How EU Carmakers Are Cashing In on the Death of the Green Agenda

5 Stocks Set to Win as the EU Scraps Green Restrictions 🚗📈

Shares of European automakers jumped after the EU announced a major easing of emissions targets, offering carmakers billions in relief. Volkswagen (VW), the biggest winner, is set to save €1.6 billion in emission-related penalties, sending its stock higher.

This marks a turning point in the EU’s aggressive green agenda, which forced automakers into an expensive transition to EVs. VW alone pledged a staggering $52 billion to electrification, yet despite this massive investment, EVs still account for just 14% of the market. The industry collectively poured €250 billion into EV development, only to lose domestic market share while also facing crippling fines of up to €1 billion per company annually for missing CO₂ targets.

Now, with delayed emission rules and relaxed penalties, automakers have room to adjust strategies—but will it be enough to rebalance their finances? Each carmaker is impacted differently, depending on their EV roadmap, market position, and investment strategy. Here’s what the EU’s policy shift means for Volkswagen, BMW, Stellantis, Renault, and Mercedes-Benz—and their bottom lines.

1. Volkswagen: From EU’s Poster Child to Market Pariah 🚗📉

Volkswagen once dreamed of being the poster child of the EU’s green revolution—the carmaker that would lead Europe into an all-electric future. Instead, it became the symbol of a sluggish German economy, an overregulated industry, and a failed green transition.

Let’s not forget: **In 2021, VW was trading at €250 per share while meeting 2025 at €88. That’s not just a stock decline—it’s a brutal reality check on Europe’s auto industry.

While VW's stock was sinking, another number was rising—support for Germany’s right-wing AfD party, which has seen its highest polling numbers in history. What started as a protest vote has transformed into a political force, fueled by economic discontent, soaring energy prices, and backlash against the EU’s aggressive green policies. A weakened economy, an overburdened industry, and job losses tied to rushed climate policies have fueled political shifts. Maybe it’s not a coincidence that as VW tanked, AfD surged—polling at over 20% nationally, more than double its support from 2021. In key industrial regions, the party is gaining traction among workers who feel abandoned by policies that prioritize environmental targets over economic stability.

The EU’s Role in VW’s Fall

Forced Electrification: VW committed $52 billion to EV development, following the EU’s aggressive green policies. The return? EVs still make up just 14% of sales, and the company bleeds money on every EV sold.

Lost Market Share: While VW chased an EV dream, Chinese competitors like BYD took over key markets, pushing VW down to third place in global EV sales.

Crippling CO₂ Fines: Until now, the EU’s rules meant VW faced up to €1 billion in annual penalties for missing emissions targets.

A $5 Billion Mistake: VW invested $5 billion in Rivian, expecting a green boom—meanwhile, the U.S. is scaling back its green agenda, leaving VW exposed in an unsteady market.

2024: The Financial Collapse Hits Hard

VW’s 2024 earnings tell the full story of a company stuck in a policy-induced nightmare:

Net profit down 60% (Q3 2024) → €2.4 billion vs. €5.8 billion last year.

Operating profit collapsed by 21% → €12.9 billion for the first nine months of 2024.

Sales in China—VW’s biggest market—fell 12% in the first nine months of 2024.

VW spent billions trying to meet the EU’s standards—only to get crushed by slowing EV demand, weak consumer confidence, and Chinese competition.

Now, the EU Hits the Brakes

With the EU’s emission rule rollback, VW just got a €1.6 billion lifeline in avoided CO₂ fines. This buys time, allowing it to shift focus back to hybrids and ICE models—the cars that actually make money.

Yet, despite its long slump, VW’s stock has surged 21% in 2024 as investors turn bullish on the German economy under new leadership and see VW as undervalued after years of underperformance. The company is finally getting some relief, but whether it can sustain the momentum remains the key question.

