Firefly Aerospace Is Ready for a Moonshot — But Don’t Be Too Greedy

The space IPO of the year is here. A $6B valuation, 100× P/S, and real lunar ambitions. But is that worth your money — or just a moonlit mirage?

🚀 Firefly Aerospace: Building a Lunar Business Before It’s Profitable

In a space market crowded with ambition and short on actual delivery, Firefly Aerospace has done what many couldn’t: it landed a spacecraft on the Moon — and completed all mission objectives. That puts it in rare company.

But Firefly isn’t stopping at one successful landing. Backed by NASA contracts and fresh off its Blue Ghost Mission 1 triumph, the company is now preparing for an IPO that values it at over $6 billion. Its pitch? Firefly is not just a rocket company — it’s building an end-to-end logistics and infrastructure platform for cislunar space.

🌕 A Moon Mission That Actually Delivered

In March 2025, Firefly’s Blue Ghost Mission 1 became the first fully successful U.S. commercial landing on the Moon. The spacecraft delivered 10 NASA-sponsored payloads to Mare Crisium and operated for 14 days as planned. Unlike competitors such as Intuitive Machines — whose lander tipped over on arrival — Firefly completed every objective and established itself as a credible lunar contractor.

The mission changed the company’s trajectory. No longer just a hopeful in the crowded launch market, Firefly became a proven delivery partner for NASA’s Commercial Lunar Payload Services (CLPS) program. That credibility unlocked more.

🚨 Firefly Wants a Piece of the Post-Rocket Lab Boom

Firefly is trying to crawl through the same open window that Rocket Lab, AST SpaceMobile, and other space startups used to capture public attention — and capital. Retail investors, flush with enthusiasm for all things orbital, have turned anything "space" into a high-multiple opportunity, especially after the stratospheric private valuation of Starlink and growing Pentagon-led initiatives like the Golden Dome, which promise to shower defense contractors with contracts for years to come.

Some might say Firefly is dreaming too big. At a proposed P/S ratio of 100, its valuation is twice as rich as Rocket Lab’s — a company with an established launch cadence, commercial traction, and satellite business already operating in space.

But Firefly has always been a company run by dreamers. And that’s where its story really begins.

🧨 Firefly Should've Died — Twice

Firefly was born out of frustration.

In 2014, Tom Markusic, an engineer who’d worked at NASA, SpaceX, Virgin Galactic, and Blue Origin, walked away from the billion-dollar boys’ club to do something reckless: build his own rocket company.

He didn’t have Elon’s money, Branson’s brand, or Bezos’s patience.

But he had rage — and a vision.

Markusic wanted to create a cheap, ultra-efficient small launch vehicle with a wild aerospike engine, something no one else dared to touch. He called it Firefly.

The idea: make a rocket that looked nothing like Falcon 9. No standard bell-shaped engine, no aluminum tanks. He wanted carbon composites, aerospike thrust, pressure-fed engines — a backyard rebellion against aerospace orthodoxy. It was scrappy and beautiful.

And then, like a candle in vacuum, it was gone.

🏚️ The Brexit Death Spiral

In 2016, just months before their first test flight, Firefly’s main investor — a London hedge fund — pulled out. Not because of technical failure. Because of Brexit. Political chaos dried up capital, and no one wanted to fund a space startup with Ukrainian roots and black budget dreams.

Firefly filed for Chapter 7 bankruptcy, laid off the entire team, and shut down.

Markusic was forced to watch U.S. Marshals seize the company’s engine off a test stand in Texas.

He called it "the worst day of my life."

🇺🇦 Resurrected by a Ukrainian Millionaire

In 2017, when the ashes were still warm, a new name appeared: Max Polyakov, a Ukrainian tech entrepreneur and founder of Noosphere Ventures. He bought Firefly’s corpse out of bankruptcy, rehired the engineers, and moved the company to Cedar Park, Texas.

The team rebuilt everything — new facilities, new Alpha rocket, new mission.

It was reborn, now as Firefly Aerospace.

