Amprius: No Promises, Just Execution

Amprius is starting to separate itself from the noise

For the second quarter in a row, the company is delivering real results — not hype, not demos, but meaningful revenue growth and a clear trajectory toward profitability. Margins are improving, customer count is rising, and production is scaling.

This is a business evolving from a high-potential R&D lab into what could soon become a serious cash generator. It’s not profitable yet, but it’s moving in that direction with momentum — and, more importantly, with discipline.

Why now?

We’re in the middle of a quiet battery revolution.

Smaller form factors. Faster charge times. Energy densities that would have been laughable five years ago.

Thanks to companies like Amprius, things that used to sound like science fiction — long-endurance drones, persistent surveillance, ultra-light aviation — are now part of both military and commercial operations. And demand is rising fast in both sectors.

A turning point

Amprious has already surpassed its entire 2024 revenue by mid-year. The company generated $26.4 million in the first half of 2025, beating last year’s full-year total of $24.2 million. Q2 alone came in at $15.1 million, up 350% year-over-year.

And this growth isn’t coming from a one-off spike — it’s driven by a growing base of paying customers, including names like Airbus, BAE Systems, AeroVironment, and the U.S. Army.

Customers are not buying hope

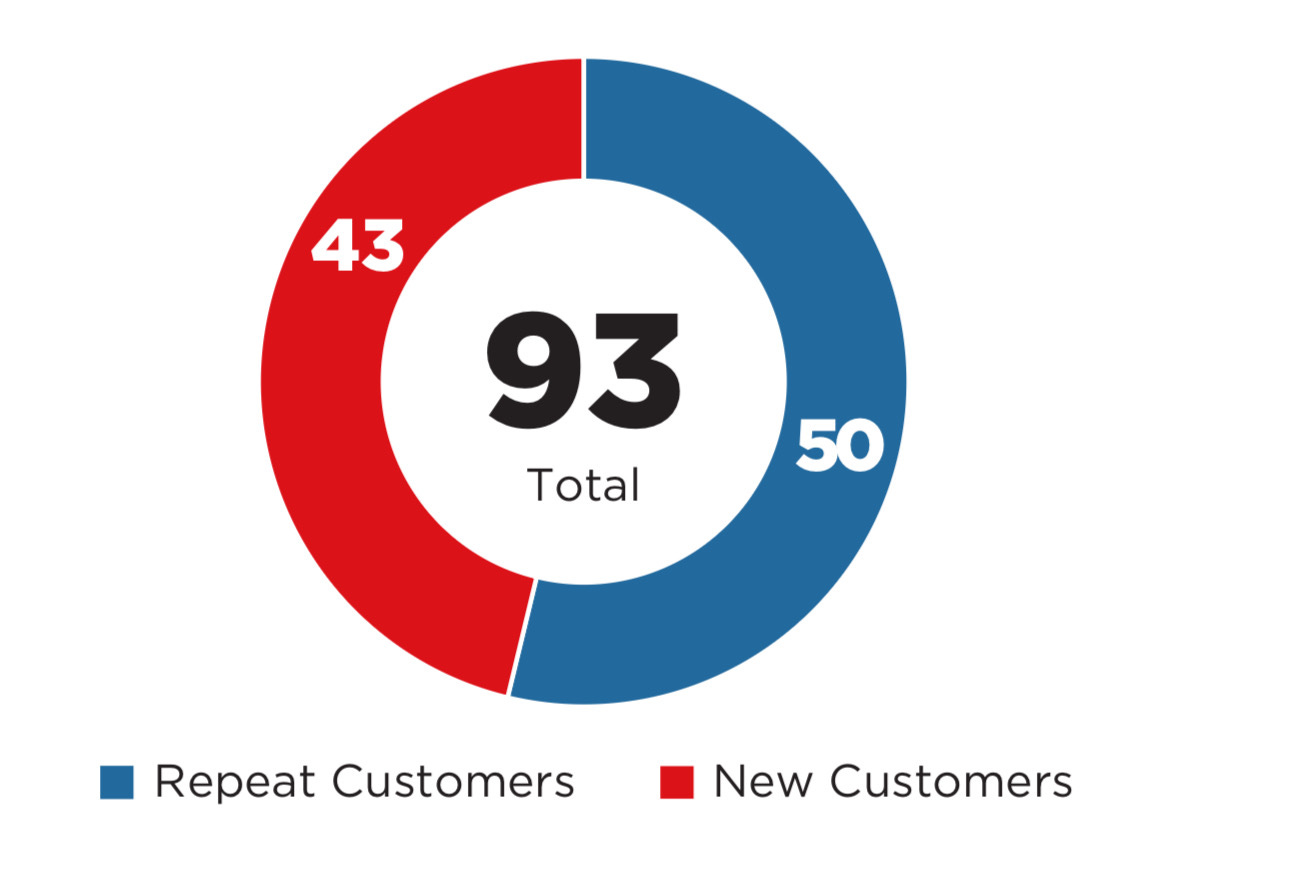

This isn’t a case of prototype tech being handed out for free. Amprius shipped to 93 customers in Q2. And 50 of them were returning — not testing, not sampling, but buying again.

Repeat demand matters. It tells you that the product works. And it tells you that switching away from Amprius is no longer an option for some of these customers.

The Zephyr moment

The most striking proof of Amprius’ tech came from Airbus subsidiary AALTO. Their solar-powered Zephyr drone — a high-altitude platform system (HAPS) flying at 70,000 feet — stayed in the air for 67 consecutive days.

During the day, the drone runs on solar power and stores surplus energy in Amprius batteries. At night, it runs entirely on those batteries.

That flight was a world record. And it was made possible by Amprius’ silicon-anode architecture — light enough to reduce mass, and dense enough to power critical systems through the night.

A real product, not a science project

The battery that powered Zephyr — the SA102 — is part of Amprius’ SiCore platform, released in April. It delivers 450 Wh/kg energy density and can fast-charge from 0 to 80% in about six minutes.

