How to Play NVIDIA Earnings Like a Pro

From CoreWeave to Vertiv: you can’t imagine how many companies depend on Jensen Huang

No earnings report is watched as closely as NVIDIA’s. The reason is simple: too many other companies depend on it. Before the AI boom, many of these firms were either ignored or stuck in obscurity.

Take SMCI — its meteoric rise last year was driven almost entirely by investors piling into anything tied to NVIDIA. Or Micron, which sat in portfolios as dead weight for years until it became a key supplier of memory chips for Jensen Huang’s GPUs. Practically overnight, it went from burden to prized asset.

Analysts expect Q2 revenue of $45.8B, representing 52.4% YoY growth. NVIDIA's guidance suggests revenue between $44.1B and $45.9B. GAAP net income is forecast at $23.2 billion, marking a 39.6% growth YoY.

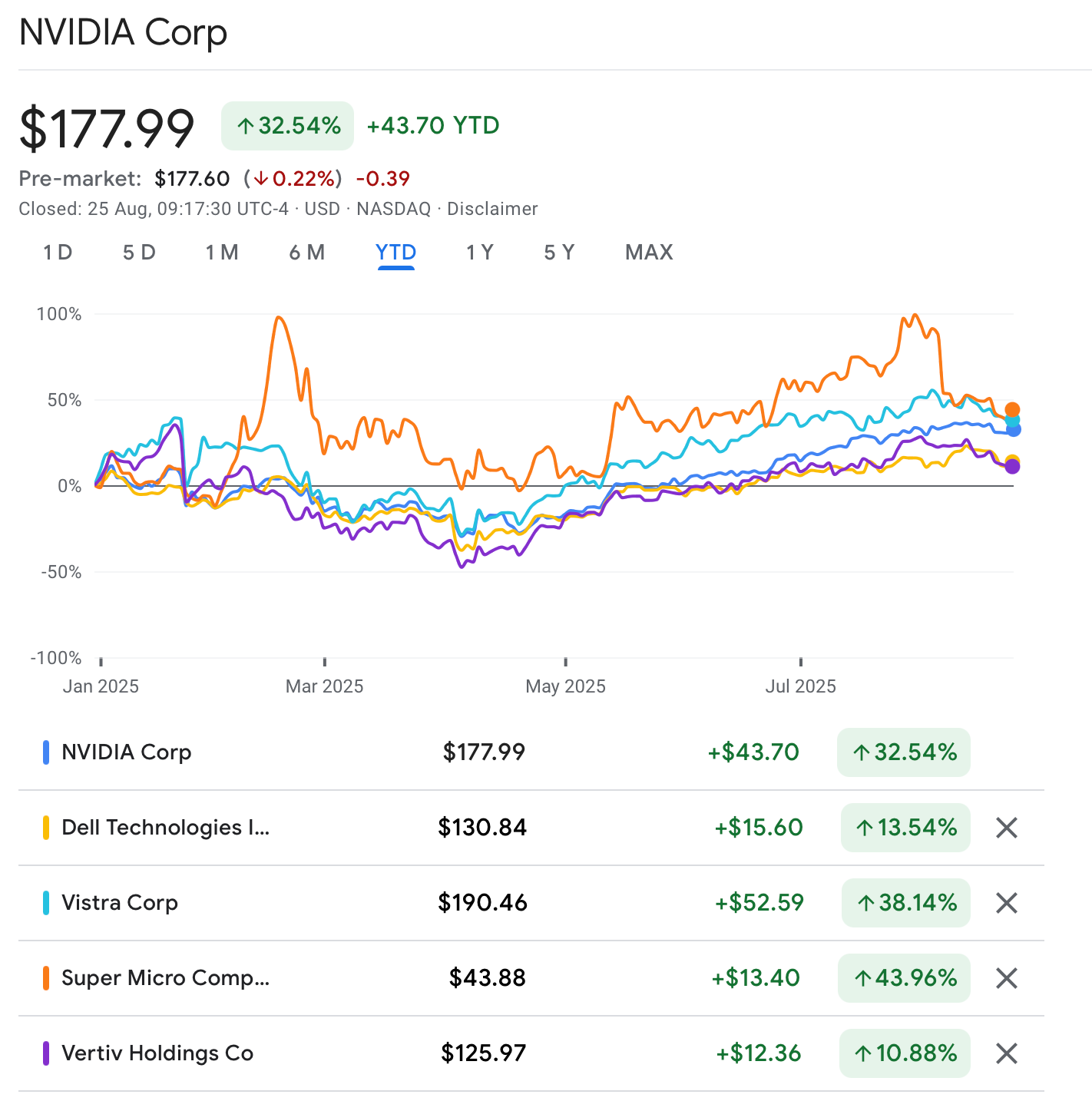

There are plenty of these stories. They rise and fall in sync with NVIDIA, as this chart shows. The sharper swings in SMCI reflect its evolution into a meme stock, frequently targeted by short sellers.

