IREN Just Landed Microsoft: The $9.7 Billion Deal That Changes Everything for AI Infrastructure

Bitcoin Miners are Becoming a New Class of High-Profit Assets

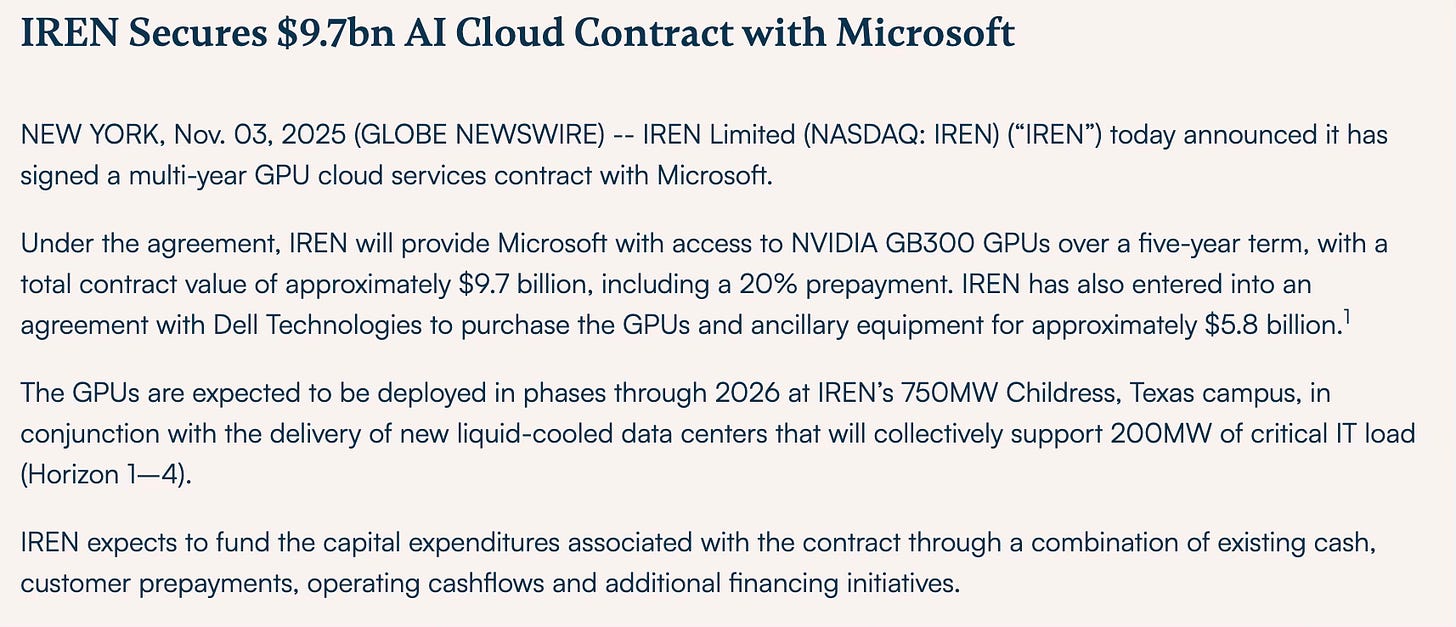

Today is an extremely important day for me and my subscribers, because IREN has just secured a landmark deal with $MSFT, a company and a sector I have written about extensively. This deal launches IREN into a new dimension, as they received a fantastic $9.7B for using only 10% of their total power capacity. I’ve always said that you shouldn’t just invest in a company; you should invest in management that recognizes the era of traditional mining is drawing to a close, and the future lies with AI/HPC (High-Performance Computing).

This transaction was highly anticipated, especially after CIFR, TERAWULF, and NEBIUS had already secured deals with Fluidstack (backed by Google) and MSFT. It should finally end the debate about what hyperscalers need most: software or capacity. $MSFT has clearly signaled today that it needs additional power capacity for years to come, which is why it is leveraging outside infrastructure:

Key Financial Terms (IREN & Microsoft)

Prepayment: 20% of the contract value (about $1.94 billion) is paid by Microsoft upfront, with the remainder paid over the contract term.

Hardware Procurement: IREN will purchase NVIDIA GB300 GPUs and related equipment from Dell Technologies for approximately $5.8 billion to fulfill the contract.

Deployment: The GPUs and supporting infrastructure will be deployed in phases through 2026 at IREN’s 750MWdata center campus in Childress, Texas.

Hyperscalers are engaged in a race to maximize cloud revenue and are spending tens of billions of dollars to do so. Google Cloud already accounts for 15% of all revenue, even while trailing Amazon by two times. It seems they don’t want to lose ground, which is why Cipher secured a $5.5B deal:

Key Terms (CIFR & AWS)

Capacity: Cipher will deliver 300 megawatts (MW) of turnkey space and power for AI workloads to AWS.

Delivery Timeline: Capacity will be delivered in two phases, starting July 2026 and completing in Q4 2026.

Rent Start: AWS rent payments begin in August 2026.

Cooling: Both air and liquid cooling capabilities will be provided.

Facility: The infrastructure will be hosted at Cipher’s Barber Lake facility in West Texas.

This confirms that miners are transitioning into a new dimension with higher capitalization and strong partners. They have become a new asset class that will see hundreds of billions of dollars poured into it. These are precisely the companies where your money should be, because we are still at the very beginning of this journey, and there is a major capacity shortage. Just today, Amazon also announced a seven-year deal with OpenAI, which is highly positive for the Neocloudsas well. I would not be surprised if Nebius also announces significant news around its earnings on 11/6.

I want to emphasize once more that it is not too late to invest in this sector. Many companies possess sufficient power capacity that can be monetized, and you can find both miners and infrastructure “picks and shovels” right here on my blog. And as always, please reach out if you have any questions.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.

Reminds me of WWE tag team champions, great update!

The $1.94 billion prepayment from Microsoft really underscores the desperation hyperscalers face for secured capacity. What's remarkable is IREN only commited 10% of their total power capacity, leaving them with massive optionality for future deals. The Dell partnership for GB300 procurement shows strong execution capability that many legacy miners lack.