But it wasn’t Silicon Valley anymore. It was Texas steel, Ukrainian money, and Markusic’s stubborn genius.

They launched Alpha in 2021. It exploded two minutes after liftoff.

The next flight in 2022 succeeded. But no one cheered too loud.

The ghost of collapse was always in the room.

🕵️♂️ The Government Kills Its Savior

Then came the next bullet — this time from Washington.

In 2021, just as Firefly was gaining traction, the U.S. government forced Polyakov to divest his entire stake. Quiet whispers turned into national security letters. The DoD didn’t like the idea of a defense contractor bankrolled by a Ukrainian with data firms in Eastern Europe.

Polyakov wasn’t charged. But he was erased.

He raged online, calling the decision political, racist, paranoid.

But it didn’t matter. Firefly was now ownerless, rudderless — again.

🔧 From Dreamers to Subcontractors

After that, Firefly changed.

Markusic stepped down.

The company pivoted — less SpaceX, more Lockheed.

It focused on infrastructure: lunar landers, transfer stages, DoD partnerships, Northrop contracts.

The dreams of radical design gave way to hardware that works — parts that can be mass-produced, certified, stacked, and launched on time.

It wasn’t sexy, but it kept them alive.

And then in March 2025, they landed Blue Ghost on the Moon.

The company that had died twice became one of the few in history to soft-land on another celestial body.

🚀 What Firefly Does — And Why It Matters

Firefly Aerospace is not just a rocket company.

It is building infrastructure for transport, deployment, and reconnaissance in space.

Its core systems function as a logistics chain:

Alpha is the launch vehicle that brings payloads into orbit.

Elytra is a space transfer vehicle designed to carry cargo further — to lunar orbit, deep space, or specific orbital destinations.

Blue Ghost is a lunar lander that delivers and operates scientific payloads on the Moon’s surface.

Ocula is a lunar orbital imaging system for surface mapping and mineral detection.

This end-to-end capability makes Firefly structurally different from many space startups.

It doesn't just launch — it transports, supports, and remains operational in space.

In July 2025, NASA awarded Firefly a $176.7 million CLPS contract to deliver five scientific payloads to the Moon’s south pole by 2029. The mission will combine Elytra and Blue Ghost, with orbital support planned for over five years.

Just days later, Firefly was selected as one of six companies in a $1.4 million NASA study to explore low-cost delivery methods for spacecraft to hard-to-reach orbits — alongside Rocket Lab, Blue Origin, and others.

Firefly is not competing in launch alone.

It’s positioning itself as a full-stack space logistics provider.

🧨 Alpha – The Startup Rocket With Something to Prove

Height: 29 meters (95 feet)

Payload to LEO: ~1,000 kg

Engines: 4 × Reaver 1 on the first stage, 1 × Lightning 1 on the second

Propellant: RP-1 / LOX (kerosene + liquid oxygen)

Thrust: ~736 kN at liftoff

Launch cost (estimated): $15M–17M

Reusability: None

Alpha is Firefly’s small satellite launcher — think of it as a direct competitor to Rocket Lab’s Electron, but with double the payload. It first reached orbit in October 2022, after a failed attempt in 2021. It’s entirely developed in-house, including propulsion, avionics, and structures.

Despite being underpowered for modern mega-constellations, Alpha proves Firefly can design, manufacture, and fly a real rocket. It also forms the first stage of the upcoming Antares 330, developed in partnership with Northrop Grumman.

🔁 Elytra – Firefly’s Orbital Transfer Vehicle

Mission role: Payload tug / Lunar transfer / Long-haul comms

First launch: 2026 (planned with Blue Ghost Mission 2)

Propulsion: Hypergolic engines (MMH + NTO)

On-orbit lifespan: 5+ years

Payload capacity: Up to ~2,000 kg depending on configuration

Cost per unit (est.): $20M–30M

Elytra is what makes Firefly different from pure launch players. It’s a space tug — meant to carry payloads from LEO to GTO, cislunar space, or deep orbit.

