Healthcare Stocks in Crosshairs? Tempus & Hims Face Growing Pains

Investors punish high-flyers amid rising risks and macro uncertainty.

Hims & Hers Beats Earnings—But Can We Trust The Management?

Hims & Hers (HIMS) delivered another strong quarter, beating expectations:

✅ EPS: $0.11 vs. $0.10 expected

✅ Revenue: $481M vs. $470M expected

✅ YoY Growth: +95% revenue surge

The stock has had a massive run, jumping from $25 to $68 this year and still up 112% YTD. But despite these impressive numbers, investors remain cautious.

Super Bowl Hype vs. Long-Term Growth

Hims reported an “unprecedented” 650% spike in traffic following its Super Bowl ad, according to data shared with Fierce Healthcare. New customer registrations hit record highs, and the Hers app surged to #2 in Apple’s Health & Wellness category (previously unranked in the top 10).

This is exactly what you want from a marketing push—huge visibility and engagement. But how valuable is this traffic if the company is simultaneously stepping away from one of its biggest growth drivers?

The Obesity Drug Setback: A Tougher Market Ahead

One of the biggest concerns is Hims’ decision to stop selling compounded obesity drugs, a move that came after increasing pressure from Eli Lilly and Novo Nordisk. These pharmaceutical giants have made it clear they want full control over the weight-loss market.

Eli Lilly just launched higher doses of Zepbound in single-dose vials at up to half its usual monthly list price, aiming to capture more uninsured patients. Additionally, on Tuesday, Lilly announced price cuts for its lower-dose vials, reducing the 2.5 mg version to $349 and the 5 mg version to $499.

This is a direct move to undercut competitors and expand market share, making it even harder for companies like Hims to compete in the weight-loss space.

So, What’s the Strategy Here?

Hims built its brand on affordable, accessible treatments, and obesity drugs were a major draw. Now, with Big Pharma slashing prices and tightening regulations, the company is pivoting but to what? Is it smart to drive massive traffic while scaling back on one of the most in-demand treatments?

Investor Takeaways: Execution Over Hype

Hims has momentum, but can management turn it into lasting growth? Here’s what investors should be asking:

Regulatory Pressures – Can Hims re-enter the obesity market in a meaningful way?

Competitive Headwinds – With Lilly and Novo Nordisk setting the rules, can Hims find a sustainable niche?

Sustainability – Are these traffic spikes translating into revenue, or just short-term wins?

Wall Street’s Mixed Signals

Analyst price targets highlight the uncertainty:

🔹 Morgan Stanley: $60

🔹 Leerink: $40

🔹 Needham: $31–$61

🔹 Citi: $25–$27

🔹 Truist: $24

Final Thought: Hims Has Something to Prove

Hims is great at getting attention, but this is a defining moment for its business model. Can it keep up the growth without the obesity drug boost, or will this be a case of hype outpacing execution?

The next few quarters will tell us everything we need to know.

Tempus AI: Strong Growth, But Market Concerns Mount

Key Financial Highlights:

Revenue: $200.7M (+35.8% YoY)

Net Loss: -$13.0M (vs -$50.5M in Q4 2023)

Adjusted EBITDA: -$7.8M (vs -$35.1M YoY)

