🚀 Germany’s Infrastructure Boom: 3 Stocks With Huge Upside

💰 Billions are flowing into Germany’s roads, energy, and construction—these 3 stocks are set to benefit

Germany is pouring €500 billion into infrastructure, transforming everything from energy grids to construction projects. Smart investors know where the money flows, and three stocks are in prime position to ride the wave of this historic investment. One of them even has 77% upside potential. Let’s dive in.

Siemens Energy (ENR.DE): Powering Germany’s Infrastructure Boom

Siemens Energy is one of Europe’s leading energy infrastructure players, providing power generation, grid solutions, and renewable energy technology. With a market capitalization of ~€45B, the company is a key beneficiary of Germany’s aggressive push into energy infrastructure upgrades and renewables.

In 2024, Siemens Energy reported revenue of €32.3B (+11.5% YoY), with operating profit improving to €2.7B (+28% YoY). The company’s order backlog hit a record €109B, signaling sustained demand for its solutions in both conventional and renewable energy sectors.

🔹 Growth Driver: The German government is investing heavily in grid modernization and energy security. Siemens Energy is a top supplier of high-voltage transmission systems, benefiting directly from these initiatives.

🔹 Interesting Fact: Siemens Energy's wind power division, Gamesa, is one of the world’s largest suppliers of offshore wind turbines, a market expected to grow at 15% CAGR over the next decade.

🔹 Stock Performance & Analyst Ratings: The stock has rebounded from lows, currently trading at ~€56.

Goldman Sachs reiterates a 'Buy' rating with a price target of €63, noting that 31% of Siemens Energy’s revenue comes from gas projects. With Germany’s 2030 gas power plant expansion (20 GW capacity), demand should accelerate after 2028. Goldman also sees a valuation gap with GE Vernova, implying further upside.

Berenberg raised its price target from €70 to €75, maintaining a 'Buy' rating. Analyst Philip Buller highlights strong current demand and sees Siemens Energy's AI-driven projects as an emerging growth catalyst with significant long-term potential.

Risks & Considerations

Wind Turbine Losses: Siemens Energy’s wind division has struggled with cost overruns and technical issues, causing previous stock volatility.

Supply Chain Risks: As a capital-intensive company, delays in component delivery could impact project timelines and margins.

Government Policy Sensitivity: Energy subsidies and regulations can shift rapidly, affecting project funding.

Final Take

With a record order backlog, strong government support, and a leading role in energy infrastructure, Siemens Energy remains a top pick for investors looking to capitalize on Germany’s infrastructure boom. While wind turbine challenges remain, the stock’s 34% upside potential makes it an attractive bet in the sector.

Heidelberg Materials (HEI.DE): The Infrastructure Backbone with 23% Upside

Heidelberg Materials (formerly HeidelbergCement) is one of the world’s largest suppliers of building materials, including cement, aggregates, and ready-mix concrete. With a market capitalization of ~€31B, the company is a direct beneficiary of Germany’s aggressive infrastructure expansion plans.

In 2024, Heidelberg Materials reported revenue of €22.6B (+7.5% YoY) and an operating profit of €3.9B (+12.3% YoY). The company has benefited from higher infrastructure spending, increased demand for construction materials, and cost-saving initiatives.

🔹 Growth Driver: Germany’s €500 billion infrastructure plan is driving demand for cement and construction materials, particularly for roads, bridges, and industrial projects. Heidelberg Materials is one of the key suppliers for these large-scale developments.

🔹 Interesting Fact: Heidelberg Materials is one of the leading players in carbon-neutral cement production, working on CCUS (Carbon Capture, Utilization & Storage) technology to meet stringent EU environmental regulations.

