How to Avoid Getting Erectile Dysfunction During the Market Crash

Am Ultimate Guide how to keep your cool and your money when market bleeds

Don’t panic sell

That day always comes out of nowhere. Everything seems perfect—analysts are giving glowing forecasts, Palantir is flirting with $200, Robinhood’s IPO is just around the corner, and you’re dreaming of early retirement with stress-free trading from a cabin in the countryside. Then suddenly, the great crash hits. I lost 6% of my portfolio in a single day, and another 4% the next. In moments like these, you quickly realize why only the best fund managers consistently beat the S&P 500. I was up 34% year-to-date and lost a third of those gains in two days. But now, let’s talk about what to do when your portfolio is already melting before your eyes.

The very first thing you shouldn’t do is panic-sell everything. If your portfolio contains quality stocks, they will recover after the correction once the selling pressure eases. I know it’s easier said than done, especially when you’ve spent months building your portfolio and it’s collapsing right in front of you. Yet, during a market crash, the fundamentals of the company don’t change.

They don’t lose clients, their financials stay intact, and the only difference is how you perceive them. In your mind, a money-making machine suddenly turns into a money pit. But that’s purely emotional. One vivid example is AMD, which earned the nickname “advanced money destroyer” during the April crash when its shares plunged from $227 to $70—only to rocket back up to $185 with astonishing speed.

Nvidia’s stock fell below $90 during the sell-off but later climbed back up to $185. This proves that after a major market downturn, a portfolio of quality stocks tends to recover. Should you try to sell high and buy back lower? The answer is simple—don’t try to time the market. It’s nearly impossible to buy at the exact bottom and sell at all-time highs. Instead, the best approach is to hold onto your stocks if you believe in their long-term value.

Don’t concentrate your portfolio in 2-3 stocks

It’s natural to wonder how to prepare for a market sell-off. A simple but crucial piece of advice is to avoid putting most of your money into only a few stocks, because unexpected events can happen with any of them.

Sure, some people became millionaires by investing solely in Tesla or Palantir, but those cases are rare. Relying too heavily on just a handful of stocks carries significant risk if something goes wrong.

We live in an era of declining interest rates—a point that Trump often reminds Powell about. But I strongly recommend looking back at 2022, when companies like Sunrun, Plug Power, and SNAP were soaring—and then consider where they stand today. What happened to Farfetch? There are many risks that investors often overlook. For example, RKLB could plummet if its first launch fails, and PLTR might miss out on the contracts it was counting on.

I remember a friend who is an asset manager telling me he was shocked by Eli Lilly, which seemed to rise every day. Now, the stock that once traded at $950 is down to around $700. Snap, which was once valued at roughly $100 billion, is now worth about $11 billion. This shows the importance of having flexibility in your portfolio. Even if one stock stumbles, the rest of your holdings can help hedge against the risk.

In conclusion, diversification and flexibility are essential for surviving and thriving during market downturns. Relying too heavily on a few “star” stocks makes you vulnerable to unexpected events, while a well-balanced portfolio can better absorb shocks. No stock or company is immune to risk, so always prepare for uncertainty by spreading your investments wisely.

As your foundation, it’s best to hold profitable companies with stable free cash flow (FCF) that can withstand even severe shocks. Companies like Microsoft or Walmart have never hurt anyone, and I include them in my portfolio as well. At least you don’t have to flinch when interest rate hikes come into the conversation.

Patience beats FOMO

It’s very important not to fall victim to FOMO—the fear of missing out—and rush into buying stocks at their absolute peak, even though it can be tempting when the market is hitting all-time or yearly highs.

For instance, Tesla’s stock peaked at around $1,200 near the end of 2021, and Bitcoin nearly hit $69,000 in November 2021. Many investors who bought at these highs faced losses of 50% or more in the months that followed. Buying at these peak prices usually means paying a premium and exposing yourself to the risk of a sharp correction or even a crash.

That’s why it’s essential to set clear price targets for buying before entering any position—having a disciplined approach can help you avoid chasing overpriced assets and preserve your capital for better opportunities.

If a stock trades 20-30% above the level you consider fair value, it’s often smarter to wait patiently for a better entry point. Take Sunrun as an example—it rose more than 300% in 2020 but then fell over 70% by 2022. Practicing this kind of discipline protects your capital and helps you avoid overpriced investments.

Often, the best returns come to those who remain calm and wait for a market pullback instead of chasing every rally. The market isn’t going anywhere—you don’t need to buy everything at once, and patience usually pays off in the long run.

Free cash is the king

Having free cash on hand is essential for a strong investment strategy. Ideally, you should keep at least 3 to 6 months’ worth of living expenses in cash to cover emergencies without forcing the sale of investments at a bad time. Beyond that, keeping about 5-10% of your investment portfolio in cash or liquid assets gives you flexibility to act when market opportunities arise.

For example, during the COVID-19 crash in March 2020, investors with cash reserves were able to buy quality stocks at discounts of 20-40%. That also can be said about the April turmoil when you could buy NVIDIA, Vertev and RKLB at bargain prices

Those without cash had to sell more expensive holdings or miss out on these bargains. Having liquid cash could allow you to buy stocks that fall 30% suddenly, positioning you well for the eventual market recovery.

This kind of preparedness avoids panic selling and gives you peace of mind knowing you can handle both personal expenses and investment chances. Maintaining a cash buffer of around 5-15% of your total portfolio is widely recommended by financial experts to balance growth potential and safety.