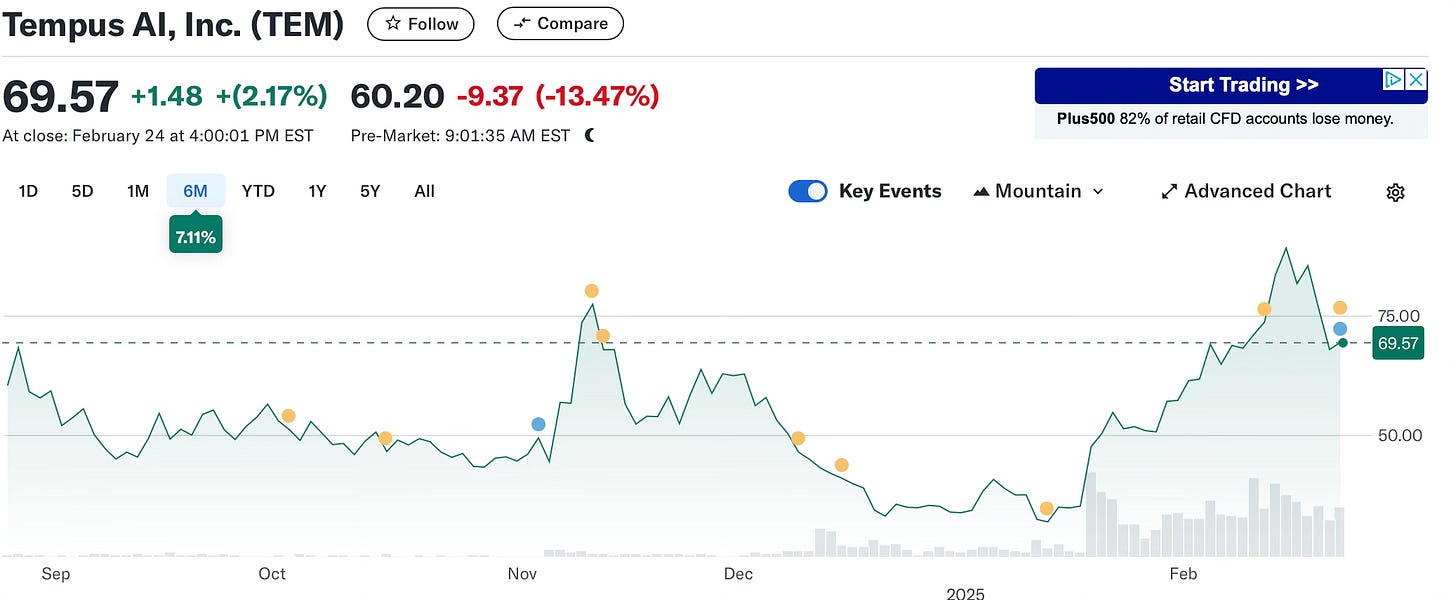

Tempus AI reported growth, but the stock has fallen 13% in after-hours trading following earnings. Despite impressive revenue figures, investor sentiment remains cautious due to the second consecutive disappointing quarter. The rapid growth earlier in the year is now facing a market correction.

Investor Takeaways: Is the Growth Sustainable?

Tempus' stock had surged 106% YTD, but now it’s facing a 13% drop post-earnings. The stock grew too quickly, and the pullback highlights the risks of an overheated market. Can the company continue to grow amidst rising macroeconomic pressures?

Forecasts for 2025:

Tempus expects $1.24 billion in revenue, exceeding analysts' $1.04 billion estimate, but can it meet those targets? The forecast is strong, but risks like tariffs and higher inflation could make the path ahead more challenging.

Market Sentiment: Analyst Views

Needham: Raised target to $70 from $56

JPMorgan: Downgraded to Neutral, cutting price target from $50 to $55

Stock Performance: Despite strong YTD performance, the recent 13% drop in after-market trading is a wake-up call.

Pelosi’s Influence: A Temporary Boost?

The stock saw a surge earlier this year after it was disclosed that Nancy Pelosi purchased shares in Tempus. Her trades have historically attracted retail investor attention, but was this just a short-term boost, or does it signal long-term confidence?

Pelosi’s disclosure of her investment in Tempus AI - 50 call options with a $20 strike price expiring in January 2026 sparked significant retail investor interest. Since her purchase on January 14, 2025, Tempus AI stock has surged from $31.83 to $68.09, reflecting a gain of over 100% in just over a month.

Macro Headwinds Ahead

The broader macro environment continues to pose a challenge. Tariffs and inflation could drive up interest rates, making it harder for companies like Tempus to maintain their current trajectory. With cash burn still a concern, the next few months will be critical.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.