Cathie Wood Dumped Palantir for This Stock

Cathie Wood’s ARK dumped most of its Palantir shares and bought into a tiny company moving human organs and pitching flying taxis. Could it really be the next Uber—or is this just a speculative bet?

The Cathie Wood Bet: Betting Big on a Loss-Making Air Mobility Startup

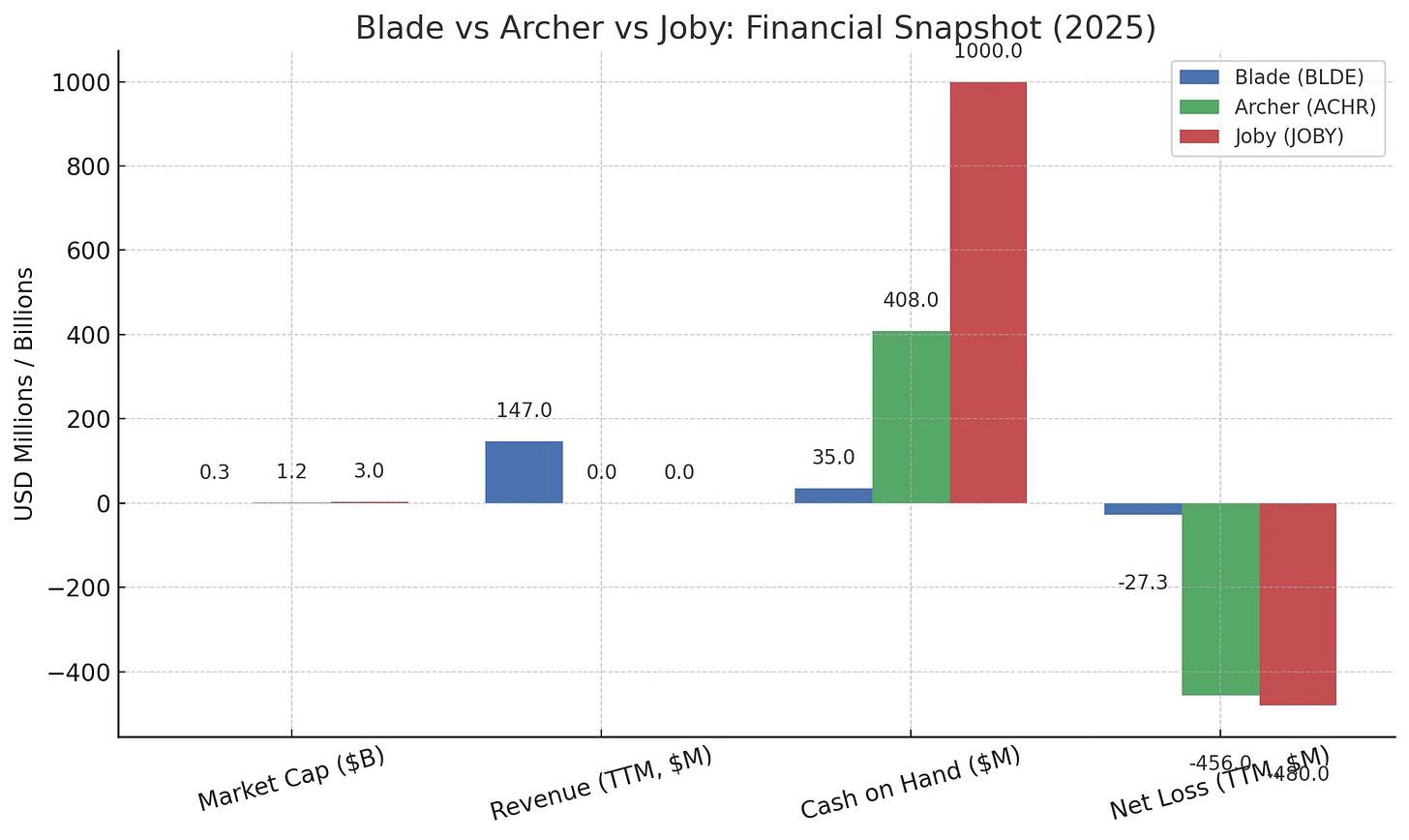

Cathie Wood has found a new favorite in Blade, a company few have heard of—unless you're in the business of organ transportation. That’s right, Blade’s core business is flying human organs for transplant. With a market capitalization of $272 million, the company fits Wood’s criteria perfectly: no profits, down 18% year-to-date, and down 63% over the last five years. Even the company admits in its filings that it may never become profitable, given the high-risk nature of its segment. Cathie currently owns around $27 million worth of Blade stock. Let’s break down whether she’s backing the right horse—and whether her approach is worth copying.

