🛡️ Europe's Defense Surge: 6 More Stocks to Watch

📍 EU Summit in London Paves Way for Massive Defense Spending Boost. If Political Will Follow The Words

European leaders met in London last week, signaling a historic increase in defense spending across the continent. As geopolitical tensions rise, nations are pushing for military expansion, rearmament, and next-gen defense tech investments.

📍 Germany’s New Coalition Plans to Increase Military Spending by Tens of Billions

Berlin has committed to expanding its defense budget beyond the €100B special fund, with plans to modernize the Bundeswehr and increase procurement of fighter jets, submarines, and missile defense systems.

📍 I’ve already covered 6 top defense stocks—now here’s another batch.

If last year’s winners like Rheinmetall and BAE Systems have already surged, the next wave of growth could come from aerospace, naval, and defense technology players. Here are 6 more stocks that stand to benefit from Europe’s military buildup.

1. Safran (SAF.PA): Defense Segment Boosts Record Earnings & Dividend Growth

Safran is a French aerospace and defense company specializing in aircraft engines, avionics, and military systems, with a market capitalization of ~€105B. While most of its revenue comes from commercial aviation, its defense segment includes fighter jet engines (Rafale, Eurofighter), helicopter systems, and military avionics.

In 2024, the company earned record revenue of €27.3B (+17.8% YoY), with operating profit surging 30.1% to €4.1B. Free cash flow hit €3.2B, allowing Safran to raise its dividend to €2.90 per share.

The defense segment was one of the strongest performers, growing 17.7% YoY, driven by higher orders for Rafale fighter jet engines and NH90 helicopter components. The company is also a key supplier for the Ariane 6 space launcher.

🔹 Interesting Fact: Almost every European military aircraft relies on some form of Safran technology, from navigation to propulsion.

The company awaits a strong 2025, expecting 10% revenue growth along with higher operating profit (€4.8 - €4.9B) and free cash flow (€3.0 - €3.2B). However, some risks remain. Safran relies on titanium supply from Russia, a potential vulnerability if trade restrictions tighten. Additionally, with operating margins at 15.1%, some analysts believe profitability may have peaked, limiting further upside.

Analyst Estimates & Price Targets

Current price: €250

2. Rolls-Royce (RR.L): Military Jet & Naval Power Drive Profit Rebound

Rolls-Royce is a British engineering company specializing in military jet engines, naval propulsion systems, and power solutions, with a market capitalization of £64B. The company supplies engines for fighter jets (Eurofighter Typhoon, F-35), nuclear submarines, and military transport aircraft, making it a key defense contractor in Europe and the U.S.

In 2024, Rolls-Royce posted a major earnings turnaround, with revenue rising 16% to £18.7B and operating profit surging to £1.7B, up from just £652M in 2023. The company also announced a £1B share buyback and reinstated its dividend for the first time since 2020 at £0.075 per share, attracting income-focused investors.

The defense segment contributed £4.5B in revenue, supported by new orders for submarine propulsion systems and increased jet engine demand. The company has secured long-term contracts with the UK Ministry of Defence and NATO partners, ensuring a steady backlog of military projects.

🔹 Interesting Fact: Rolls-Royce is the sole supplier of nuclear propulsion systems for the UK’s Royal Navy submarines, including the next-generation Dreadnought-class.

The company expects double-digit profit growth in 2025, aiming for higher operating margins (13-15%) and free cash flow of £1.9 - £2.2B. However, cost pressures from rising material prices and supply chain disruptions could impact near-term profitability.

3. Hensoldt (HAG.DE): Rising Defense Demand Strengthens Sensor & Radar Orders

Hensoldt is a German defense electronics company specializing in radar, surveillance, and sensor technologies, with a market capitalization of ~€6.2B. The company supplies high-tech sensor systems for fighter jets, naval vessels, and missile defense, making it a key player in European military modernization and NATO defense programs.

In 2024, Hensoldt’s revenue grew to €1.85B (+13.5% YoY), while net profit jumped 29% to €183M, supported by higher demand for airborne and ground-based radar systems. Defense budgets across Europe continue to rise, fueling strong order intake.