What makes Elytra special: it's based on flight-proven tech — the same propulsion system that landed Blue Ghost on the Moon. That means reliable, low-maintenance ops, even far from Earth.

The “Elytra Dark” variant is optimized for long-term lunar missions, acting as a relay for landers and powering Firefly’s upcoming Ocula imaging network.

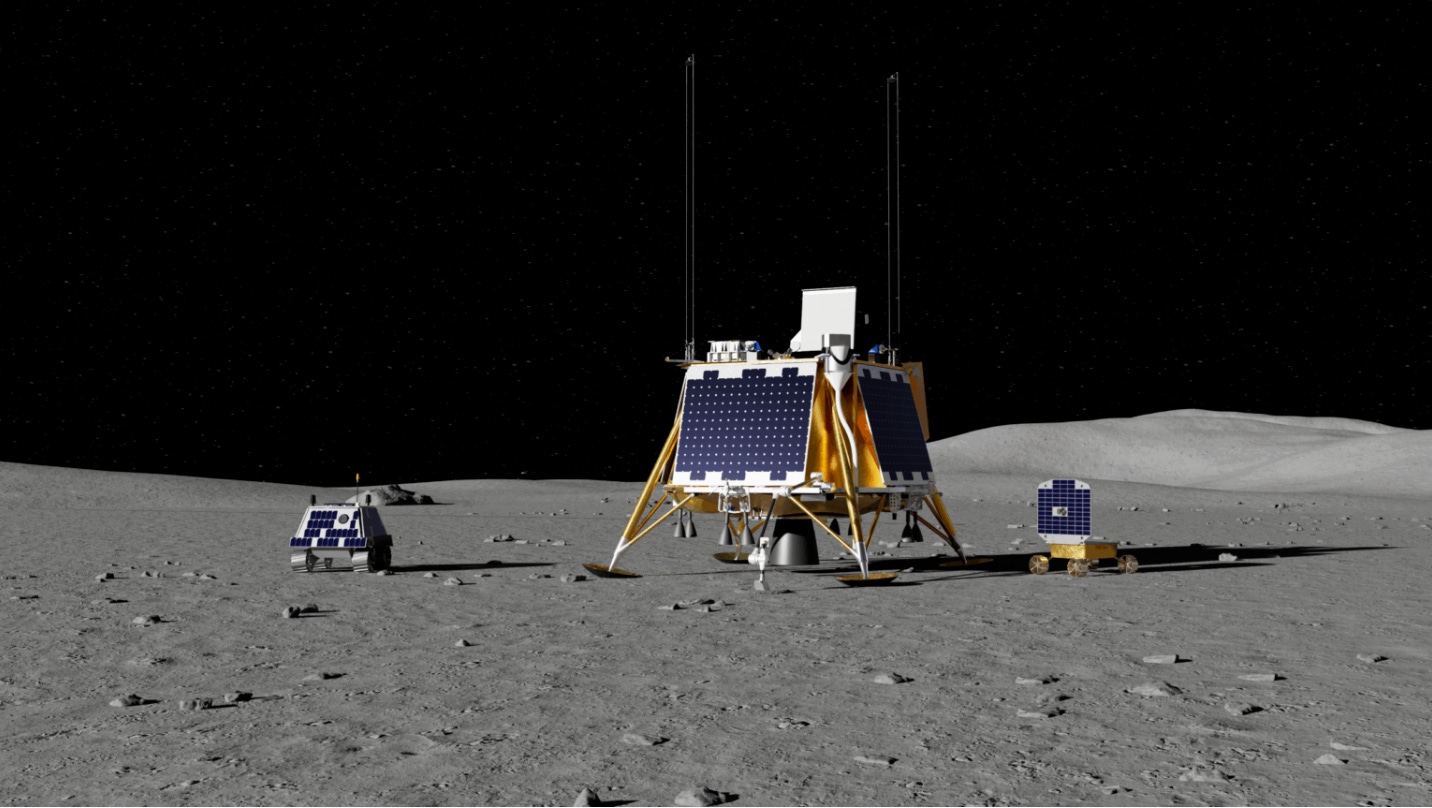

🌕 Blue Ghost – Their Lunar Workhorse

Lander height: ~3 meters

Payload capacity: ~155 kg (Mission 1); ~300+ kg (future missions)