The Uber Model—In the Sky

The broader air mobility segment is heating up thanks to companies like Archer and Joby, riding the wave of eVTOL (electric vertical take-off and landing) development. This is exactly the space Blade is aiming to grow in. Its business model is similar to Uber's: Blade owns just 10 aircraft; the rest are leased from third parties who supply the planes, pilots, equipment, and even catering. The real challenge for Blade is finding passengers willing to pay for flying over traffic.

The Core: Organ Transport and the Medical Engine

Blade operates across three segments: transporting human organs for transplant, short-distance flights of 10–100 miles, and jet charters. So far, the dead generate more revenue than the living—but even that line of business is stagnating.

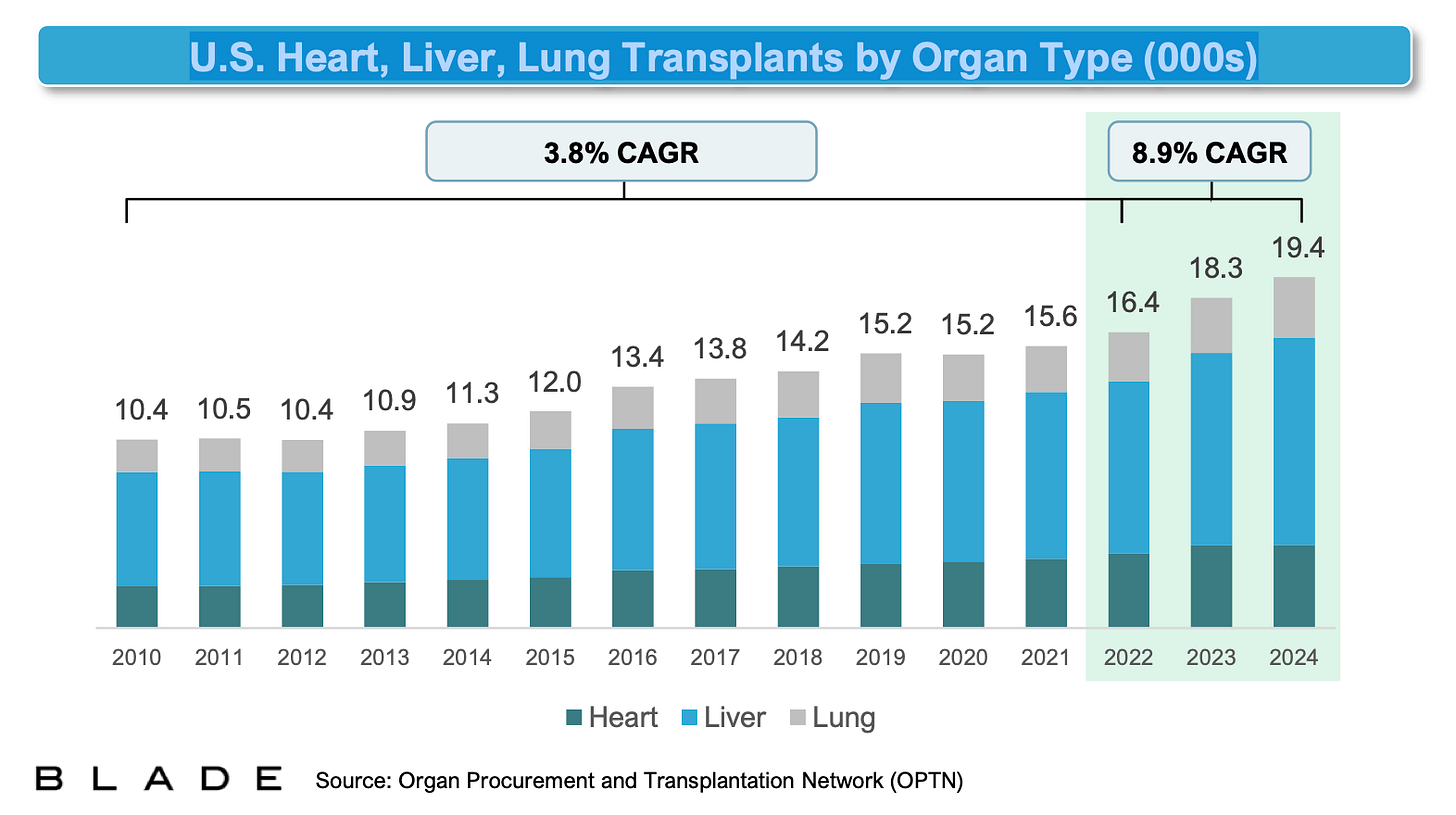

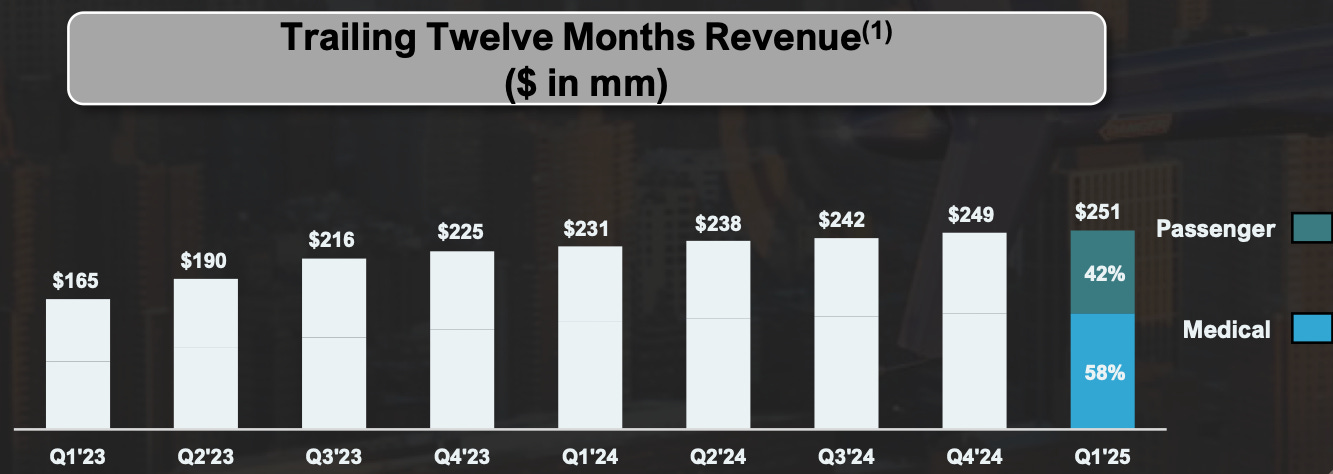

Medical transport makes up 58% of Blade’s revenue, or $147 million annually (as of March 31, 2025). However, the company is plateauing in this segment. First-quarter 2025 revenue came in at $35.9 million—almost identical to the same quarter last year. Over the past three years, thanks to medical advancements, the number of life-saving organ transplants has grown at a modest 7–8% annually. So while moderate growth is possible, a major boom is unlikely. Blade recently highlighted the addition of two new clients in April, but the segment remains high-risk: any operational failure can lead to massive lawsuits and high-profile legal battles. This demands heavy investment in compliance, logistics, and risk management.

In 2024, Blade acquired ten fixed-wing aircraft specifically for medical flights. These are placed in high-volume geographies to improve utilization, uptime, and reliability. Although operated by third parties, they’re owned and prioritized by Blade—giving it better control over cost and performance. With a 22.1% medical flight margin and $7.9 million in medical flight profit this quarter, this is Blade’s core revenue engine.