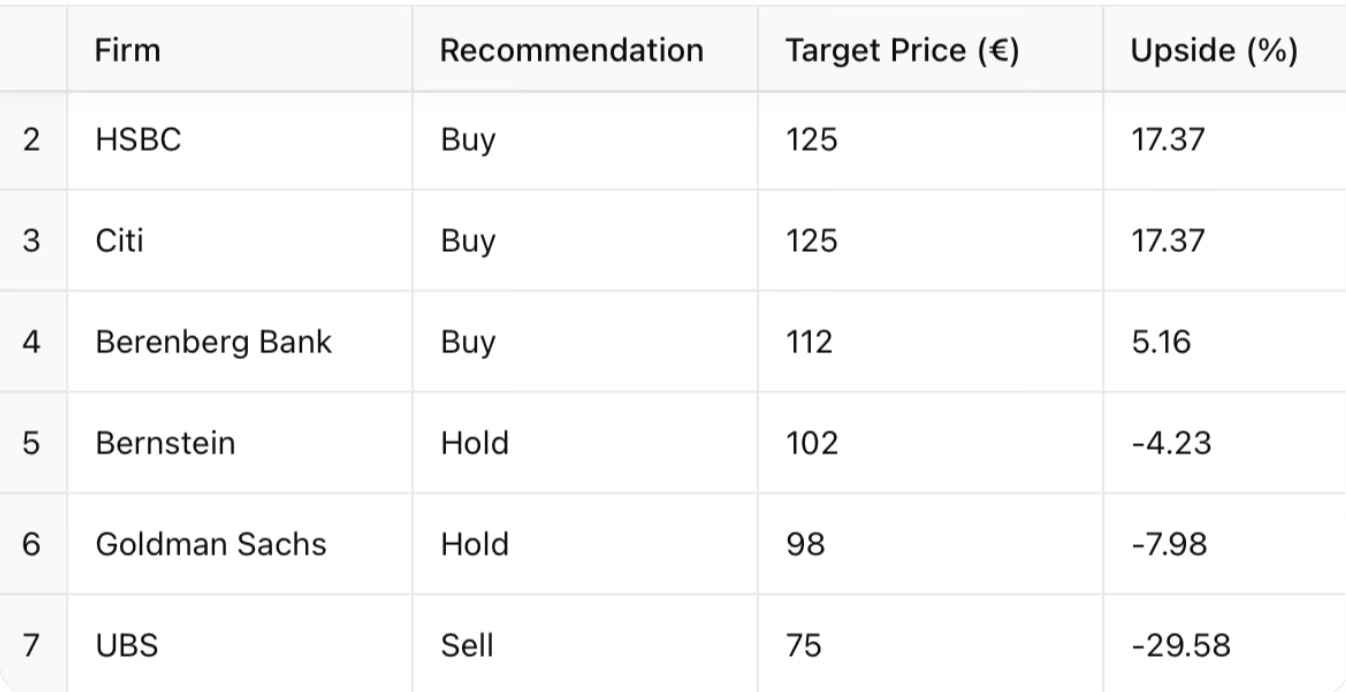

Analysts Price Targets (Current Price: €106.5)

BMW: The Automaker That Played It Smarter 🚗📈

While Volkswagen bet big on the EU’s green agenda and got burned, BMW took a more pragmatic approach—and it’s paying off. Instead of going all-in on EVs, BMW balanced its investments between electrification and traditional combustion engines, ensuring profitability while still meeting regulatory requirements.

2024 Performance & Market Position

Revenue Growth: BMW reported a 4.5% increase in sales in Q1 2024, driven by strong demand for high-end models.

EV Expansion Without Overcommitment: The company’s EV sales rose 18% YoY, but hybrids and combustion vehicles still make up the bulk of deliveries, keeping profitability stable.

Stock Price Struggles:

BMW's stock has been declining since 2023, reflecting investor concerns over slowing global demand, rising costs, and competition from Chinese automakers.

While BMW remains profitable, its stock performance lags expectations, showing that even a balanced EV strategy isn't enough to shield automakers from broader market pressures.