Mission duration: Up to 14 days on surface

Power system: Solar arrays + battery

Landing method: Autonomous soft-landing using hypergolic engines

NASA contract (Mission 4): $176.7 million

First successful landing: March 2025 (Mission 1)

Blue Ghost is Firefly’s signature win — a robotic lunar lander that not only landed, but completed all its scientific objectives, carrying NASA payloads like SCALPSS and rovers from the U.S. and Canada.

Future missions will go deeper — to the Moon’s south pole, deploying advanced instruments for water detection, thermal analysis, and radiation measurement. Elytra will provide orbiting support.

The NASA-sponsored payloads onboard Blue Ghost include two rovers – the MoonRanger rover and a Canadian Space Agency rover – as well as a Laser Ablation Ionization Mass Spectrometer (LIMS), a Laser Retroreflector Array (LRA), and the Stereo Cameras for Lunar Plume Surface Studies (SCALPSS), which also flew on Blue Ghost Mission 1. These payloads will help uncover the composition and resources available at the Moon’s south pole, advance lunar navigation, evaluate the chemical composition of lunar regolith, and further study the effects of a lander’s plume on the Moon’s surface during landings.

Following Blue Ghost Mission 4 operations, Elytra Dark will remain operational in lunar orbit for more than five years in support of Firefly’s Ocula lunar imaging service. The mission enables a third Elytra Dark in Firefly’s growing constellation to provide customers with faster revisit times for lunar mapping, mission planning, situational awareness, and mineral detection services. The first two Elytra Dark vehicles will launch as part of Blue Ghost Mission 2 to the far side of the Moon in 2026 and Blue Ghost Mission 3 to the Gruithuisen Domes in 2028.

Source: Firefly Aerospace, July 29, 2025 press release

👁 Ocula – The Eyes That Never Blink

Platform: Hosted aboard Elytra

Mission: Persistent lunar imaging, resource mapping, surveillance

Resolution: Sub-meter (est.), multi-spectral

Target customers: NASA, DoD, commercial miners

Planned constellation: 3+ Ocula systems by 2029

Coverage: Near real-time lunar orbit reconnaissance

Ocula is Firefly’s long play — a space-based observation platform designed to offer continuous monitoring of the Moon.

Each unit rides inside an Elytra vehicle and provides:

High-res surface imagery

Thermal and mineral analysis

Navigation aid for other missions

Strategic lunar situational awareness

This isn't just about pretty pictures. It’s data infrastructure for the Moon, and no one else is building it right now at this level of integration.

🌌 Total Addressable Market (TAM): Where Firefly Fits in the Space Economy

To understand Firefly’s real potential, we need to look beyond its current revenue and analyze the scale of the opportunity in each of its business segments. Firefly isn’t just a launch company — it aims to provide infrastructure across the entire value chain of space delivery, exploration, and data.

We’ve broken down the TAM into four main verticals — launch, orbital logistics, lunar surface operations, and lunar data services — and backed each with conservative, base, and optimistic CAGR scenarios. These are informed by industry research from sources including NSR, Euroconsult, MarketsandMarkets, Allied Market Research, and Rocket Lab’s own financial disclosures.

🚀 1. Launch Services (Alpha Rocket)

Market context:

According to Euroconsult and Space Capital, the global satellite launch services market is worth ~$10 billion in 2024, with small- and medium-lift players like Rocket Lab, Relativity, and Firefly targeting the sub-$100M launch segment.

Growth outlook:

MarketsandMarkets projects a ~12.2% CAGR for the broader launch services market through 2030.

However, small launchers are growing faster — Rocket Lab, for example, posted a ~41% CAGR in revenue between 2022 and 2024.

Keep reading with a 7-day free trial

Subscribe to Edge of Power to keep reading this post and get 7 days of free access to the full post archives.