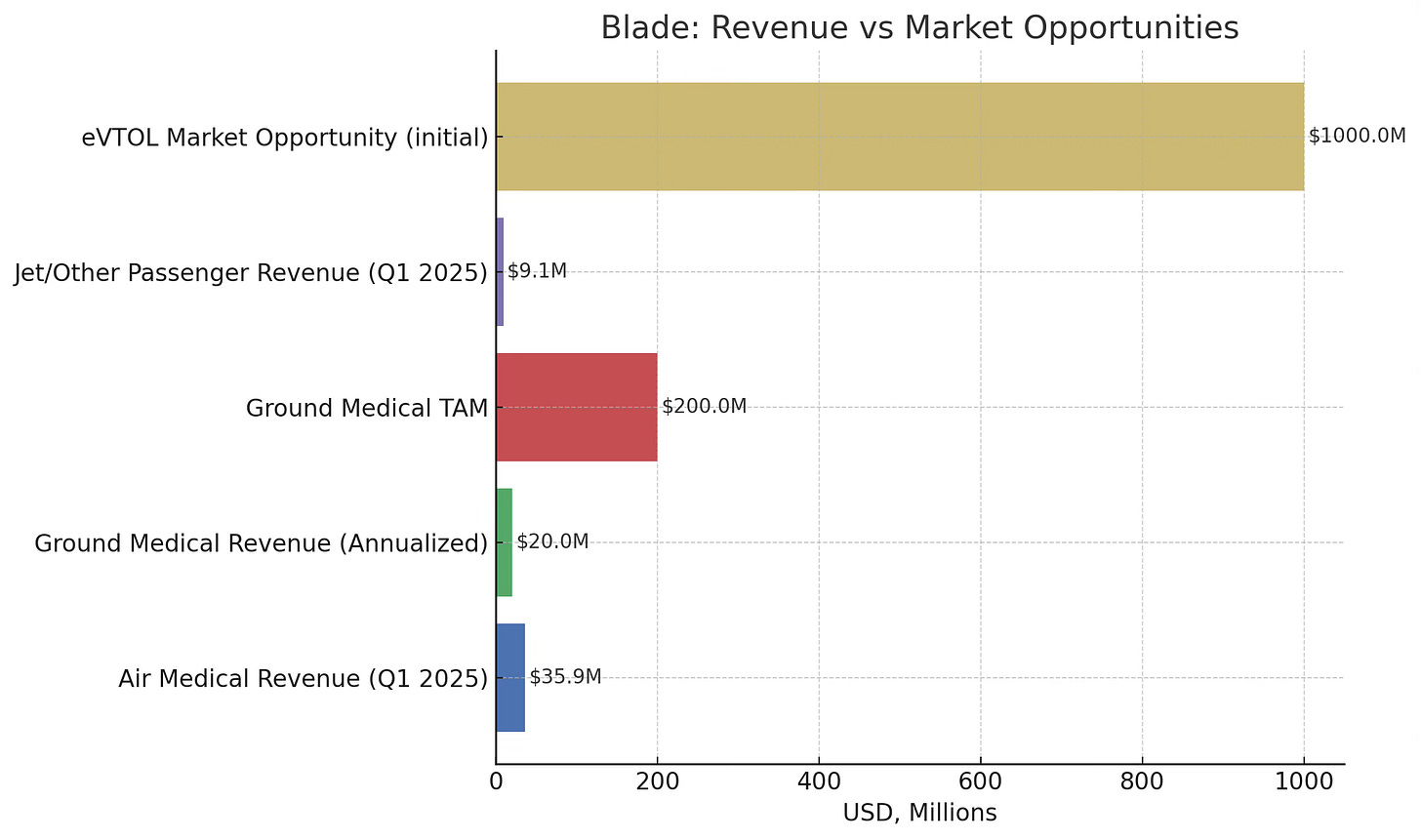

It’s also important to clarify that Blade's $35.9 million in Q1 2025 medical revenue refers specifically to its air transport business. Separately, its ground transport segment—which involves vans and ambulances—brought in around $5 million this quarter, or $20 million on an annualized basis. These are two distinct, though complementary, revenue streams.

Ground Expansion: A Quiet Growth Engine

The ground medical segment already operates 50 vehicles across 9 U.S. hubs and has an estimated total addressable market of $200 million. Blade believes it can maintain over 30% margins here with sub-one-year payback periods—making it one of the most capital-efficient bets in its portfolio. With only 10% market share currently, there’s significant room for scale.

