IREN vs Nebius — Who’s Winning the AI Race?

The real question isn’t who’s better, but which demand curve grows faster — labs or enterprises

The AI gold rush has created one of the most unusual market setups in recent memory. Demand for compute is insatiable, and NVIDIA, the clear supplier of picks and shovels, has deliberately chosen not to become a hyperscale cloud itself. Its DGX Cloud is more of a showroom than a profit engine, designed to highlight the potential of its chips and funnel customers toward partners. That decision left a vacuum — and into that vacuum rushed a new class of companies.

For a while, the conversation was dominated by CoreWeave and Nebius. CoreWeave specialized in leasing out raw GPU clusters, while Nebius built a full-stack AI cloud with software and enterprise-friendly tools. Both became shorthand for the future of AI infrastructure. But this year introduced a new contender: Iris Energy (IREN). And IREN represents the evolution of the Bitcoin miner into an AI infrastructure provider.

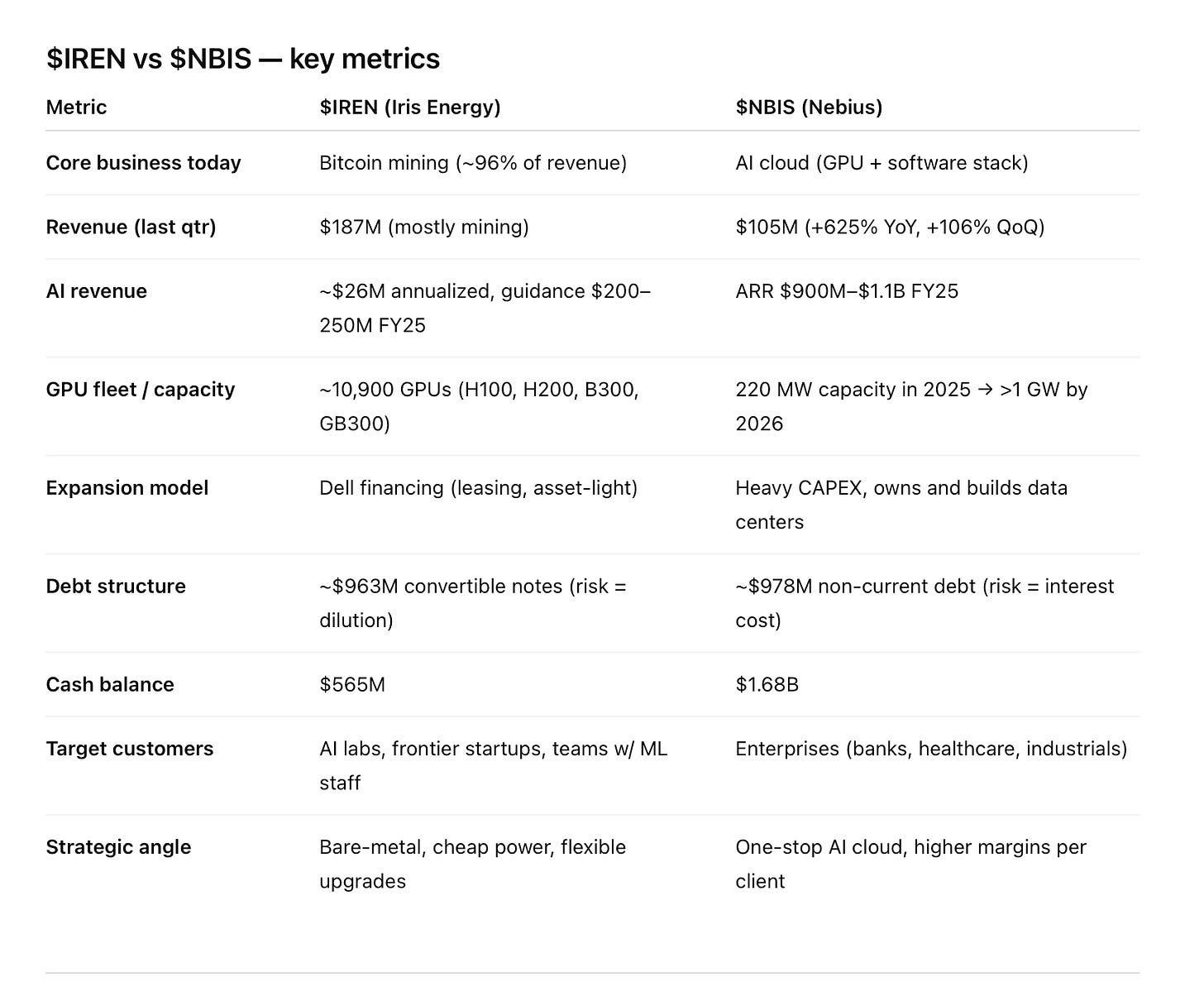

After $IREN’s strong earnings, many investors started to compare it with $NBIS and debate who will grow faster. On the surface it makes sense — both are plays on AI infrastructure. But the reality is that their monetization models are very different.

IREN — the “raw compute” bet.

The company owns data centers and secures cheap renewable power. Its product is bare-metal GPU capacity, targeted at AI labs, frontier model startups, and customers with strong in-house ML teams.

Today, 96% of IREN’s revenue still comes from bitcoin mining, but the GPU business is scaling quickly. The Dell financing partnership allows them to expand without heavy balance sheet dilution.

$NBIS — the “AI cloud + tools” bet.

Nebius positions itself as a one-stop AI cloud: not just GPU compute, but a platform with built-in tools — AI Studio, model management, analytics. This is aimed at enterprises that don’t have massive ML teams and prefer to get ready-to-use AI services rather than assemble everything themselves.

The takeaway.

This isn’t a contest of “who wins.” The real question is which demand curve grows faster: raw compute customers chasing performance, or enterprises that will pay for integrated AI cloud services.