It also operates in extreme temperatures from -30°C to +60°C and passes the U.S. military’s nail penetration safety test. And yes — it’s shipping now.

The margin story

Q2 was the first time Amprius turned positive gross margin, flipping from -195% a year ago to +9%.

That’s a massive shift — and it matters. A tech company improving gross margin this early, while still ramping, signals that the business model is scalable.

They’re not dumping money into factories either. Amprius is scaling through contract manufacturing — in both the U.S. and South Korea. That gives them flexibility and global access, without the capex burden.

Policy is now on their side

AMPX benefits directly from new U.S. policy initiatives.

In June 2025, the Trump administration signed an executive order to promote domestic drone manufacturing. In July, the Department of Defense issued a directive requiring procurement to prioritize U.S.-made drones.

The DoD is shifting its posture: small drones are now being treated as “consumables,” not long-term platforms. That shift favors suppliers who can deliver lightweight, powerful, cost-effective batteries at scale.

This is Amprius’ home turf.

Beyond drones

While most of the current revenue comes from aerospace and defense, Amprius is starting to expand into the light electric vehicle (LEV) market.

And they have an advantage: their batteries are drop-in replacements. That means no need for OEMs to redesign their platforms — just switch the cell, and performance improves immediately.

With short design cycles and growing LEV demand globally, this is a natural second market.

Financial health

Amprius ended Q2 with $54 million in cash and no debt. The burn rate is low, and additional capital can be raised if needed through their open shelf.

Importantly, they’ve already secured 1.8 GWh of manufacturing capacity through their contract network. They don’t need to build new gigafactories from scratch — they can focus on delivery.

The mispricing

Right now, Amprius is priced like a pre-revenue moonshot. But that story is outdated.

They’re shipping product. They’re scaling margins. They’re backed by defense budgets, government policy, and commercial demand. And they’ve built something that others — including legacy battery giants — haven’t.

This isn’t about promise. It’s about positioning. And the market hasn’t caught up yet.

Bottom line

While some battery startups are still chasing validation, Amprius is already generating it — in the field, in the air, and on the balance sheet.

That doesn’t make it risk-free. But it does make it real.

This publication is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers are solely responsible for their own investment decisions. The author may hold positions in the securities mentioned.