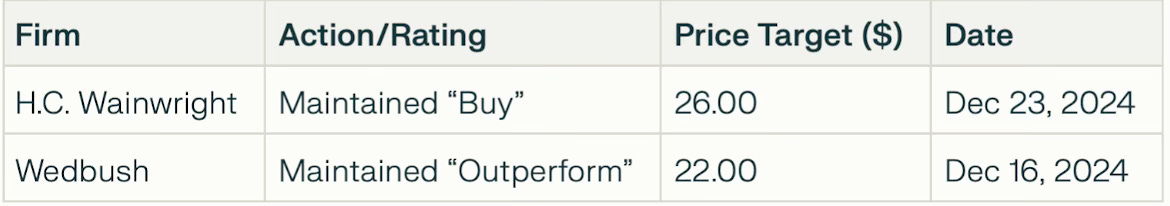

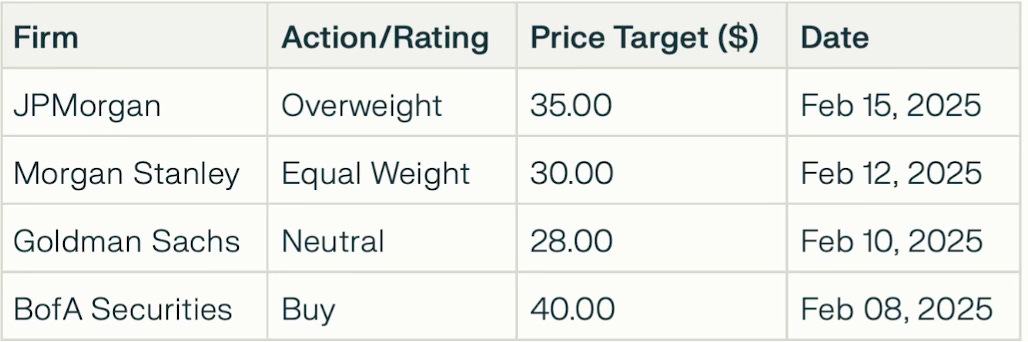

10. Rubrik Inc. (RBRK): Cybersecurity Innovation

News: Rubrik will release its Q4 and FY2025 earnings on 03/13, after market close. It continues to innovate with its Rubrik Security Cloud, which leverages machine learning to secure data across enterprise, cloud, and SaaS environments. Recent advancements include the integration of Data Security Posture Management (DSPM) to address sensitive data exposure concerns in generative AI adoption.

Opinion: Rubrik’s focus on innovation and expanding its cybersecurity offerings positions it well in a rapidly growing market. The integration of DSPM into its platform demonstrates its ability to adapt to emerging challenges, such as generative AI risks, while FedRAMP authorization strengthens its appeal to government clients. However, the company faces increasing competition from other cybersecurity firms and must continue to differentiate itself through cutting-edge solutions and partnerships.

That’s it for this issue of NextGen Stocks! I’d love to hear your thoughts, do you agree with my analysis? Are there any stocks on your radar? Hit reply and let me know. Also, if you found this valuable, consider sharing it with a friend who’s into future-focused investing. See you in the next edition!

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.