How to think about the two models

Let’s imagine you’re the customer who needs GPU power. Depending on your situation, the decision between $IREN and $NBIS looks completely different.

Case 1: You’re a frontier AI lab or a startup training large models

You already employ ML engineers, DevOps, data scientists.

You know how to assemble a tech stack: networking, storage, model training pipelines.

What you care about is maximum raw power at the lowest possible cost.

For you, $IREN is the logical choice. They provide bare-metal GPU clusters, backed by cheap renewable power and large-scale data centers. You don’t need software add-ons or consulting. You just want compute at scalewithout overpaying.

Example: a company like Anthropic or Mistral would be a natural IREN customer. They want thousands of GPUs, they already have teams, and they can manage everything themselves.

Case 2: You’re a large enterprise (bank, manufacturer, retailer, healthcare provider)

You don’t have a 200-person AI engineering team.

You want to adopt AI, but you can’t afford to spend 12–18 months wiring together hardware, data pipelines, orchestration tools, inference servers, and monitoring.

What you care about is speed and simplicity. You’d rather pay more per unit of compute if it means the product is close to plug-and-play.

For you, $NBIS is the logical choice. Nebius doesn’t just sell GPU power — they bundle it with tools like AI Studio, MLflow, ClickHouse. This gives you workflows for training, inference, and analytics already integrated. It’s more expensive than raw bare metal, but the time-to-value is much shorter.

Example: a company like Caterpillar or Shell could be a NBIS client. They want to apply AI to optimize operations, but they don’t want to hire an entire AI lab from scratch.

From Bitcoin to Bare Metal

Bitcoin miners once looked like the dinosaurs of digital infrastructure. They consumed vast amounts of energy to produce a volatile asset, always under political and environmental scrutiny. But miners also perfected something no one else had: access to extremely cheap power and massive industrial-scale data centers.