The sensor and radar division remains the core growth driver, benefiting from contracts tied to Eurofighter Typhoon upgrades, missile warning systems, and electronic warfare solutions. The company is also involved in the Future Combat Air System (FCAS), a next-gen fighter jet program backed by Germany, France, and Spain.

🔹 Interesting Fact: Hensoldt provides the radar system for the Eurofighter Typhoon, one of the most advanced fighter jets in European air forces.

The company expects strong growth in 2025, with further defense orders anticipated as Germany increases its military spending. However, risks include potential project delays and supply chain challenges, which could impact near-term revenue recognition.

4. Kongsberg Gruppen (KOG.OL): NATO’s Key Supplier for Missiles & Defense Systems

Kongsberg Gruppen is a Norwegian defense and technology company specializing in missile systems, remote weapon stations, and naval defense, with a market capitalization of 21.2B USD. The company is a key supplier to NATO, producing Naval Strike Missiles (NSM) and Joint Strike Missiles (JSM), widely used by Western allies.

In 2024, revenue surged to NOK 48.9B (+20.3% YoY), while net profit climbed 38.1% to NOK 5.1B. Strong demand from European and U.S. defense contracts fueled growth, particularly in naval and missile systems.

The missile division remains the primary growth driver, as the U.S., Germany, and other NATO members ramp up orders for next-generation naval and air defense capabilities. Kongsberg also supplies remote-controlled weapon stations used on armored vehicles, a segment seeing increased demand due to modern warfare shifts.

🔹 Interesting Fact: Kongsberg’s Naval Strike Missile was selected as the primary anti-ship weapon for the U.S. Navy’s frigates, beating out U.S. competitors.

The company expects continued double-digit revenue growth in 2025, supported by a record-high order backlog. However, analysts remain divided on valuation, with some arguing the stock is overpriced after a strong rally.

5. Airbus (AIR.PA): Defense & Space Segment Bolsters Steady Growth

Airbus is a European aerospace corporation renowned for its commercial aircraft, but it also maintains a significant Defense and Space division, with a market capitalization of ~€130B. This segment produces military aircraft (e.g., A400M airlifter), satellites, and defense systems, serving various European and international defense agencies.

In 2024, Airbus reported total revenues of €69.2B (+6% YoY), with the Defense and Space segment contributing €12.1B (+5% YoY). The company achieved a record €16.7B in order intake for this segment, reflecting robust demand for its defense products.

The A400M military airlifter program delivered seven units in 2024, including the first for Kazakhstan, underscoring Airbus's role in global military logistics. Additionally, the company is involved in the Eurofighter Typhoon program, providing advanced avionics and systems integration.

🔹 Interesting Fact: Airbus is a key partner in the Future Combat Air System (FCAS), a collaborative defense project among Germany, France, and Spain, aiming to develop a next-generation fighter jet and related systems.

For 2025, Airbus anticipates stable growth, with expectations of moderate revenue increases and sustained profitability. However, challenges such as supply chain constraints and geopolitical uncertainties could impact production schedules and new orders.

Analyst Estimates & Price Targets

6. Fincantieri (FCT.MI): Naval Defense Contracts Propel Growth Amid Diversification

Fincantieri is an Italian shipbuilding company with a strong presence in the naval defense sector, boasting a market capitalization of ~3B. The company specializes in constructing frigates, corvettes, and submarines for various navies worldwide, including the Italian Navy and the U.S. Navy.

In 2024, Fincantieri secured several notable defense contracts:

€1B contract for two Constellation-class frigates (FFG 66 and FFG 67) for the U.S. Navy, with completion expected by April 2030.

€1.5B contract for two FREMM EVO frigates for the Italian Navy, in collaboration with Leonardo.

€1.18B contract with the Indonesian Navy for two Thaon di Revel-class offshore patrol vessels, enhancing its footprint in Southeast Asia.

