AI’s Power Shift: How NVIDIA made Musk nervous

Who will win from NVIDIA’s deal with OpenAI

The NVIDIA–OpenAI deal is the creation of a vast conglomerate of companies, all tiedtogether through Jensen Huang’s supply chain and financing. In essence, this is NVIDIA’s strategic response to the loss of the Chinese market: nurturing a U.S.-based AI powerhouse that will be nearly impossible to surpass given the scale of funding behind it.

For NVIDIA, $100 billion is an enormous outlay — roughly half of its annual revenue. Yet everything depends on how the deal is structured. At the same time, this answers the pressing question of where OpenAI will secure the cash to honor its $300B cloud deal with Oracle. Oracle, in turn, just reshuffled its leadership, moving Safra Catz to an executive chair role. Only recently, she was at Trump’s dinner table, but today the priority is execution for Oracle’s most important client.

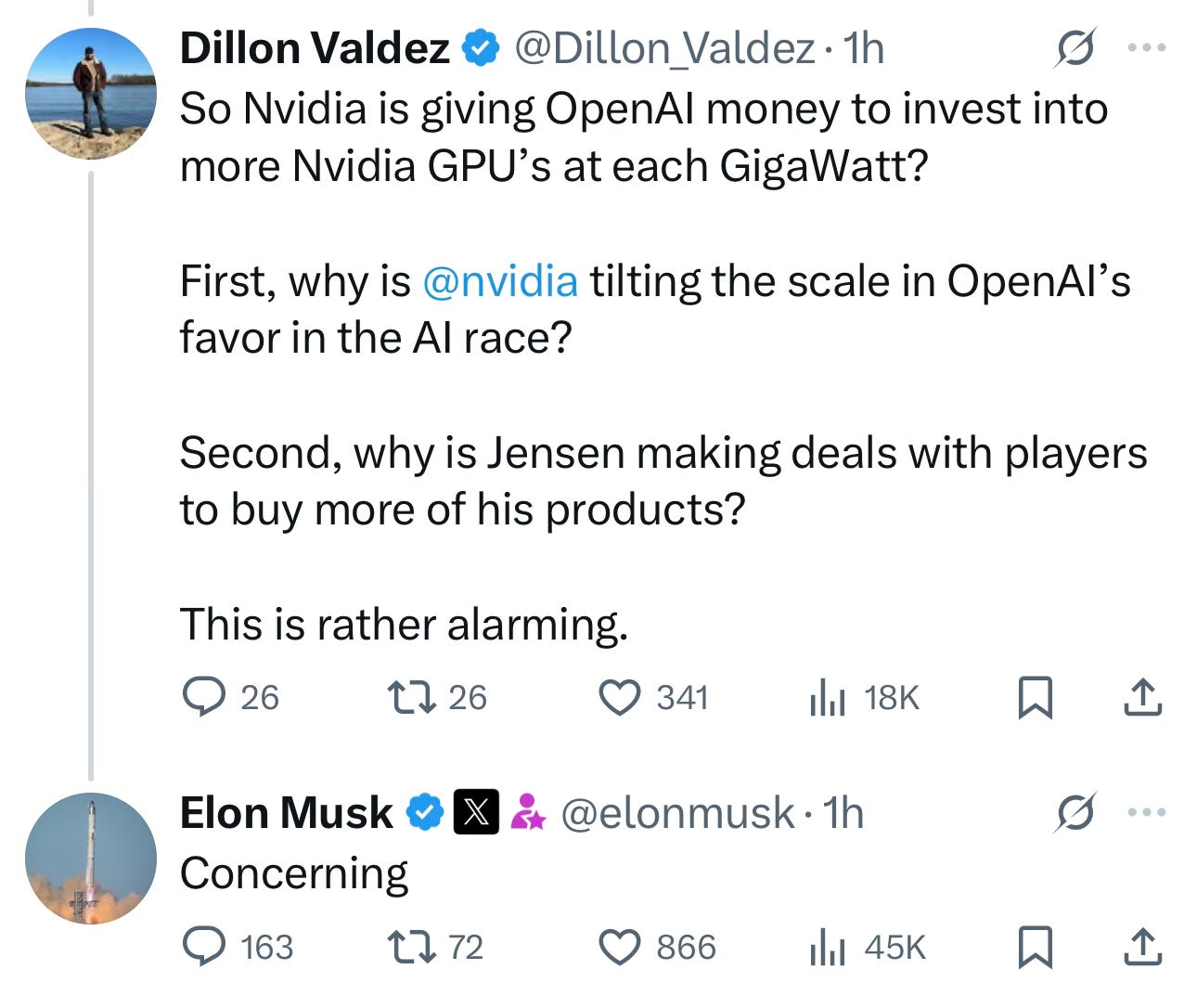

Musk is Nervous

The urgency of this shake-up underscores the stakes. NVIDIA, by injecting capital on this scale, not only gains a stake in OpenAI but also guarantees massive demand for GPUs that haven’t even been released yet. This secures its own pipeline years into the future, while giving Sam Altman a war chest to preserve leadership in AI. He has already promised new products in the near term.

Meanwhile, Elon Musk is left wondering how xAI can possibly compete, since raising such sums from venture capital alone looks increasingly unrealistic. The implication is clear: other hyperscalers will have to spend even more. Google’s capex is $85B — NVIDIA is signaling it will go further, effectively raising the bar beyond reach.

New Rulers

This deal also redraws the AI capital markets landscape. If OpenAI successfully taps into Oracle’s infrastructure while being capitalized by NVIDIA, it creates a quasi-duopoly between NVIDIA-powered clouds and Microsoft’s Azure pipeline. That leaves Amazon and Google in a defensive position, forced to escalate spending to avoid losing strategic workloads. Apple, for all its resources, looks increasingly sidelined in the AI infrastructure race — consumer devices alone will not offset the tectonic shift toward AI-first ecosystems.

Another implication is geopolitical. By anchoring OpenAI inside a U.S. capital and supply ecosystem, NVIDIA and Oracle effectively create a “national champion” for AI — a counterweight to China’s Baidu and Huawei. In the long run, this may even influence regulatory policy: Washington will be reluctant to constrain NVIDIA too harshly if it becomes the backbone of America’s AI leadership.

From a market perspective, this is not just about one stock or one deal. It is about the emergence of AI infrastructure as the new oil — with its own cartels, price cycles, and choke points. NVIDIA is positioning itself as both the OPEC and the Exxon of this new world, and OpenAI is the flagship client that validates this model.

Who wins from this deal?

Keep reading with a 7-day free trial

Subscribe to Edge of Power to keep reading this post and get 7 days of free access to the full post archives.