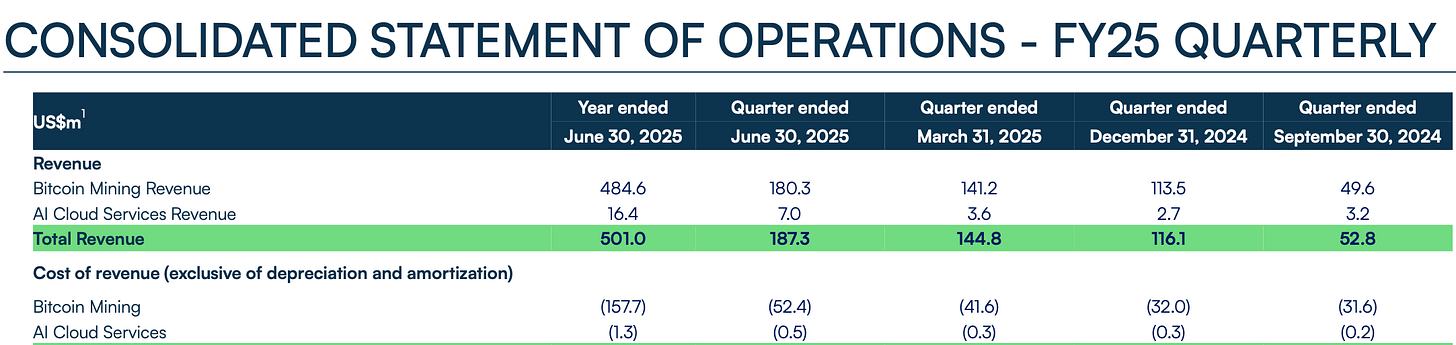

That advantage is now being re-deployed. IREN still earns 96% of its revenue from mining ($180M in Q4 FY25), but it is rapidly diversifying into AI. Instead of buying GPUs outright, IREN uses financing and leasing structures through Dell and other partners. This matters for two reasons:

It avoids the risk of being stuck with outdated hardware if NVIDIA refreshes its lineup faster than expected.

It allows IREN to scale faster than its balance sheet alone would support.

The numbers tell the story:

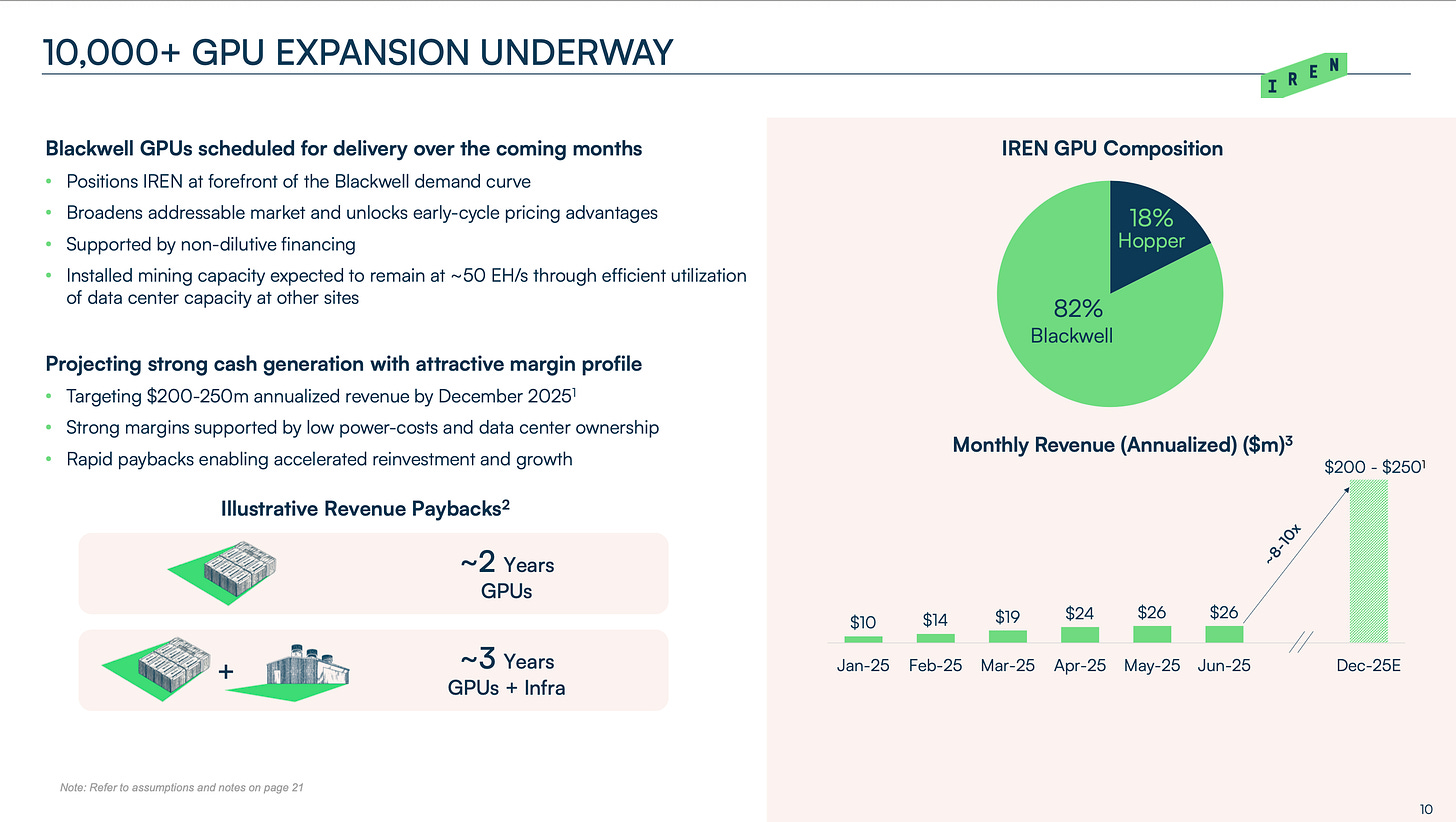

10,900 GPUs already secured (H100, H200, B300, GB300).

AI revenue annualizing at ~$26M, with guidance to reach $200–250M by December 2025.

$187M revenue in Q4 FY25, with net income of $176.9M — still overwhelmingly from mining, but showing the profit engine they want to replicate in AI.

In short, IREN is turning the DNA of a miner — cheap energy, fast payback, industrial efficiency — into the foundation of a new AI compute business. Think of it as a “next-gen miner” that looks less like a Bitcoin operation and more like a slimmed-down, cost-focused version of AWS.

NBIS: the One-Stop Shop

Nebius, by contrast, has a very different model. Rather than positioning as a landlord of bare-metal GPUs, it sells a ready-to-use AI cloud. Customers get GPU access bundled with tools like AI Studio, MLflow, and ClickHouse — the building blocks needed to train, deploy, and analyze models. For an enterprise that wants to adopt AI but doesn’t have a 200-person machine learning team, this is a huge shortcut.

The trade-off is simple: NBIS customers pay more per unit of compute than they would at IREN. But they also save months of internal development and avoid the complexity of building an entire AI stack in-house. NBIS bets on the enterprise adoption curve — that banks, manufacturers, retailers, and healthcare providers will all demand integrated AI services, not just raw horsepower.

Again, the numbers reinforce the story:

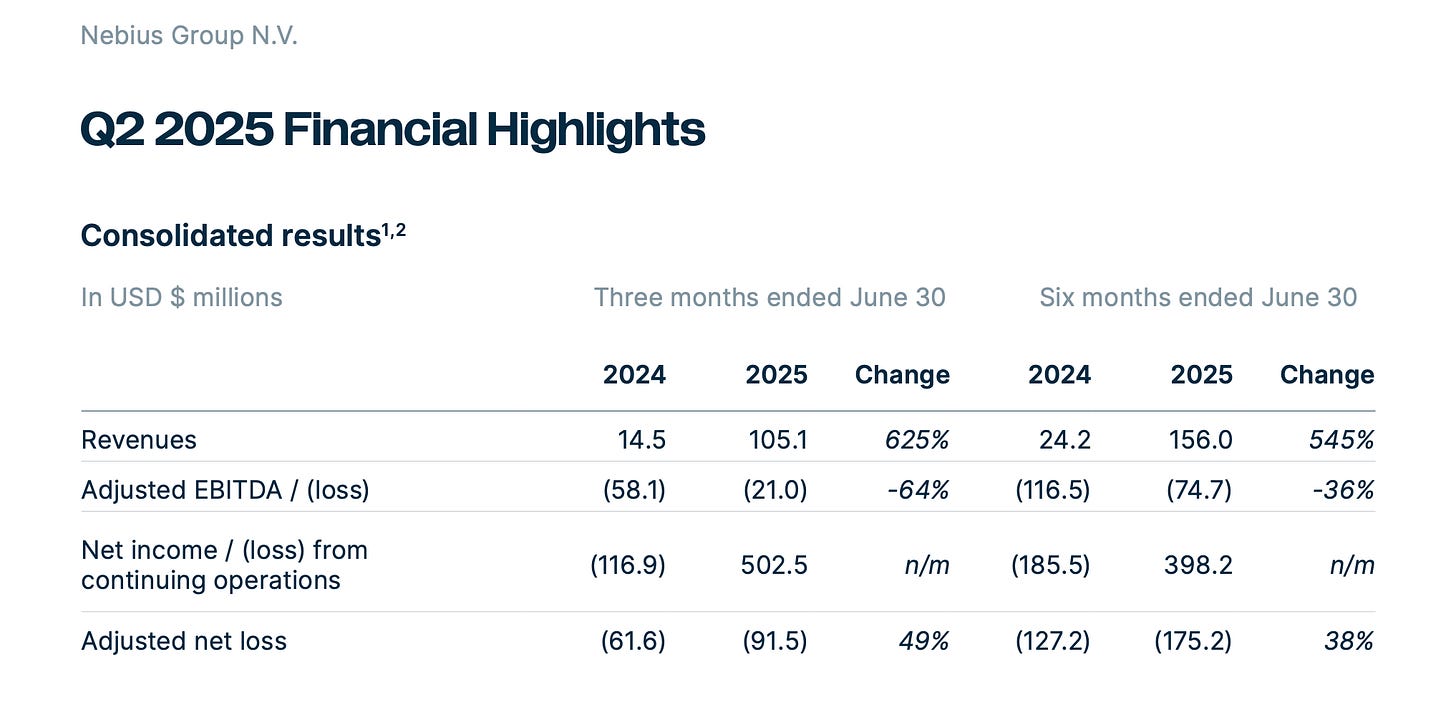

Q2 2025 revenue: $105M, up 625% YoY and 106% QoQ.

Raised ARR guidance to $900M–$1.1B for 2025.

Targeting >1 GW capacity by 2026 (vs. ~220 MW today).

$1.68B cash on the balance sheet to fund the buildout.

This is not “GPU landlord” economics. This is a bet that enterprises will pay a premium for a one-stop shop.

The CoreWeave Warning

No conversation about this market is complete without CoreWeave. The company set the tone early, with a $30B backlog of GPU contracts and the blessing of NVIDIA. But it also loaded up with more than $11B in debt, forcing it to pay an estimated $250M per quarter just in interest. The message to investors is clear: backlog alone doesn’t equal safety. Balance sheet structure matters as much as demand.

That’s where IREN tries to differentiate. Its financing strategy is designed to be asset-light and flexible. And unlike CoreWeave, which is now locked into heavy leverage, IREN can rotate GPUs as technology shifts without carrying the same debt burden.

CoreWeave: Buy The Debt?

CoreWeave finds itself in the most challenging position since its market debut. Its stock price has been declining, analysts are offering conflicting forecasts, and the once-burning enthusiasm among investors has all but vanished.

Why Both Models Can Work

So where does this leave us? In a paradoxical but healthy place: both models can coexist. The sheer size of AI demand is big enough to support multiple winners.

If you believe the frontier of AI will be defined by labs and startups chasing raw performance, then IREN’s bare-metal, low-cost model is best positioned.

If you believe the real money will come from enterprises adopting AI broadly, then NBIS’s one-stop cloudcaptures that demand more directly.

And if you’re cautious, CoreWeave serves as a reminder: pay attention not just to revenue and backlog, but also to how the business is financed.

The Investor Takeaway

AI infrastructure is not a zero-sum race. It’s more like an ecosystem forming around NVIDIA’s chips. Some companies will win by being the cheapest landlord of compute; others will win by packaging compute into usable products.

Right now, the market is aggressively re-rating $IREN because of the projected multi-fold growth in AI revenue. Management guides to $200–250M in annualized AI Cloud revenue already this year, compared with just $26M at the start of 2025. That’s why the stock is being priced as if the transition from miner to cloud player is almost a done deal.

But investors shouldn’t forget two things. First, bitcoin mining is still >$1B in annualized revenue — 96% of the current business. That cash flow is what funds the pivot. Second, as the company itself discloses in its filings, all projections are heavily dependent on (a) utilization of new GPU clusters, and (b) the price of bitcoin. Both factors are volatile.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Really good piece of writing, thank you !