These contracts have bolstered Fincantieri's order book, ensuring a stable revenue stream for the coming years. The company's diversification strategy includes ventures into radar systems, exemplified by a €500M joint venture with EDGE Group to support the UAE Navy.

🔹 Interesting Fact: Fincantieri is part of the European Patrol Corvette (EPC) project, aiming to develop a new class of multipurpose naval vessels for several European navies, enhancing interoperability and standardization.

Looking ahead to 2025, Fincantieri expects to leverage its diversified portfolio and strategic partnerships to maintain growth. However, potential challenges include geopolitical risks and supply chain disruptions, which could affect project timelines and costs.

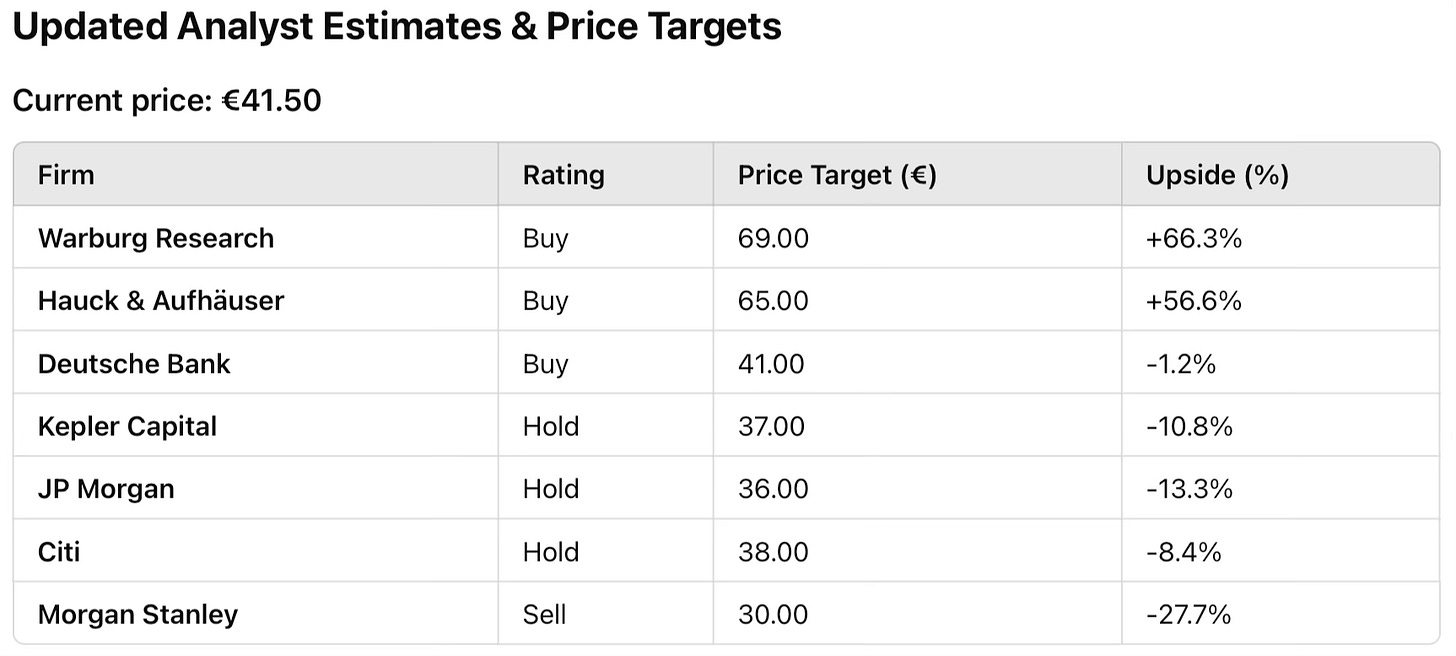

Analyst Estimates & Price Targets

Current price €9.81

Markets move fast, but the real edge comes from seeing the bigger picture. Whether it's geopolitics, tech wars, or hidden stock plays, staying ahead means staying informed. If you're not already subscribed, now's the time—because in this game, knowledge isn’t just power, it’s profit. See you in the next edition of Market Edge!"

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.