Italy Drops Starlink. Can Europe Really Replace Elon Musk?

Italy freezes Starlink deal as EU eyes strategic space independence. Can struggling Eutelsat rise to the challenge?

Italy may drop Starlink—and that’s a big blow to Elon Musk, who has been lobbying the Italian government for months. But what’s truly shocking? Rome openly admits the delay is political.

"It seems to me that everything has come to a standstill," Italy’s Defense Minister Guido Crosetto told La Repubblica, adding that talks shifted from technical matters to "statements" made by and about Musk.

This isn’t just a Starlink story. It’s a geopolitical statement: Europe is fed up with Musk—and increasingly uneasy with U.S. influence.

Starlink: America’s Soft Power Play

Starlink isn’t just a business—it’s an arm of U.S. diplomacy. Elon Musk pitches it at the highest political levels. Want good ties with Washington? Get yourself a satellite constellation.

U.S. Commerce Secretary Lutnick recently promoted Starlink to officials managing a $42 billion rural broadband program. This raised fresh concerns about Musk’s outsized influence and potential conflicts of interest.

Italy, one of the closest U.S. allies—led by a prime minister who even attended Trump’s inauguration—backing off? That’s no small signal. If Italy walks, it means even pro-U.S. leaders are wary of dealing with the current administration.

The Local Alternative: Can Eutelsat Step In?

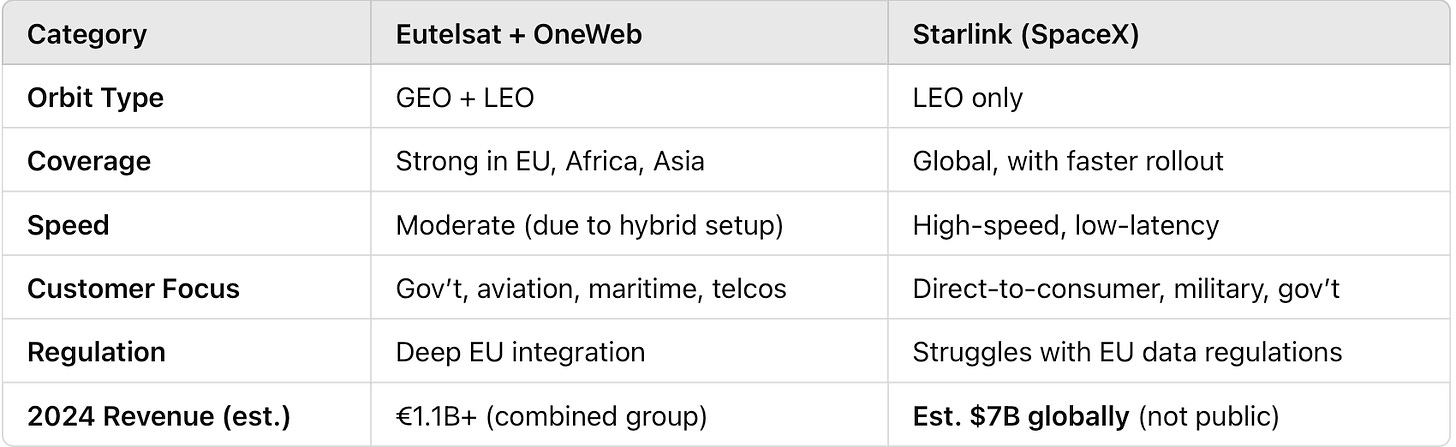

Eutelsat is Europe’s biggest satellite operator—but it’s nowhere near Starlink in scale or performance:

Eutelsat has around 650 LEO satellites (via OneWeb acquisition in 2023), compared to Starlink’s 7,000+.

Eutelsat also operates 35 GEO satellites, which offer broader coverage but higher latency.

Capex outlook: €500M–€600M in 2025, down from €700M–€800M.