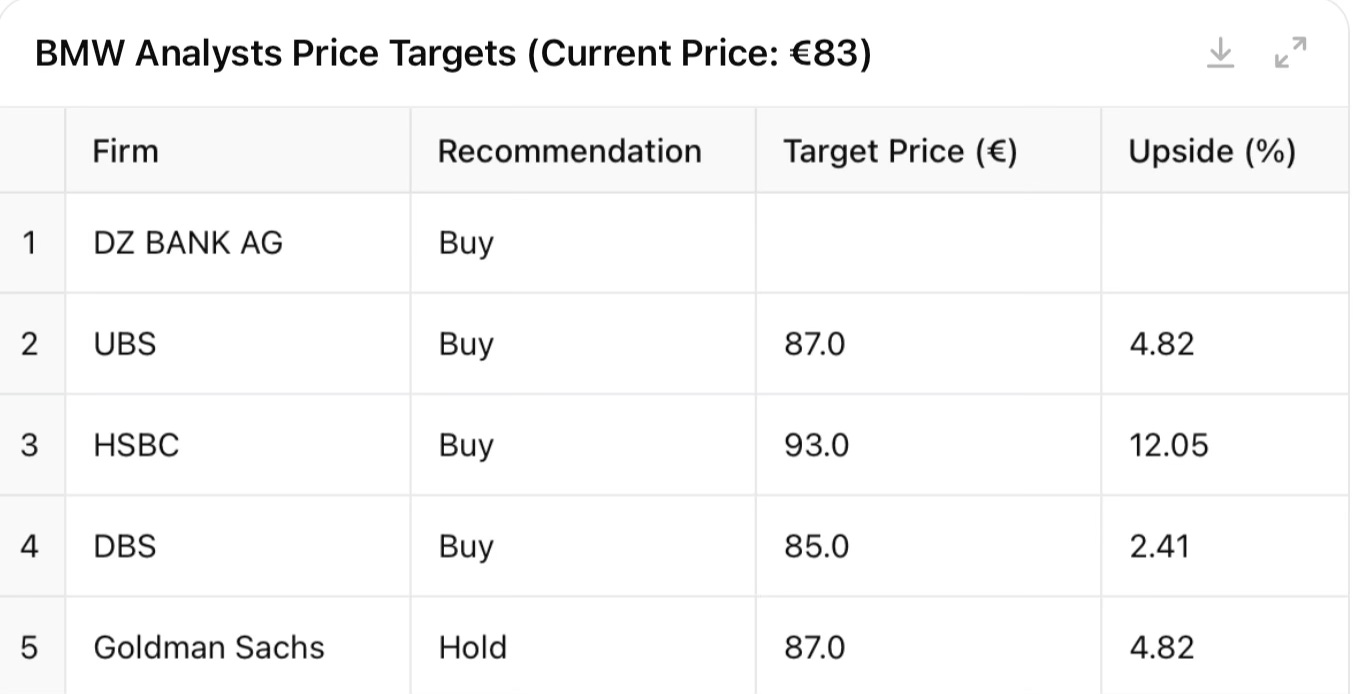

Investor Insights & Guidance

Valuation Check: BMW trades at a lower P/E ratio than its EV-focused competitors, making it an attractive value play for long-term investors.

Dividend Stability: BMW’s dividend yield remains strong, appealing to income-focused investors looking for stable cash flows.

Investment Outlook: Analysts see BMW as a safer bet than VW, given its more measured approach to EVs and strong brand positioning in luxury markets.

4. Mercedes-Benz: Luxury Meets Market Reality 🚗💶

Mercedes-Benz built its reputation on engineering excellence and premium branding, but its transition into the EV era has been anything but smooth. Unlike BMW, which kept a balanced portfolio, Mercedes aggressively pushed into EVs—and now it’s facing the consequences.

2024 Performance & Market Challenges

Revenue Decline: Group revenue decreased by 4.5% to €145.6 billion in 2024, down from €152.4 billion in 2023.

Profitability Pressure: Earnings before interest and taxes (EBIT) dropped by nearly 31% to €13.6 billion in 2024, compared to €19.7 billion the previous year.

Net Profit Slump: Net profit fell approximately 28% to €10.4 billion, primarily due to weaker sales in key markets like China.

Stock Price Struggles: Mercedes’ stock has been on a downward trend since mid-2023, reflecting investor concerns about slowing global luxury car demand and high production costs.

How the EU Policy Shift Benefits Mercedes

More Time to Adapt: With emission targets relaxed, Mercedes can extend the lifecycle of profitable combustion models while adjusting its EV strategy.

Lower Regulatory Costs: The risk of heavy CO₂ fines is reduced, helping the company preserve cash flow for other investments.

Stellantis: Dreaming of Comeback after Stock Collapse

While Volkswagen and Mercedes struggled under the weight of the EU’s green mandates, Stellantis played the long game—and it’s not paying off yet. The company, which owns brands like Peugeot, Fiat, Jeep, and Opel, took a cost-conscious approach to EV expansion, balancing investments in electrification with a continued focus on internal combustion and hybrid models.

33% Upside ahead?

Revenue Decline: Stellantis posted €5.5 billion in net profit for 2024, a staggering 70% drop from €18.6 billion in 2023.

Stock Price Collapse: Stellantis' stock has plunged from €26 a year ago to just €12 today, wiping out billions in market value.

Market Challenges: The company, like many of its peers, has been hit by rising material costs, supply chain disruptions, and slowing global auto demand.