Hedging, Options & Market Lessons

1. Why hedges mattered this summer

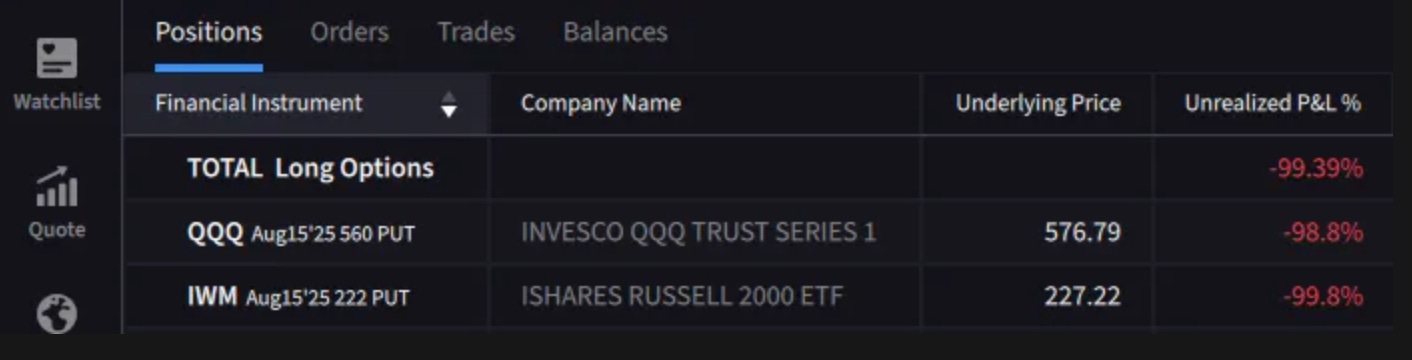

In July, volatility was muted and equities were grinding higher into earnings season. That was the kind of backdrop where downside protection in benchmarks like QQQ and IWM looked sensible. As the month progressed, SPX stalled near its upper band, VIX lifted from historically low levels, and TLT caught a bid as long-term yields retreated from the 5% mark. Those were early signs of stress building under the surface.

Sentiment shifts rarely show up in one place. IPOs billed as “highly successful” such as FIG, FLY, and BLSH now sit below their IPO lows, while CRCL and CRWV add to the picture with steep drawdowns from where most buyers actually entered. Crypto IPOs were marketed as catching fire but turned out more like catching falling knives.

At the same time, retail favorites and recent highfliers lost momentum, while SPX bands, VIX, and TLT reflected creeping stress. When cracks open across different corners of the market, hedges start to matter. Not because they time reversals, but because they buffer portfolios when narratives break down.

The key point: hedges are insurance, not lottery tickets. You don’t expect them to make money, you expect them to cap losses when risk materializes. The mistake was letting runners from late July protection expire worthless after the recovery. Hedges work best when they are sized right and trimmed into strength, not left to bleed.

2. Market structure & index pivots

The 222 level in IWM became the defining battleground of the summer. It was front-run by sellers in early August, then reclaimed and tested later in the month. QQQ rejected a major weekly trendline, with all three benchmarks putting in lower-high pivots that only a decisive reclaim could undo.

Why this matters: markets often rotate around liquidity zones where supply and demand balance. Levels like 222 in IWM are not magic, but they become self-fulfilling because that is where orders cluster. Understanding this dynamic is why active management matters more than buy-and-hold when volatility shifts.

3. Cash-Secured Puts: smart entry, not blind income

CSPs proved effective when written with location and volatility in mind, not just a few percent out of the money for “income.” Selling puts into exhaustion zones or near strong support created opportunities both for premium and for entry at attractive levels.

Recent setups include

PLTR – Filled on Sep 19 ’25 110 PUT (highlighted in the quarterly review). Support and volatility made it a level worth owning if assigned.

CRWD – Filled on Sep 19 ’25 370 PUT as pullback plus IV made the setup appealing.

CRCL – After a $130 offering the tape is fragile, but CSPs around that zone look tempting with IPO-high retest risk.

CRWV – Lockup expiration weakness through 100 makes puts interesting in this area.

NVDA – Sep 19 ’25 135 PUT aligns with a high-confluence support zone.

ORCL – Sep 19 ’25 195 PUT matches weekly trendline, major volume node, and moving average support.

SMCI – Sep 19 ’25 35 PUT provides a defined cushion on a volatile name.

For readers who don’t open the full CSP writeup, here are the core principles in brief:

Strategic acquisition tool – CSPs are “limit orders with benefits.”

Strike selection – Focus on confluence zones such as trendlines, volume nodes, and moving averages.

Risk & capital – Always cash-secured. No leverage. Only sell on stocks worth owning.

APY focus – Use annualized yield to compare trades across expiries.

Lifecycle – Assigned shares can transition into covered calls to lower basis or set exits.

This way, CSPs complement hedges. Hedges reduce tail risk, CSPs monetize patience.

4. Broader takeaways (current/forward-looking)

As of August 21, 2025, VIX has barely moved despite choppy price action. If this controlled lift continues instead of a gap-driven spike, it may signal a shift away from reflexive buy-the-dip toward a slower roll-over. Crypto has yet to clear its leveraged longs. BTC at 112k and ETH around 3900 and 3500 remain near-term markers.

Muted volatility and unflushed leverage often precede grinding drawdowns rather than collapses. That punishes passive holders while rewarding those who layered in hedges and structured CSP entries ahead of time.

Closing thought

If the rules of market turmoil are about not panicking, not chasing tops, and keeping cash available, then this section is about what to actually do with that cash. Hedges cap the downside. CSPs turn idle capital into opportunity. Together they transform simple advice into an actionable playbook for volatile markets.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.