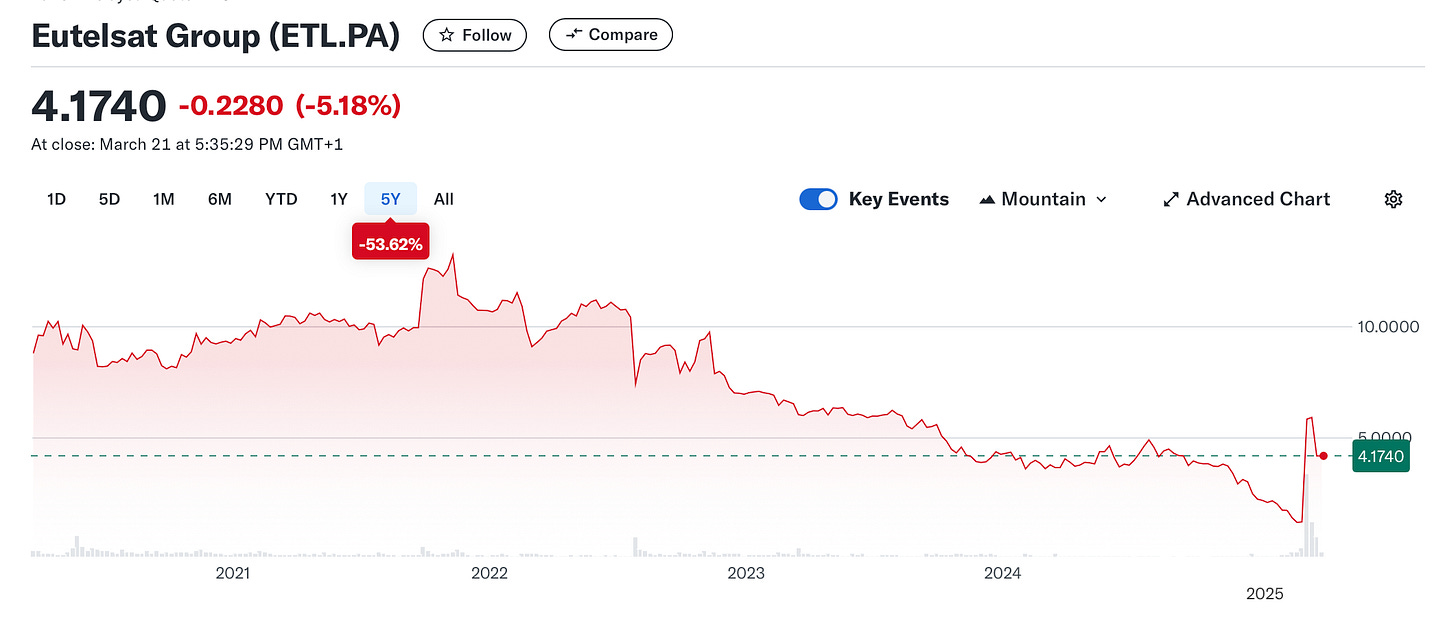

In February the company’s stock plummeted after its earnings report. The steep decline was driven by a €535 million goodwill impairment on its GEO assets—reflecting lower expected future cash flows in a market shifting decisively toward LEO system. On March 6, Fitch downgraded Eutelsat to “BB” from “BB+”.

The long-term chart looks grim: 10 years ago the stock traded at €30—today it’s at €4.17. It briefly surged 500% in March on hype over replacing Starlink in Ukraine—but then crashed 40% from its peak.

What’s Next: Risk, Reward—and Reality Check

Eutelsat is in financial trouble. Without a management overhaul and strategy shift, it risks burning through cash and disappointing both investors and EU backers.

What’s worse—it hasn’t earned its spot. The company’s shot at relevance exists only because of Musk’s political fallout—not its own execution.

But here’s the catch:

Massive EU defense and digital spending could still transform Eutelsat into a global leader.

Italy alone won’t flip the switch. A coordinated EU push is needed. Brussels must ask itself:

Is it better to keep trailing the U.S.—or start building something of its own?

That answer may decide the future of Europe’s tech autonomy.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Europe really needs to have an alternative to Starlink. Let's hope they can fund this alternative as well as other technological and military initiatives.