Analysts expect Q2 revenue of $45.8 billion, up 52.4% YoY. NVIDIA’s own guidance suggests $44.1B–$45.9B, while GAAP net income is forecast at $23.2 billion, a 39.6% YoY increase.

To understand who will be most affected by NVIDIA’s earnings, we start with those in the same food chain — the suppliers feeding into its GPUs.

📌 Memory Suppliers

In NVIDIA’s food chain, these are absolutely critical — no DRAM, no HBM, no GPU boom.

Micron ($MU) – a dead weight stock for years, suddenly reborn as a key supplier of HBM and memory modules for Jensen Huang. Its re-rating over the past year came purely from NVIDIA demand.

Samsung Electronics – the world’s biggest memory maker, but in AI they’re effectively following NVIDIA’s lead. Their HBM supply cadence is dictated by GPU demand.

SK Hynix – the fiercest rival to Samsung, positioning aggressively in HBM3. Any hiccup or production delay at Hynix ripples through NVIDIA’s entire ecosystem.

These companies don’t just “benefit” from NVIDIA — they live and die with its guidance. A strong NVIDIA print → instant repricing of MU, Samsung, Hynix.

After the chip suppliers, the next layer in NVIDIA’s food chain:

📌 Server and rack builders

These companies make sure GPUs don’t just exist, but actually run inside real-world infrastructure.

HP (HPE) and Dell may look like boring legacy PC names, but in the AI cycle they’ve quietly become rack-and-stack plays. They’re packaging GPUs into servers at massive scale, and every enterprise buyer that can’t get a direct deal with NVIDIA is lining up at their door.

Super Micro (SMCI) is the poster child of this group — once a niche server builder, now trading like an AI high-flyer. The company isn’t selling groundbreaking tech; it’s selling speed.

They can ship GPU-packed racks faster than the giants, and in an industry where lead times decide who wins, that makes them indispensable. Of course, that speed and hype also turned SMCI into a meme stock, which explains its wild volatility.

These firms don’t design the GPUs — but without them, NVIDIA’s chips would just be expensive silicon sitting in boxes. They’re the enablers, turning GPU demand into actual datacenter capacity.

📌 Data centers and the power systems

Vertiv ($VRT) is the quiet winner here. It doesn’t build GPUs, but it sells the power distribution and cooling systems without which no datacenter can run AI at scale. Every new GPU cluster means new orders for Vertiv.

Vistra ($VST), an energy utility, has turned into a pure AI proxy. The surge in power demand from hyperscalers has put utilities back on the map, and Vistra is right in the middle of it.

Equinix ($EQIX) and Digital Realty ($DLR) operate the datacenters that house all this hardware. They’re not chasing headlines, but their business model scales directly with NVIDIA demand: more GPUs → more racks → more leased capacity.

This is the less glamorous side of AI, but without these enablers, the chips don’t matter. NVIDIA’s results ripple straight into their order books.

Even the best GPU racks are useless if they can’t talk to each other. That’s where networking and interconnect players come in.

📌 Networking and interconnect players

Arista Networks ($ANET) has become the go-to switch provider for hyperscalers. Its high-throughput networking gear is a must-have in GPU clusters, and AI demand has given Arista a new growth engine.

Broadcom ($AVGO) sits deeper in the plumbing. Their custom chips and interconnect solutions enable the bandwidth NVIDIA’s GPUs need to actually scale. Without Broadcom’s networking silicon, the AI story bottlenecks.

Marvell ($MRVL) is another player in the same space, capturing design wins around optical interconnects — critical when every nanosecond of latency costs money in large-scale training runs.

📌 GPU Cloud & Mining Proxies

CoreWeave ($CRWV) – the closest thing to a pure-play NVIDIA cloud partner. They don’t design chips, but their entire business model is renting out NVIDIA GPUs to AI clients. If Jensen sneezes, CoreWeave catches a cold.

Iris Energy ($IREN) – once just another Bitcoin miner, now repurposing its datacenter footprint and cheap power contracts into an AI hosting story. The stock has been riding the “GPU demand” narrative hard — no surprise it’s trending today.

Nebius ($NBIS) – another infrastructure name positioning itself as an NVIDIA-adjacent play. Their GPU hosting angle makes them part of the same trade: not designing silicon, but monetizing the AI hardware rush.

These names show how far NVIDIA’s gravity extends. From cloud upstarts like CoreWeave to ex-miners like IREN, companies are reinventing themselves just to stay inside the AI orbit.

As we can see, hundreds of companies depend on NVIDIA — not only the ones listed here, but also their suppliers, clients, and partners. Jensen Huang has built a massive ecosystem around the company, which means a broad circle of powerful players is directly invested in NVIDIA’s success. And that’s not even counting smaller startups like RXRX and WRD, where NVIDIA holds stakes or runs joint projects.

Really clear breakdown of just how wide NVIDIA’s reach has become. Fascinating to see how many sectors now move in sync with its earnings, from memory to power to even ex-Bitcoin miners.

Keep up the good work! I'm rooting for you.