CEO’s Optimistic Guidance: Stellantis believes it can return to revenue growth in 2025, banking on cost-cutting measures and a diversified vehicle portfolio. Some analysts give the stock 33% upside

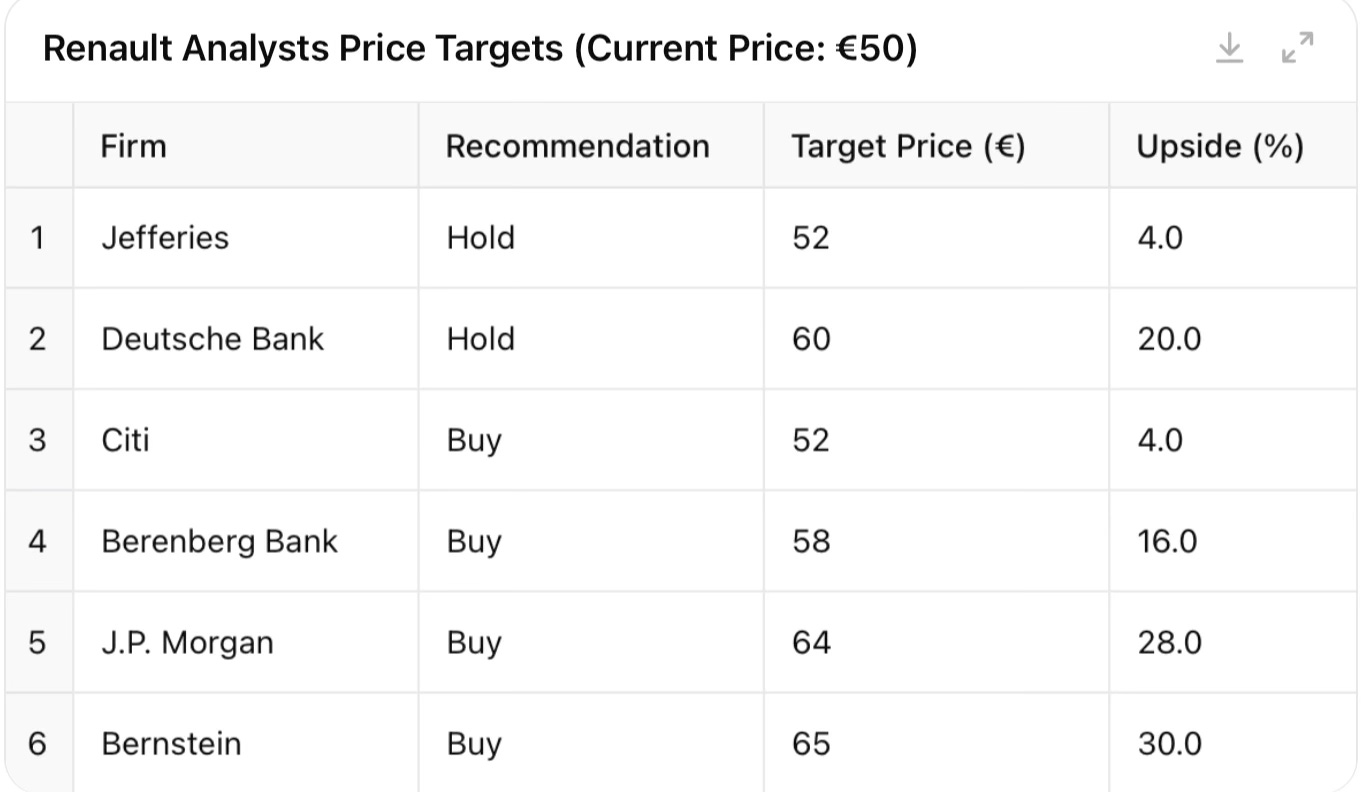

5. Renault: 30% Upside for “no rules” 🚗⚡

Renault has always played by its own rules in the European auto market—sometimes to its advantage, other times to its downfall. While competitors like VW and Mercedes scrambled to keep up with the EU’s green push, Renault leaned into affordability and hybrid tech rather than making an all-in EV bet.

2024 Performance & Market Challenges

Strong Revenue Growth: Despite market turbulence, Renault posted €52 billion in revenue for 2024, up 10% YoY, thanks to strong demand for budget-friendly models and hybrids.

Stock Performance: Renault’s stock is up 7% YTD and 115% during the last 5 years that's much better than competitors.

China Risks: Renault exited China in 2020, avoiding the direct hit that VW and Stellantis are taking from Chinese EV competition. Probably, that's how the story will end for other EU carmakers. It's hard to compete with giant state subsidies. Moreover, Chinese carmakers work as one big factory to decrease the price.

Investor Insights & Guidance

European Market Dependence: Renault lacks the global reach of Stellantis, making it more vulnerable to a European economic slowdown.

Scaling EV Profitability: While hybrids are profitable, Renault’s full EV lineup is still struggling to generate strong margins.

How the EU Policy Shift Benefits Renault

Less Pressure to Scale EVs Quickly: Renault now has more time to refine its EV strategy without regulatory overreach.

Hybrid Edge: With the EU allowing hybrids to stay in the market longer, Renault’s focus on affordable hybrid models gives it a competitive advantage.

Cost Flexibility: Unlike VW, which overinvested in EVs, Renault’s smaller-scale EV approach now looks like a smarter bet.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.