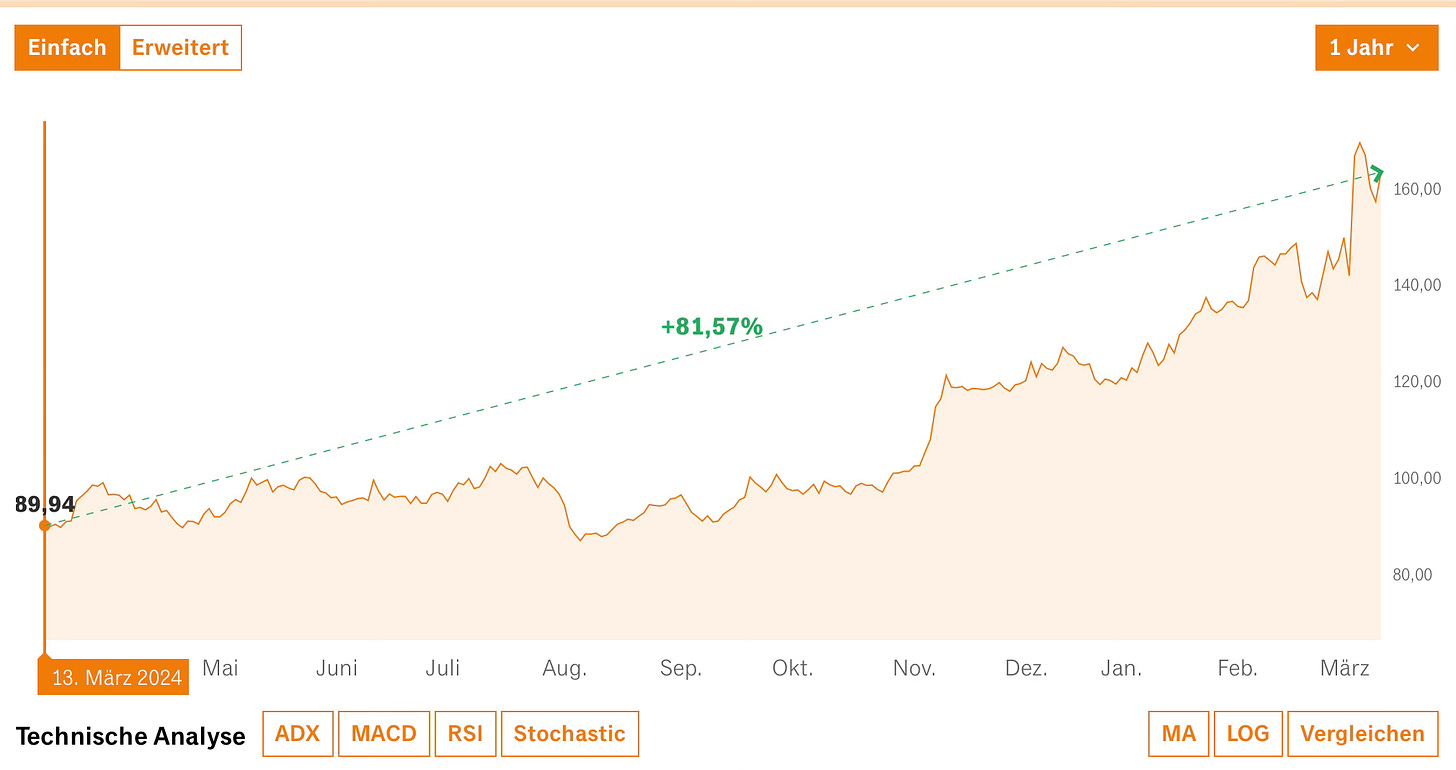

🔹 Stock Performance & Analyst Ratings: The stock is currently trading at ~€163, with analysts targeting €200, implying a +23% upside potential. Analysts remain bullish on infrastructure-driven demand and operational efficiencies as key reasons for future growth.

Risks & Considerations

Cyclicality: The construction sector is heavily influenced by economic cycles, meaning a slowdown in GDP growth could impact cement demand.

Environmental Regulations: Stricter EU emissions rules may lead to higher compliance costs for cement producers.

Energy Costs: Cement production is energy-intensive, and fluctuations in natural gas and electricity prices could affect profitability.

Final Take

With Germany’s infrastructure boom, strong demand for materials, and a growing focus on sustainability, Heidelberg Materials is a stable, lower-risk play in the infrastructure sector. While it may not have the explosive upside of smaller growth stocks, its 23% potential gain makes it an attractive pick for investors looking for steady, infrastructure-backed returns.

PNE AG (PNE.DE): The Renewable Energy Winner with 77% Upside

PNE AG is a German renewable energy developer specializing in wind power, both onshore and offshore. With a market capitalization of ~€1B, the company is a major beneficiary of Germany’s push for green energy, aligning with the country’s ambitious goal of carbon neutrality by 2045.

In 2024, PNE reported revenue of €208M (+15% YoY), with an operating profit of €31M (+22% YoY). The company has a project pipeline exceeding 6 GW, positioning it for rapid expansion as Germany scales up its renewable energy infrastructure.

🔹 Growth Driver: Germany’s commitment to installing 115 GW of onshore wind capacity by 2030 is a massive tailwind for PNE. The company is one of the few pure-play wind energy developers positioned to capitalize on this surge in demand.

🔹 Interesting Fact: PNE AG is expanding beyond just wind, with growing investments in solar farms and green hydrogen, further diversifying its revenue streams.

🔹 Stock Performance & Analyst Ratings: The stock is currently trading at ~€13, with a target price of €23, implying a +77% upside potential. Analysts cite strong project execution and favorable government policies as key reasons for the bullish outlook.

Warburg Research raised its price target from €22.80 to €23.80, maintaining a 'Buy' rating. Analyst Jan Bauer highlighted PNE’s strong EBITDA outlook for 2024 and 2025, citing recent project expansions in wind and solar developments as key growth drivers.

Risks & Considerations

Regulatory Delays: Renewable energy projects are heavily dependent on government approvals, which can slow growth.

Capital Intensity: Developing wind farms requires significant upfront investment, and interest rate fluctuations could impact profitability.

Competition: Larger energy firms entering the renewable sector could challenge PNE’s market share.

Final Take

With a robust project pipeline, strong government backing, and high upside potential, PNE AG presents one of the most compelling renewable energy plays in Germany. At a 77% upside, this stock is a high-risk, high-reward bet on the future of green energy.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.