Jet Charters and the First Signs of Life

In addition to short-distance flights, the jet charter segment is also gaining traction. Revenue from jets and other services jumped 60% year-over-year, contributing nearly half of Blade’s total passenger revenue this quarter. Jet charters offer higher ticket values and more predictable scheduling, helping balance the cost volatility of short hops.

For the first time, Blade posted a positive adjusted EBITDA in this division—$54,000 in Q1 2025, compared to a loss of $2.7 million a year earlier. Passenger flight profit nearly doubled to $4 million. It's still small in absolute terms but shows operational progress.

The Luxury Geography Advantage

Blade isn’t trying to win on volume—it’s betting on luxury. Its New York service gets you from Manhattan to the airport in 10 minutes. Its European presence stretches from the French Riviera to Monaco, syncing with peak seasonal demand from tourists and high-net-worth clientele. These routes aren’t just about saving time—they’re about selling status.

Marketing Philosophy: Too Cool to Advertise?

And yet, despite the aspirational nature of its routes, Blade’s approach to branding is puzzling. The company believes that as it becomes more widely known, future campaigns will lose their effectiveness—essentially implying that too much awareness is bad. In a market where prestige typically grows with visibility, this stance seems both counterintuitive and risky.

The eVTOL Moonshot

Looking ahead, the biggest long-term upside may come from eVTOL. Today, Blade’s operations are constrained by noise and infrastructure. eVTOLs—quiet, electric, and more flexible—could unlock new routes overnight.

Blade estimates this could become a billion-dollar opportunity, targeting 5 large and 30 mid-sized metro areas globally. If they succeed in integrating eVTOL aircraft from manufacturers like Joby and Archer, they could scale massively without having to build the planes themselves.

But here’s the tension: will OEMs let Blade handle bookings, or will they go direct-to-consumer and cut the platform out?

Financial Discipline: Trimming the Fat

Blade recently exited its unprofitable Canadian operations, signaling a shift toward profitability-focused strategy. This move shows the company is no longer chasing scale blindly—it’s trying to stabilize margins and position itself for sustainable growth.

Competitors and Cash: A Tale of Two Models

Unlike Blade, which operates with tight budgets and real revenue, Archer and Joby raised billions through SPACs in 2021. Joby has over $1B in cash, backed by Toyota and Delta. Archer raised over $1.1B and secured a $125M investment from United Airlines.

Blade doesn’t manufacture aircraft and therefore doesn’t get hype-based venture capital. But it also doesn’t burn hundreds of millions annually. Its model is leaner and closer to commercial viability.

The Valuation Puzzle: How Much Could Blade Be Worth?

As of May 2025, Uber trades at approximately 4.2x forward revenue, based on its $44 billion in annual revenue and $185 billion market capitalization. Blade, by contrast, trades at just over 1.5x trailing revenue.

If Blade grows to $250M revenue and is valued at 2.5x sales, it could be worth $625M. If eVTOL plays out and Blade reaches $500M revenue with a 3–4x multiple, a $1.5B–2B valuation is not out of the question.

But that all hinges on one thing: will Blade be allowed to own the customer relationship, or will the aircraft makers try to do it all?

Conclusion: Opportunity or Illusion?

Blade is a company in transition. It’s trimming the fat, improving margins, and showing early signs of life in passengers. At the same time, it’s betting on eVTOL and hoping to own the demand layer.

It’s also worth stating clearly: the presence of Blade in Cathie Wood’s portfolio doesn’t guarantee anything—except perhaps increased volatility. ARK’s strategy is driven by long-term thematic conviction, not short-term fundamentals, and it’s evident that Wood is unbothered by near-term underperformance. In other words, Blade’s inclusion in her fund says more about her tolerance for moonshots than it does about the company’s intrinsic value.

The stock trades like Blade has no future, but the company is moving like it does. Whether that mismatch is opportunity or illusion depends on three things:

Can Blade turn ground transport into a growth engine?

Will eVTOL infrastructure materialize—and include Blade?

Can Blade stay relevant if manufacturers go full-stack?

If the answer is yes to even one or two, Blade might be deeply undervalued. If not, it's a fascinating case study in Silicon Valley optimism colliding with transportation reality.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.